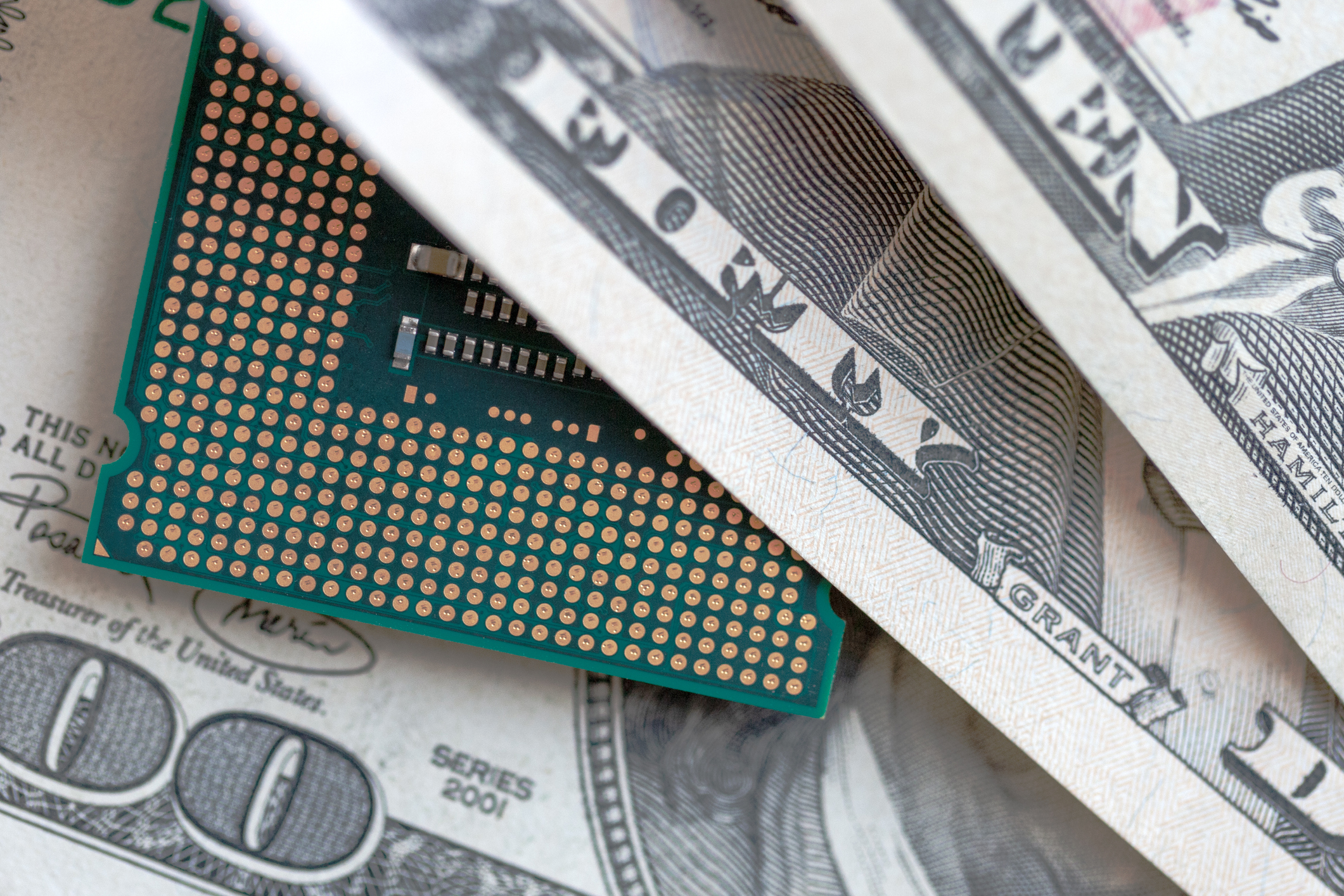

Intel Stock In 2025: Assessing The Risk And Reward

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Intel Stock in 2025: Assessing the Risk and Reward

Intel, a titan of the semiconductor industry, has faced a turbulent few years. But with a renewed focus on innovation and a massive investment in new manufacturing capabilities, the question on many investors' minds is: what will Intel stock look like in 2025? This article delves into the potential risks and rewards, offering a comprehensive assessment to help you navigate this complex investment landscape.

