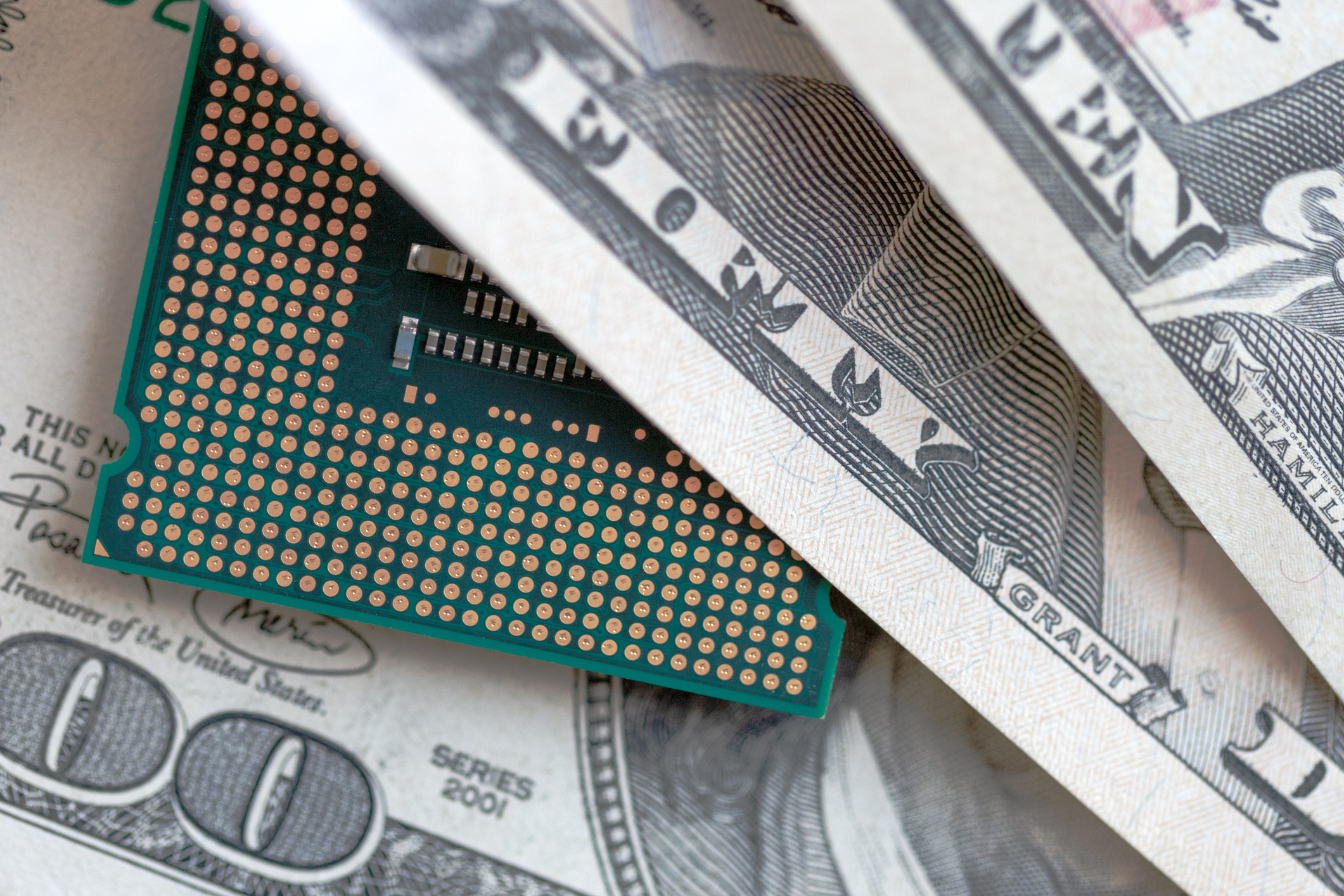

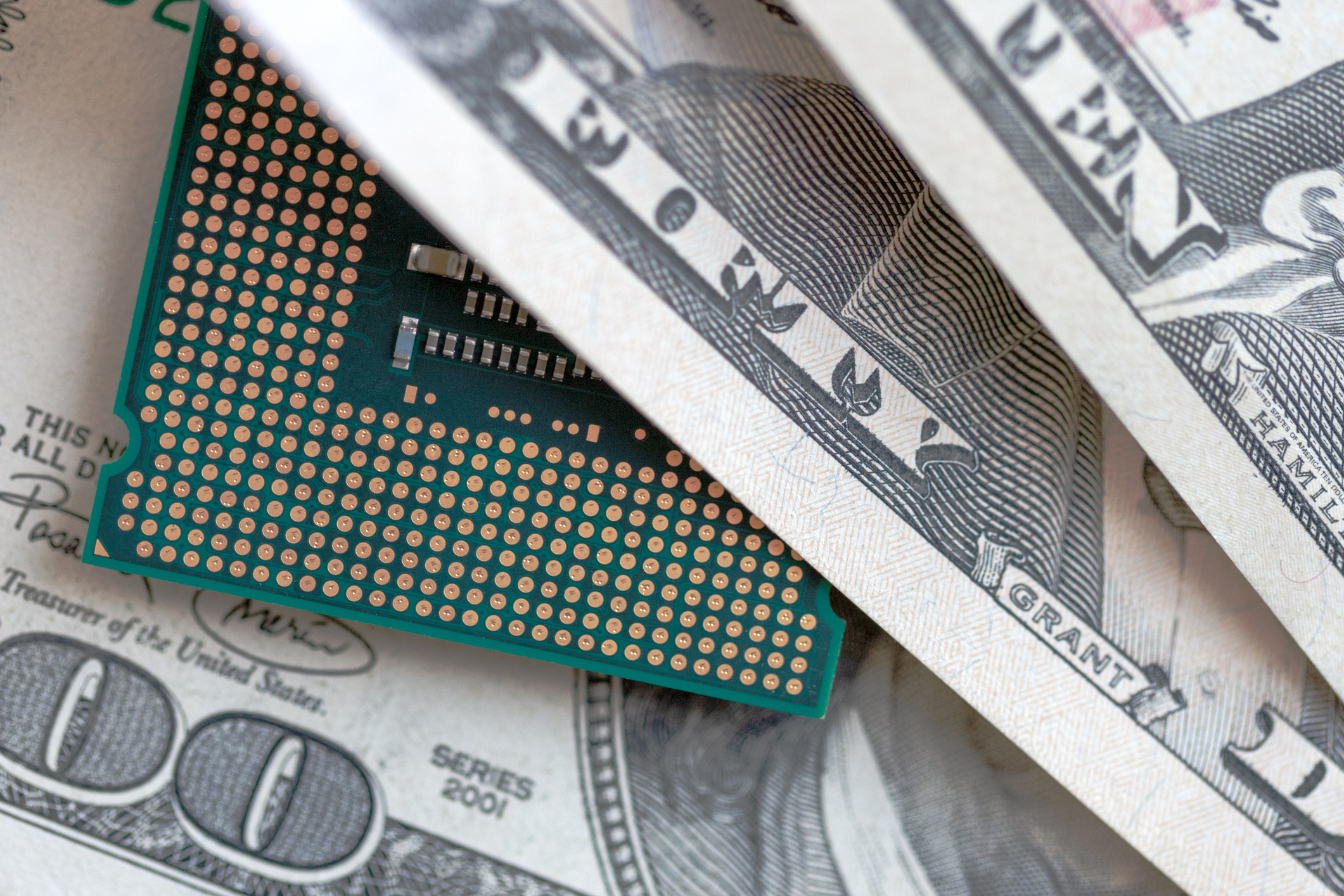

Intel's Comeback: Will Investors See A Profit By 2025?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Intel's Comeback: Will Investors See a Profit by 2025?

