Intel Investment Strategy: Evaluating The 2025 Turnaround Potential

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Intel Investment Strategy: Evaluating the 2025 Turnaround Potential

Intel, a once-dominant force in the semiconductor industry, faces a critical juncture. Its ambitious investment strategy aims for a significant turnaround by 2025, but can it deliver? This in-depth analysis examines Intel's current position, its planned investments, and the potential challenges and rewards on its path to resurgence.

Intel's Current Challenges: A Legacy to Overcome

For years, Intel lagged behind competitors like TSMC and Samsung in process technology, losing market share in both the CPU and GPU markets. This technological gap, coupled with increased competition and fluctuating global demand, led to significant financial pressure. The company's reliance on a mature manufacturing process also hindered its ability to compete effectively with rivals boasting cutting-edge fabrication techniques. This struggle to maintain technological leadership is a key factor analysts consider when evaluating Intel's 2025 projections.

The 2025 Turnaround Plan: Massive Investments and Strategic Shifts

Intel's strategy for a 2025 turnaround hinges on substantial capital expenditure. Billions are being poured into advanced manufacturing facilities, research and development, and strategic acquisitions. Key aspects of this plan include:

- IDM 2.0 Strategy: This strategy involves a hybrid approach, combining internal manufacturing with external foundry partnerships. This allows Intel to leverage its own expertise while also gaining access to additional manufacturing capacity.

- Focus on Leading-Edge Processes: Intel is aggressively investing in its next-generation process nodes, aiming to regain its technological edge. The success of its 7nm, 5nm, and beyond processes is crucial to its future competitiveness.

- Expansion into New Markets: Intel is diversifying beyond its traditional CPU focus, exploring opportunities in high-growth areas like AI accelerators and other specialized chips.

- Talent Acquisition and Retention: Attracting and retaining top engineering talent is essential for executing the complex technological advancements needed for the turnaround.

Analyzing the Potential for Success: Challenges and Opportunities

While Intel's investment strategy is ambitious, several challenges remain:

- Execution Risk: Successfully implementing such a large-scale transformation requires flawless execution across multiple fronts. Delays or unforeseen technical difficulties could significantly impact the timeline.

- Competition: The semiconductor industry is fiercely competitive. Maintaining a technological lead against established players and agile startups will be an ongoing struggle.

- Global Economic Uncertainty: Global economic downturns can severely impact demand for semiconductors, potentially affecting Intel's revenue projections.

- Yield Rate Challenges: Achieving high yield rates in advanced manufacturing processes is crucial for cost-effectiveness. Low yields can negate the benefits of technological advancements.

However, there are also significant opportunities:

- Growing Demand for Semiconductors: The long-term outlook for the semiconductor market remains positive, driven by the increasing demand from various sectors like AI, 5G, and automotive.

- Government Support: Various governments are actively investing in domestic semiconductor manufacturing, potentially providing Intel with financial incentives and support.

- Strong Brand Recognition: Intel's brand recognition and established customer relationships provide a significant advantage in the market.

Conclusion: A High-Stakes Gamble

Intel's 2025 turnaround potential is a high-stakes gamble. The scale of its investments and the complexity of the technological challenges involved are undeniable. However, the potential rewards are equally substantial. The success or failure of its strategy will significantly impact not only Intel's future but also the broader semiconductor landscape. Continuous monitoring of Intel's progress in key areas like process technology, yield rates, and market share will be crucial in determining the ultimate success of this ambitious undertaking. Further analysis is needed to assess the complete picture and predict the likelihood of a full turnaround by 2025. Stay tuned for further updates on Intel's progress.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Intel Investment Strategy: Evaluating The 2025 Turnaround Potential. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Fandangos Best First Day Superman Prime Video Early Access Tickets Top Ytd Sales

Jun 11, 2025

Fandangos Best First Day Superman Prime Video Early Access Tickets Top Ytd Sales

Jun 11, 2025 -

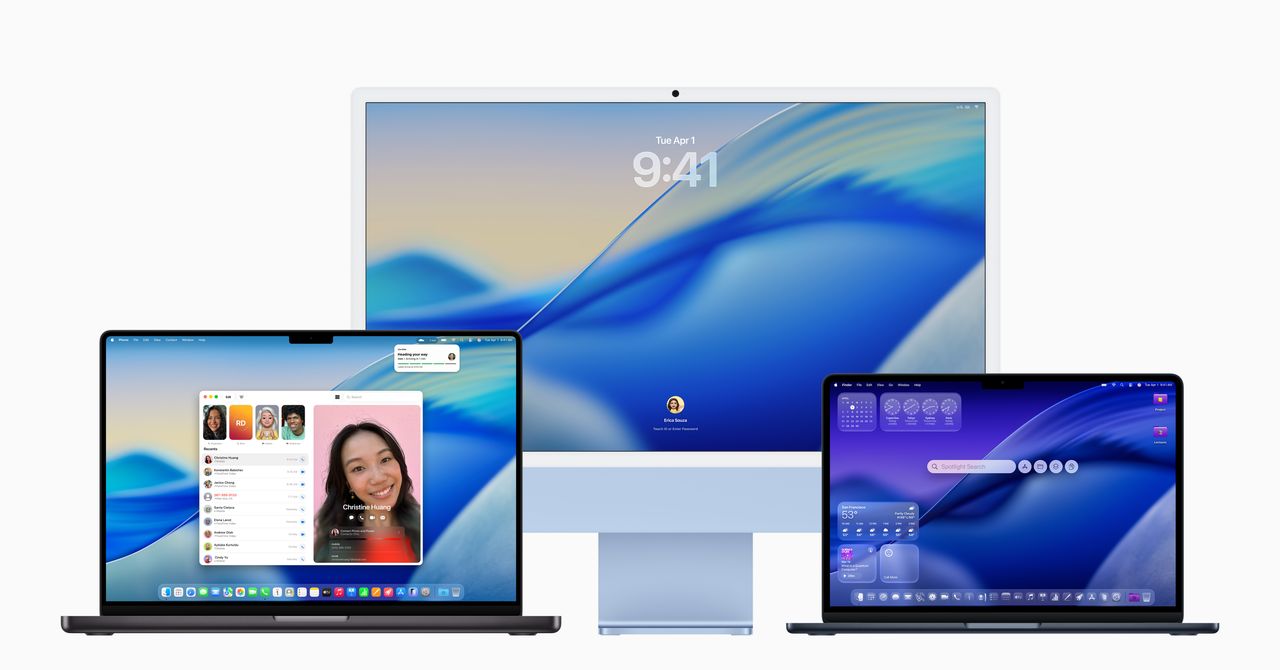

Farewell Intel Apples Transition To Apple Silicon Concludes

Jun 11, 2025

Farewell Intel Apples Transition To Apple Silicon Concludes

Jun 11, 2025 -

Packers Wide Receiver Experiments With Position Shift To Secure Roster Spot

Jun 11, 2025

Packers Wide Receiver Experiments With Position Shift To Secure Roster Spot

Jun 11, 2025 -

Is This The End For The Classic Mac Book Pro Apples Plans Unveiled

Jun 11, 2025

Is This The End For The Classic Mac Book Pro Apples Plans Unveiled

Jun 11, 2025 -

Boost Mac Performance And Intelligence With Mac Os Tahoe 26

Jun 11, 2025

Boost Mac Performance And Intelligence With Mac Os Tahoe 26

Jun 11, 2025