Intel's Current Landscape: Navigating the Challenges

Intel's recent struggles stem from several factors. The rise of competitors like TSMC and Samsung in the advanced chip manufacturing space has presented a significant challenge. Delayed product launches and difficulties in transitioning to smaller manufacturing nodes have also impacted profitability and market share. However, the company is actively addressing these issues through a multi-pronged strategy.

The Road to 2025: Key Factors Influencing Intel's Stock

Several key factors will determine Intel's stock performance by 2025:

-

Manufacturing Prowess: Intel's massive investment in its IDM 2.0 strategy, focusing on internal manufacturing and external partnerships, is crucial. Success in ramping up production of leading-edge chips will be vital for regaining market share and profitability. Failures here could severely impact the stock.

-

Product Innovation: The success of new products, including its next-generation CPUs and GPUs, is paramount. Positive market reception and strong adoption rates are crucial for boosting revenue and investor confidence. Conversely, underperforming products could further erode Intel's position.

-

Market Competition: The competitive landscape remains intensely fierce. Maintaining a technological edge against competitors like AMD, Nvidia, and the aforementioned TSMC and Samsung will be a constant battle. Falling behind in innovation or manufacturing capabilities could significantly impact stock performance.

-

Global Economic Conditions: Macroeconomic factors, such as inflation and potential recessions, will inevitably influence Intel's stock price. A strong global economy generally benefits technology companies, while economic downturns often lead to reduced demand for semiconductors.

-

Government Regulations and Geopolitics: Increasing geopolitical tensions and government regulations, particularly around semiconductor manufacturing and supply chains, will play a significant role. Navigating this complex regulatory environment effectively is crucial for Intel's success.

Assessing the Risk:

The risks associated with Intel stock are considerable. The highly competitive nature of the semiconductor industry, reliance on successful product launches, and vulnerability to global economic fluctuations all contribute to this risk. Failure to execute its manufacturing and innovation strategies effectively could lead to significant stock price declines.

Assessing the Reward:

Despite the risks, the potential rewards are also significant. A successful turnaround, driven by leading-edge manufacturing capabilities and innovative product offerings, could lead to substantial stock price appreciation. Intel's brand recognition, established customer base, and vast resources provide a solid foundation for future growth. Furthermore, the growing demand for semiconductors across various industries presents a significant long-term opportunity.

Conclusion: A Cautious Optimism

Intel's future remains uncertain, making it a high-risk, high-reward investment. While the company faces significant challenges, its aggressive investment in manufacturing and its commitment to innovation suggest a potential for a strong comeback. Investors should carefully assess their risk tolerance and conduct thorough due diligence before making any investment decisions. Staying informed about Intel's progress in key areas like manufacturing yields, product launches, and market share will be crucial for evaluating the stock's performance leading up to 2025 and beyond. Consider consulting with a financial advisor before making any investment decisions.

Further Reading:

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Intel Stock In 2025: Assessing The Risk And Reward. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Exclusive New Superman Trailer Shows Off Baby Guy Gardner Fight And Laser Battle

Jun 11, 2025

Exclusive New Superman Trailer Shows Off Baby Guy Gardner Fight And Laser Battle

Jun 11, 2025 -

The Best New Songs Of 2025 Our Updated Playlist

Jun 11, 2025

The Best New Songs Of 2025 Our Updated Playlist

Jun 11, 2025 -

Never Enough Turnstiles Highly Anticipated Tour Announced

Jun 11, 2025

Never Enough Turnstiles Highly Anticipated Tour Announced

Jun 11, 2025 -

Packers Bold Move Can Wide Receivers Replace Jaire Alexander At Cornerback

Jun 11, 2025

Packers Bold Move Can Wide Receivers Replace Jaire Alexander At Cornerback

Jun 11, 2025 -

Tragic School Shooting In Austria Death Toll Reaches At Least 10

Jun 11, 2025

Tragic School Shooting In Austria Death Toll Reaches At Least 10

Jun 11, 2025