Intel (INTC) Plummets: Time To Buy The Dip? Analysis And Outlook.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Intel (INTC) Plummets: Time to Buy the Dip? Analysis and Outlook

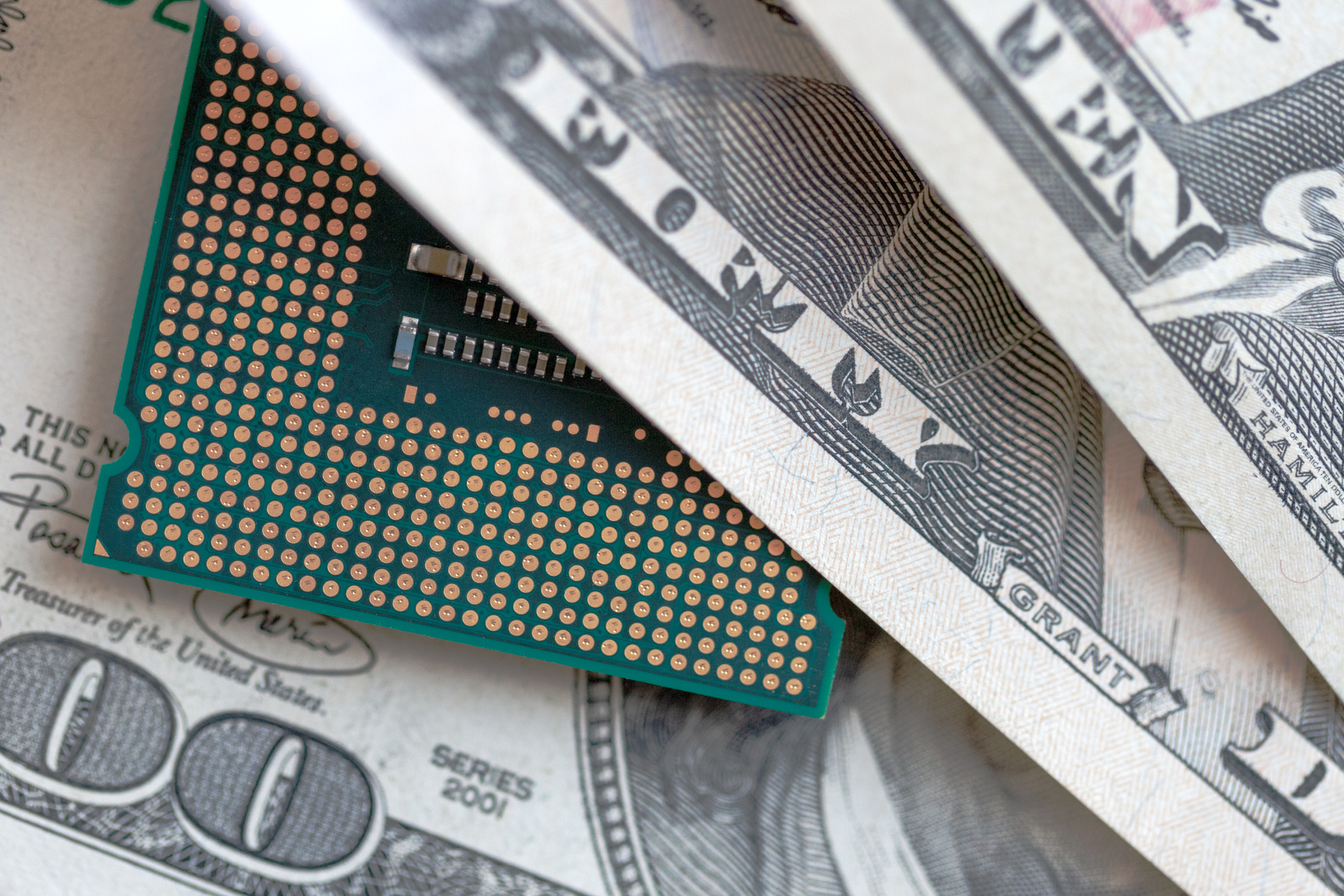

Intel (INTC) stock took a significant dive recently, leaving many investors wondering if this is a buying opportunity or a sign of further trouble. The recent price drop has sparked intense debate among analysts and investors alike, prompting crucial questions about the future of the chip giant. Is this a temporary setback, or the beginning of a longer-term decline? Let's delve into the analysis and explore the potential outlook for INTC.

