Intel's Turnaround Strategy: A 2025 Investment Analysis.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Intel's Turnaround Strategy: A 2025 Investment Analysis

Intel, a once-dominant player in the semiconductor industry, has faced significant challenges in recent years, losing market share to rivals like TSMC and Samsung. However, under CEO Pat Gelsinger, the company is undergoing a major transformation, aiming for a significant turnaround by 2025. This article analyzes Intel's strategy and explores whether it represents a sound investment opportunity.

Intel's Ambitious Goals for 2025

Gelsinger's "IDM 2.0" strategy is multifaceted, focusing on several key areas:

-

Increased Capital Expenditure (CAPEX): Intel has pledged massive investments in new fabrication plants (fabs) – a crucial step to regain manufacturing leadership. This ambitious expansion aims to bolster its production capacity and compete effectively on cost and technology. This includes significant advancements in process nodes, aiming to match and surpass competitors in chip manufacturing.

-

Process Technology Leadership: Falling behind in process node technology was a major contributor to Intel's decline. The company is aggressively pursuing advancements in its manufacturing processes, aiming to regain its technological edge by 2025. This involves significant R&D investment and a renewed focus on innovation.

-

Expanded Foundry Services: Intel is aggressively entering the foundry business, offering its manufacturing capabilities to other chip designers. This diversification strategy aims to generate additional revenue streams and leverage its expanding production capacity. This move directly challenges industry leaders like TSMC.

-

Focus on High-Growth Markets: Intel is prioritizing investments in high-growth segments like data centers, artificial intelligence (AI), and autonomous vehicles. These strategic shifts aim to capitalize on burgeoning market demands and secure long-term growth.

Challenges and Risks

While Intel's turnaround strategy is ambitious, it faces several challenges:

-

Competition: The semiconductor industry is intensely competitive. TSMC and Samsung already possess advanced manufacturing capabilities and significant market share. Overcoming this entrenched competition requires significant investment and execution.

-

Execution Risk: Successfully implementing such a large-scale transformation requires flawless execution. Delays in fab construction, yield issues, or technological setbacks could significantly impact the timeline and financial projections.

-

Geopolitical Factors: The global chip industry is increasingly affected by geopolitical factors, including trade wars and supply chain disruptions. These uncertainties add complexity and risk to Intel's investment plans.

Investment Analysis: Is Intel a Buy?

The success of Intel's turnaround hinges on its ability to execute its strategy flawlessly. While the massive investments are risky, the potential rewards are substantial. The increased capacity and technological advancements could lead to significant revenue growth and improved profitability by 2025.

However, investors should carefully consider the challenges and risks involved. A thorough due diligence process, including analysis of Intel's financial statements, competitive landscape, and technological roadmap, is crucial before making any investment decisions. Consulting with a qualified financial advisor is highly recommended.

Looking Ahead

Intel's turnaround attempt is a high-stakes gamble. Success would solidify its position as a major player in the semiconductor industry, while failure could lead to further market share erosion. The next few years will be critical in determining whether Intel's bold strategy pays off. The 2025 timeframe offers a significant benchmark for assessing the effectiveness of their current initiatives. Keep a close eye on Intel's progress reports and financial performance for a clearer picture of their long-term prospects.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Intel's Turnaround Strategy: A 2025 Investment Analysis.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Combating The Extreme Heat Crisis The Importance Of Localized Initiatives

Jun 11, 2025

Combating The Extreme Heat Crisis The Importance Of Localized Initiatives

Jun 11, 2025 -

At Least 10 Killed In Devastating School Shooting In Austria

Jun 11, 2025

At Least 10 Killed In Devastating School Shooting In Austria

Jun 11, 2025 -

Complete 2025 Nba Mock Draft Two Rounds Of Predictions And Player Comparisons

Jun 11, 2025

Complete 2025 Nba Mock Draft Two Rounds Of Predictions And Player Comparisons

Jun 11, 2025 -

Milwaukee Brewers Call Up Jacob Misiorowski A Look At The Future

Jun 11, 2025

Milwaukee Brewers Call Up Jacob Misiorowski A Look At The Future

Jun 11, 2025 -

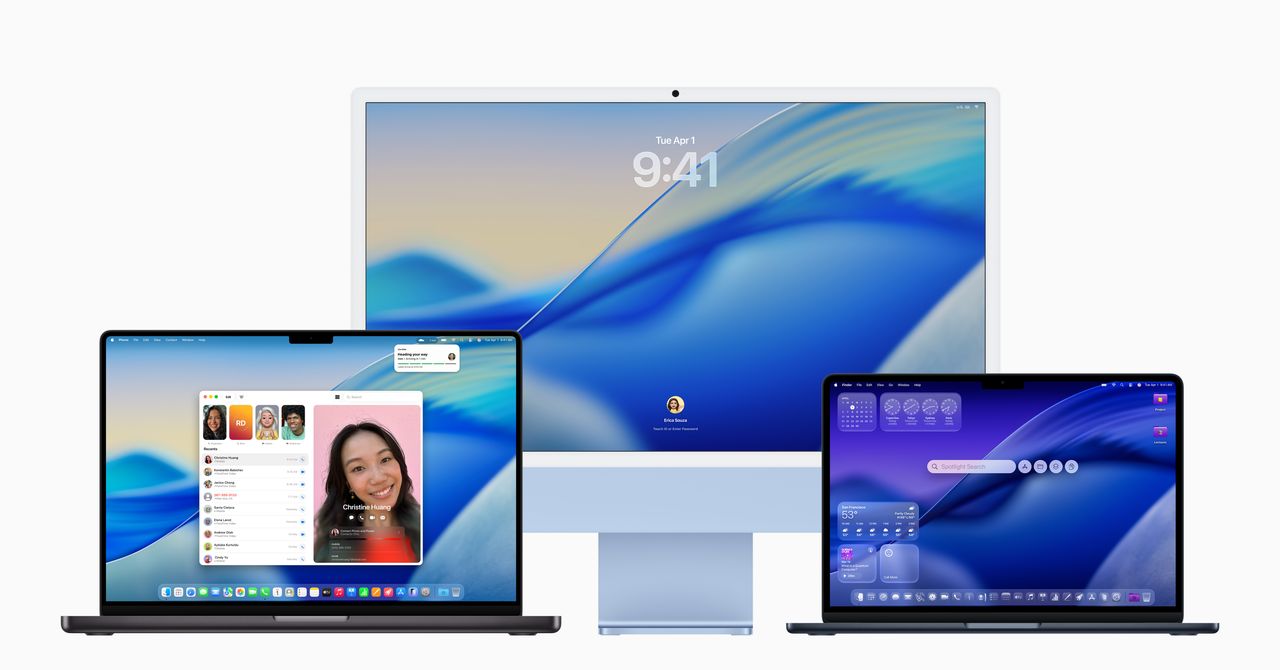

Intel Processors Out A Retrospective On Apples Silicon Shift

Jun 11, 2025

Intel Processors Out A Retrospective On Apples Silicon Shift

Jun 11, 2025