Intel, once the undisputed king of the microprocessor market, has faced significant challenges in recent years. The rise of competitors like AMD and TSMC has significantly impacted Intel's market share and profitability. However, under new CEO Pat Gelsinger, the company is charting an ambitious course for a comeback. But will this ambitious turnaround strategy translate into profits for investors by 2025? Let's delve into the details.

Intel's Strategic Shift: More Than Just Chips

Gelsinger's vision for Intel goes beyond simply producing better chips. His "IDM 2.0" strategy involves a multi-pronged approach:

-

Increased Internal Manufacturing: Intel is investing heavily in expanding its own manufacturing capabilities, aiming to regain its edge in process technology. This includes significant investments in new fabs (fabrication plants) and advanced manufacturing processes. This move is crucial for regaining control over its supply chain and reducing reliance on external foundries like TSMC.

-

Focus on High-Performance Computing (HPC): Intel is aggressively pursuing the lucrative HPC market, vital for data centers and artificial intelligence. This segment offers higher margins and significant growth potential compared to the consumer market.

-

Openness and Collaboration: Unlike its previous more insular approach, Intel is now embracing collaboration with other companies. This includes working with external partners to leverage their expertise and expand its reach.

-

Expanding into New Markets: Intel is also looking beyond its traditional core markets, exploring opportunities in areas like autonomous vehicles and the Internet of Things (IoT).

The Road to 2025: Challenges and Opportunities

While Intel's strategy is ambitious and promising, several significant challenges remain:

-

Catching Up in Process Technology: Regaining a technological lead over rivals like TSMC and Samsung in node size (the size of transistors) will require substantial investment and time. This is a critical factor in performance and power efficiency.

-

Competition: The semiconductor market is fiercely competitive. AMD, with its strong Ryzen processors and successful partnerships, remains a major threat. Nvidia also poses a significant challenge in the GPU and AI accelerator markets.

-

Economic Uncertainty: Global economic conditions can significantly impact demand for semiconductors. A downturn in the economy could affect Intel's sales and profitability.

Will Investors Profit by 2025? A Cautious Outlook

Predicting the future of any company is inherently speculative, and Intel's comeback story is no exception. While Gelsinger's strategy offers a compelling roadmap for long-term growth, achieving substantial profitability by 2025 is ambitious. The company faces stiff competition and needs to overcome significant technological hurdles.

Several factors will determine Intel's success:

- The success of its new manufacturing processes: Meeting ambitious timelines and yields will be crucial.

- The market acceptance of its new products: Successfully competing with rivals in key market segments is essential.

- The overall health of the global economy: A strong economy will boost demand for semiconductors.

In conclusion: Intel's comeback is underway, but whether investors will see substantial profits by 2025 remains uncertain. The company's strategic shifts are promising, but significant challenges lie ahead. Investors should approach Intel with a long-term perspective, recognizing that the turnaround will take time and is subject to various market forces. Continuous monitoring of Intel's progress in areas like process technology advancements and market share gains will be crucial in assessing the potential for future profitability. For more in-depth financial analysis, consider consulting with a qualified financial advisor.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Intel's Comeback: Will Investors See A Profit By 2025?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Did Elon Musk And Scott Bessant Fight At The White House

Jun 11, 2025

Did Elon Musk And Scott Bessant Fight At The White House

Jun 11, 2025 -

Jacob Misiorowskis Rise What To Watch In The Brewers System

Jun 11, 2025

Jacob Misiorowskis Rise What To Watch In The Brewers System

Jun 11, 2025 -

Analyzing The 2024 Nba Draft A Deep Dive Into Team Needs And Best Value Picks

Jun 11, 2025

Analyzing The 2024 Nba Draft A Deep Dive Into Team Needs And Best Value Picks

Jun 11, 2025 -

Live Cricket England And West Indies Clash In Third T20 International

Jun 11, 2025

Live Cricket England And West Indies Clash In Third T20 International

Jun 11, 2025 -

Urgent Evacuation Order Issued Lu Lit Alert Requires Immediate Action

Jun 11, 2025

Urgent Evacuation Order Issued Lu Lit Alert Requires Immediate Action

Jun 11, 2025