INTC Stock Down 35%: Is It A Buy Or Sell Signal?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

INTC Stock Down 35%: Is it a Buy or Sell Signal?

Intel (INTC) has experienced a significant downturn, with its stock price plummeting by 35%. This dramatic fall has left many investors wondering: is this a buying opportunity, or a signal to sell and cut losses? The answer, as always, is complex and depends heavily on individual investment strategies and risk tolerance. Let's delve into the factors driving this decline and explore potential future scenarios.

Understanding Intel's Recent Struggles

Intel's stock price drop isn't a sudden event; it's the culmination of several interconnected challenges. The company has faced intense competition from rivals like AMD, particularly in the CPU market. AMD's Ryzen processors have gained significant market share, impacting Intel's revenue and profitability. Furthermore, Intel's delays in transitioning to advanced manufacturing nodes have further hampered its competitiveness. This has led to concerns about its ability to innovate and keep pace with the rapidly evolving semiconductor industry. The global economic slowdown and decreased demand for PCs have also contributed to the company's struggles.

Analyzing the 35% Drop: Key Factors

- Market Share Loss: AMD's aggressive advancements have undeniably chipped away at Intel's dominance in the CPU market. This loss of market share directly impacts revenue and investor confidence.

- Manufacturing Delays: Intel's setbacks in transitioning to smaller, more efficient manufacturing processes have created a competitive disadvantage, affecting its ability to produce cutting-edge chips.

- Economic Slowdown: The global economic climate plays a significant role. Reduced demand for electronics, particularly PCs, impacts sales and profitability across the semiconductor sector.

- Increased Competition: The semiconductor industry is fiercely competitive. Beyond AMD, companies like Nvidia and Qualcomm are also vying for market share, creating a challenging environment for Intel.

Is it a Buy or Sell? A Closer Look at the Options

The 35% drop presents a classic dilemma for investors. On one hand, the low price might seem attractive – a potential bargain for long-term investors. However, the underlying challenges facing Intel are substantial and cannot be ignored.

Arguments for Buying:

- Potential Turnaround: Intel is a major player in the industry with significant resources. A successful turnaround, driven by new product launches or strategic acquisitions, could lead to substantial gains.

- Undervalued Asset: Some analysts argue that the current stock price undervalues Intel's assets and potential. This makes it an attractive proposition for investors with a long-term perspective.

- Dividend Yield: Intel offers a relatively high dividend yield, making it appealing to income-seeking investors.

Arguments for Selling:

- Continued Challenges: The competitive landscape remains challenging, and Intel's struggles might persist for some time.

- Uncertain Future: The company's future performance is far from certain, making it a risky investment.

- Better Alternatives: Investors might find more attractive opportunities in other, more dynamic sectors of the tech industry.

Conclusion: Due Diligence is Crucial

The decision to buy or sell INTC stock after its 35% drop requires careful consideration. It's crucial to conduct thorough research, analyze financial reports, and assess your own risk tolerance before making any investment decisions. Consulting with a qualified financial advisor is also highly recommended. Remember that past performance is not indicative of future results. The information provided here is for informational purposes only and should not be considered financial advice.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Always conduct your own research and consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on INTC Stock Down 35%: Is It A Buy Or Sell Signal?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Dwyane Wade And Udonis Haslem A Birthday Message Of Friendship

Jun 11, 2025

Dwyane Wade And Udonis Haslem A Birthday Message Of Friendship

Jun 11, 2025 -

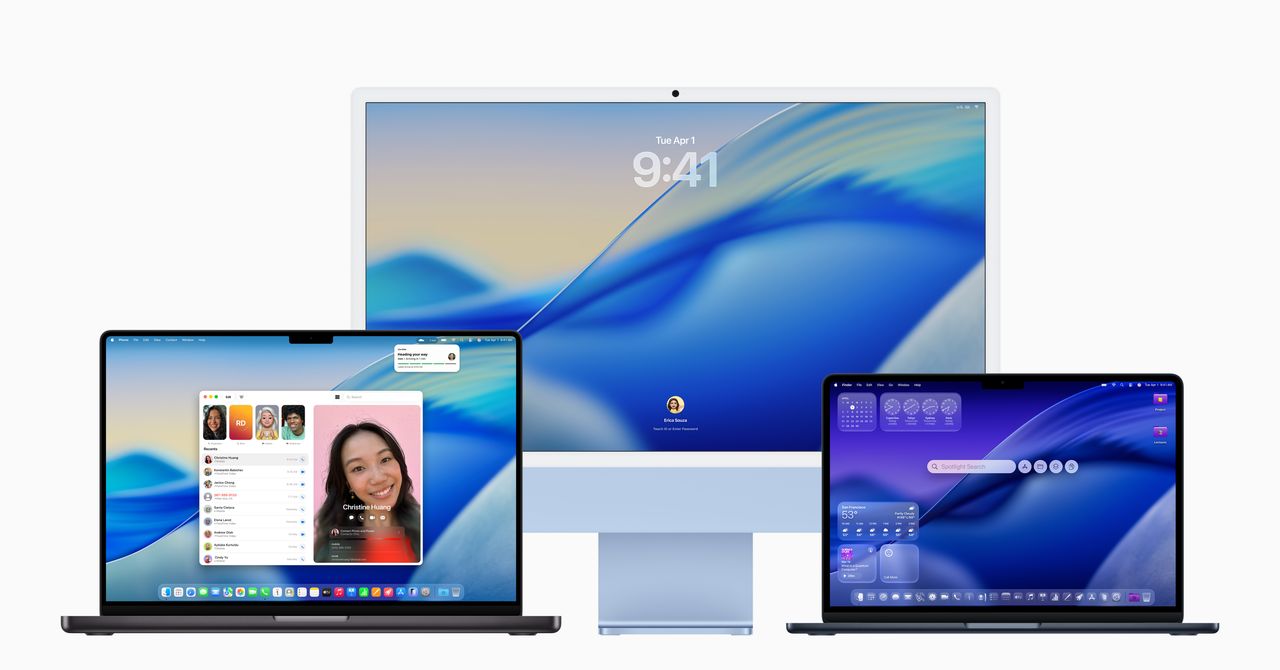

Apples Transition Complete Intel Macs Officially Retired

Jun 11, 2025

Apples Transition Complete Intel Macs Officially Retired

Jun 11, 2025 -

2025 Nba Draft Mock Full Two Round Analysis And Player Profiles

Jun 11, 2025

2025 Nba Draft Mock Full Two Round Analysis And Player Profiles

Jun 11, 2025 -

Comprehensive 2025 Nba Mock Draft Two Round Picks With Player Comparisons

Jun 11, 2025

Comprehensive 2025 Nba Mock Draft Two Round Picks With Player Comparisons

Jun 11, 2025 -

Intels Pat Gelsinger A New Strategy To Regain Chip Manufacturing Leadership

Jun 11, 2025

Intels Pat Gelsinger A New Strategy To Regain Chip Manufacturing Leadership

Jun 11, 2025