Intel (INTC) Down 35%: A Deep Dive Into The Stock's Performance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Intel (INTC) Down 35%: A Deep Dive into the Stock's Plummet

Intel Corporation (INTC) has experienced a significant downturn, with its stock price plummeting by approximately 35% in [Insert Time Period, e.g., the last quarter/year]. This dramatic fall has sent shockwaves through the tech industry and left investors scrambling to understand the underlying causes. This article delves into the key factors contributing to Intel's sharp decline and explores potential implications for the future.

The Crumbling Foundation: Key Factors Behind Intel's Stock Drop

Several interconnected issues have converged to create this perfect storm for Intel. These include:

-

Increased Competition: The semiconductor market has become fiercely competitive. Companies like AMD, with its Ryzen processors and strong inroads into the data center market, have successfully challenged Intel's dominance. This intensified rivalry has put immense pressure on Intel's market share and pricing strategies. [Link to an article comparing AMD and Intel processors]

-

Manufacturing Delays and Technological Setbacks: Intel has faced significant delays in its advanced manufacturing process, falling behind its competitors in the race to produce smaller, more efficient chips. This technological lag has hampered its ability to release cutting-edge processors, impacting both its performance and its ability to compete on price. [Link to an article detailing Intel's manufacturing challenges]

-

Weakening Global Demand: The global economic slowdown, particularly impacting the PC market, has reduced demand for Intel's processors. This decreased demand has further exacerbated the pressure on the company's revenue and profitability. [Link to an article discussing the global economic slowdown]

-

Investor Sentiment: Negative news and a string of underwhelming financial reports have eroded investor confidence in Intel's long-term prospects. This loss of confidence has fueled the sell-off, further depressing the stock price.

Is This a Buying Opportunity or a Sign of Further Decline?

The sharp decline in Intel's stock price has understandably raised the question: is this a buying opportunity or a warning sign of further trouble? There's no easy answer.

Some analysts argue that the current valuation presents a compelling entry point for long-term investors, believing that Intel possesses the resources and brand recognition to eventually recover. They highlight the company's significant investments in R&D and its strong presence in various segments of the semiconductor industry.

Others remain cautious, pointing to the ongoing challenges and the uncertainty surrounding Intel's ability to regain its competitive edge. They suggest that the stock price could fall further before finding a bottom.

What to Watch For:

Investors should closely monitor several key factors in the coming months:

- Intel's upcoming product launches: The success or failure of new processors and other technologies will significantly impact investor sentiment.

- The company's progress in manufacturing: Any improvements in Intel's manufacturing process could boost investor confidence.

- The overall state of the global economy: A global economic recovery would likely benefit Intel's sales.

Conclusion:

The 35% drop in Intel's stock price reflects a confluence of significant challenges. While the company possesses strengths, investors need to carefully weigh the risks and rewards before making any investment decisions. Further analysis and careful monitoring of the factors discussed above are crucial for navigating this turbulent period for Intel and its shareholders. Conduct thorough due diligence and consider consulting a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Intel (INTC) Down 35%: A Deep Dive Into The Stock's Performance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Turnstile Announces Extensive 2025 Us Headlining Tour Full Details Inside

Jun 11, 2025

Turnstile Announces Extensive 2025 Us Headlining Tour Full Details Inside

Jun 11, 2025 -

Comprehensive 2025 Nba Mock Draft Two Round Picks And Player Comparisons

Jun 11, 2025

Comprehensive 2025 Nba Mock Draft Two Round Picks And Player Comparisons

Jun 11, 2025 -

The Truth About Jason Momoas Dating Life In 2025 Separating Fact From Fiction

Jun 11, 2025

The Truth About Jason Momoas Dating Life In 2025 Separating Fact From Fiction

Jun 11, 2025 -

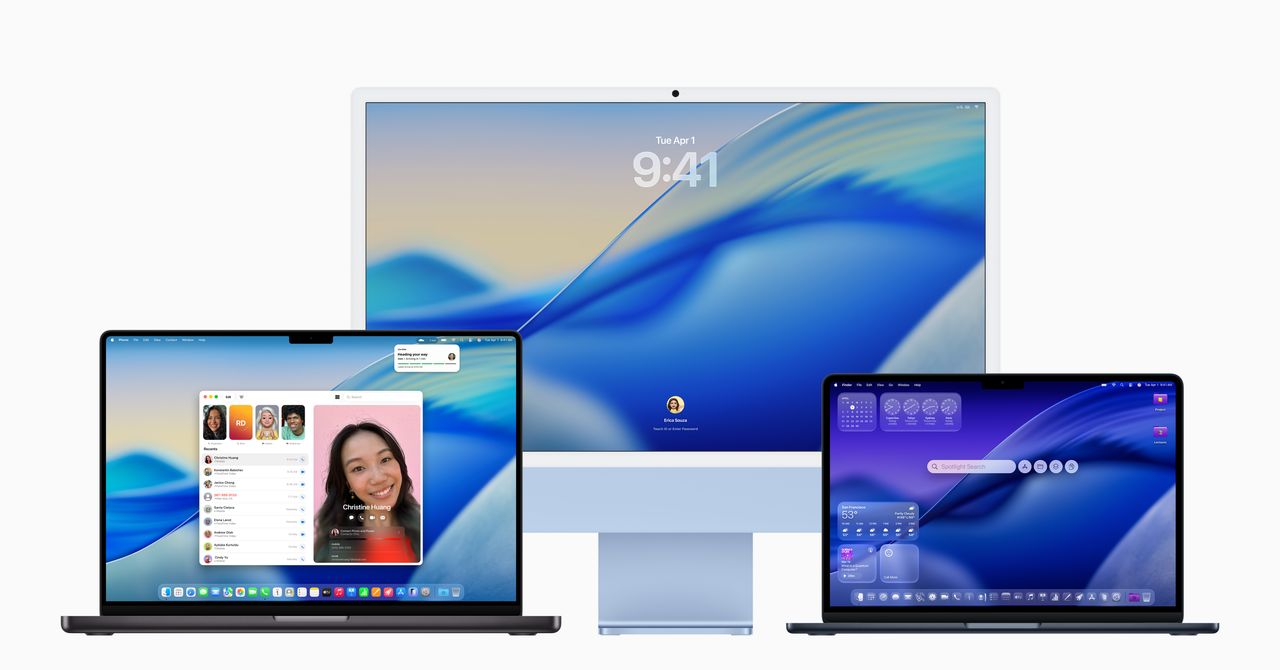

Intels Departure From Apple Macs Impact And Future Implications

Jun 11, 2025

Intels Departure From Apple Macs Impact And Future Implications

Jun 11, 2025 -

Report Elon Musk And Scott Bessant Engage In Public Argument At White House

Jun 11, 2025

Report Elon Musk And Scott Bessant Engage In Public Argument At White House

Jun 11, 2025