Understanding the Recent Decline

Intel's recent plummet can be attributed to a confluence of factors. Disappointing quarterly earnings, coupled with increased competition in the semiconductor market, have fueled investor uncertainty. The company's struggle to compete with rivals like AMD and TSMC in the advanced chip manufacturing arena has also contributed to the negative sentiment. Concerns about weakening PC demand and the overall macroeconomic climate further exacerbated the sell-off. Specifically, the latest earnings report revealed weaker-than-expected revenue and profit margins, raising concerns about Intel's ability to execute its long-term strategy.

Key Factors Affecting Intel's Performance:

- Fierce Competition: The semiconductor industry is incredibly competitive. AMD's strong performance in CPUs and TSMC's dominance in advanced chip manufacturing have significantly pressured Intel's market share.

- Manufacturing Challenges: Intel's transition to a new manufacturing process has faced delays and challenges, hindering its ability to produce cutting-edge chips. This lag has allowed competitors to gain a significant advantage.

- Weakening PC Demand: The global PC market is experiencing a slowdown, impacting Intel's revenue streams. This downturn is driven by factors such as inflation and reduced consumer spending.

- Macroeconomic Uncertainty: The overall economic climate plays a significant role in the tech sector's performance. Global uncertainties and inflationary pressures can significantly impact investor sentiment and spending on technology.

Is it Time to Buy the Dip?

The question of whether to buy Intel stock after its recent decline is complex and depends largely on individual risk tolerance and investment horizon. While the price drop presents a potentially attractive entry point for long-term investors, several risks remain. The company's turnaround strategy needs time to prove effective, and continued competition could pose further challenges.

Arguments for Buying:

- Undervalued Asset: Some analysts believe that the current stock price undervalues Intel's long-term potential, particularly considering its significant presence in the data center market and its ongoing investments in new technologies.

- Potential for Turnaround: Intel's substantial resources and experience could enable it to navigate the current challenges and execute its turnaround strategy successfully. The company's new CEO has outlined ambitious plans for innovation and growth.

- Dividend Yield: Intel offers a relatively high dividend yield, providing a source of income for investors while they wait for the stock price to appreciate.

Arguments Against Buying:

- Ongoing Competition: The competitive landscape remains fierce, and there's no guarantee that Intel will be able to regain its lost market share.

- Execution Risk: Intel's turnaround plan involves significant challenges and risks. Failure to execute successfully could lead to further declines in the stock price.

- Economic Uncertainty: The global macroeconomic environment remains uncertain, which poses significant risk for technology stocks.

The Outlook for INTC

The outlook for Intel remains uncertain. The company faces significant challenges, but it also possesses considerable strengths and resources. Successful execution of its turnaround strategy is crucial for a positive outlook. Investors should carefully weigh the risks and rewards before making any investment decisions. It's crucial to conduct thorough due diligence and consider consulting with a financial advisor before investing in INTC or any other stock.

Conclusion:

The recent decline in Intel's stock price presents both opportunities and risks. Whether or not this is a "buy the dip" scenario depends on your individual investment strategy and risk tolerance. Thorough research and a long-term perspective are crucial when considering investing in INTC during this period of uncertainty. Stay informed about the latest news and developments to make the most informed decisions. Remember to consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Intel (INTC) Plummets: Time To Buy The Dip? Analysis And Outlook.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Best Songs Of 2025 A Mid Year Roundup

Jun 11, 2025

Best Songs Of 2025 A Mid Year Roundup

Jun 11, 2025 -

Predicting The 2024 Nba Draft A Comprehensive Mock Draft Analysis

Jun 11, 2025

Predicting The 2024 Nba Draft A Comprehensive Mock Draft Analysis

Jun 11, 2025 -

Intel Stock 2025 Is A Turnaround On The Horizon For Investors

Jun 11, 2025

Intel Stock 2025 Is A Turnaround On The Horizon For Investors

Jun 11, 2025 -

Experts 2025 Nba Mock Draft Complete Two Round Predictions And Player Comparisons

Jun 11, 2025

Experts 2025 Nba Mock Draft Complete Two Round Predictions And Player Comparisons

Jun 11, 2025 -

Dominant Display Brooks Switch Hit Decisive Against Windies

Jun 11, 2025

Dominant Display Brooks Switch Hit Decisive Against Windies

Jun 11, 2025