Institutional Money Drives $5 Billion+ Into Bitcoin ETFs: What It Means

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Institutional Money Drives $5 Billion+ into Bitcoin ETFs: What it Means for the Future of Crypto

The cryptocurrency market is buzzing with excitement as institutional investors pour billions into Bitcoin exchange-traded funds (ETFs). Recent data reveals a staggering influx of over $5 billion into Bitcoin ETFs, signaling a significant shift in market sentiment and potentially paving the way for broader crypto adoption. This massive investment isn't just another ripple; it's a tidal wave, reshaping the landscape of digital assets and raising crucial questions about the future of Bitcoin and the broader cryptocurrency market.

What Fueled this Surge in Investment?

Several factors have contributed to this unprecedented surge in institutional investment in Bitcoin ETFs:

-

Regulatory Clarity: The approval of the first Bitcoin futures ETF in the US marked a watershed moment, boosting investor confidence and paving the way for more accessible investment vehicles. While a spot Bitcoin ETF remains under review, the approval of futures ETFs has significantly reduced regulatory uncertainty.

-

Inflation Hedge: With persistent inflation concerns globally, investors are seeking alternative assets to protect their portfolios. Bitcoin, often perceived as a hedge against inflation, is becoming an increasingly attractive option for diversification.

-

Institutional Adoption: Major financial institutions are increasingly recognizing the potential of Bitcoin and are actively seeking ways to integrate it into their investment strategies. This move towards institutional adoption lends credibility and stability to the cryptocurrency market.

-

Increased Accessibility: Bitcoin ETFs offer a relatively straightforward and regulated way for institutional investors to gain exposure to Bitcoin without the complexities of directly managing cryptocurrency holdings. This accessibility is a major driver of the recent investment surge.

What Does This Mean for the Future of Bitcoin?

The influx of billions into Bitcoin ETFs has profound implications for the future of the cryptocurrency:

-

Price Appreciation: The increased demand driven by institutional investment is likely to exert upward pressure on Bitcoin's price, potentially leading to further price appreciation in the coming months. However, it's important to note that market volatility remains a factor.

-

Mainstream Adoption: This massive investment serves as a powerful endorsement of Bitcoin's viability, potentially accelerating its mainstream adoption by individual investors and businesses.

-

Increased Market Maturity: The growing participation of institutional investors is likely to contribute to increased market maturity and stability, reducing volatility in the long term.

-

Further Regulatory Scrutiny: The significant investment could trigger further regulatory scrutiny and potentially lead to the approval of spot Bitcoin ETFs, further solidifying Bitcoin's position in the financial world.

Potential Risks and Considerations

While the outlook appears positive, it's crucial to acknowledge potential risks:

-

Market Volatility: Despite the increased institutional investment, Bitcoin remains a volatile asset. Significant price swings are still possible.

-

Regulatory Uncertainty: Although regulatory clarity has improved, the regulatory landscape for cryptocurrencies is still evolving, and future changes could impact the market.

-

Security Risks: Security breaches and hacks remain a concern in the cryptocurrency space.

Conclusion: A New Era for Bitcoin?

The $5 billion+ influx of institutional money into Bitcoin ETFs marks a significant milestone in the history of cryptocurrencies. It signals a growing acceptance of Bitcoin as a legitimate asset class and suggests a potential shift towards a more mature and regulated cryptocurrency market. While risks remain, the current trend indicates a bullish outlook for Bitcoin's future, promising increased mainstream adoption and potential price appreciation. However, investors should always conduct thorough research and understand the risks involved before investing in any cryptocurrency. For more information on Bitcoin and cryptocurrency investments, you might find resources on sites like [link to a reputable financial news source]. Remember, this article is for informational purposes only and is not financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Institutional Money Drives $5 Billion+ Into Bitcoin ETFs: What It Means. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

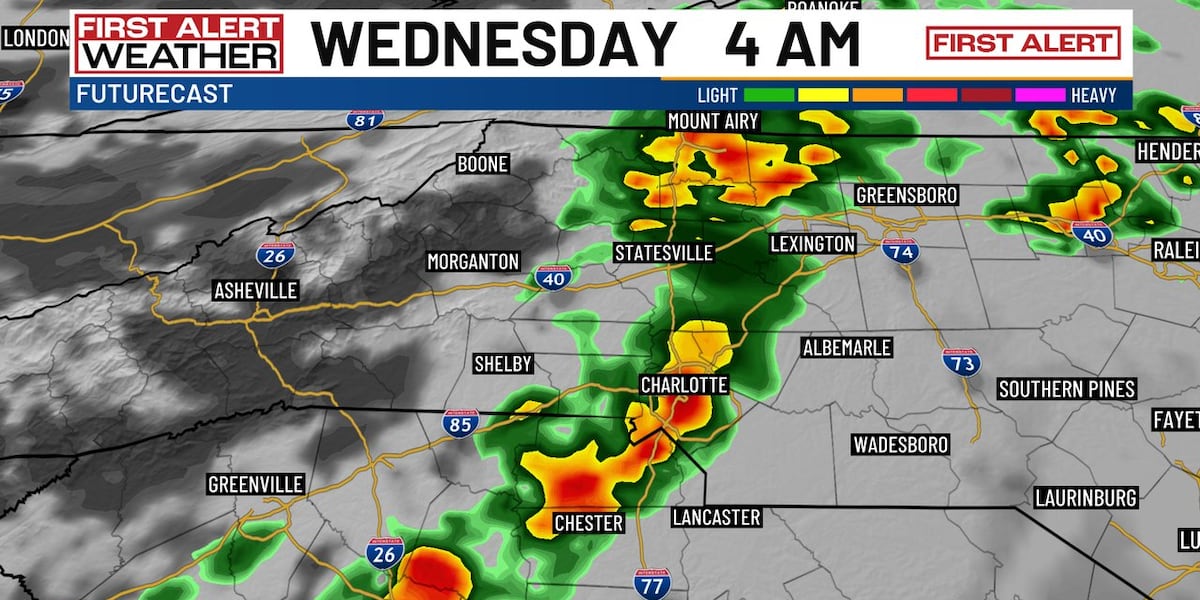

Overnight Storm Warning Charlotte Area Under Severe Weather Threat

May 21, 2025

Overnight Storm Warning Charlotte Area Under Severe Weather Threat

May 21, 2025 -

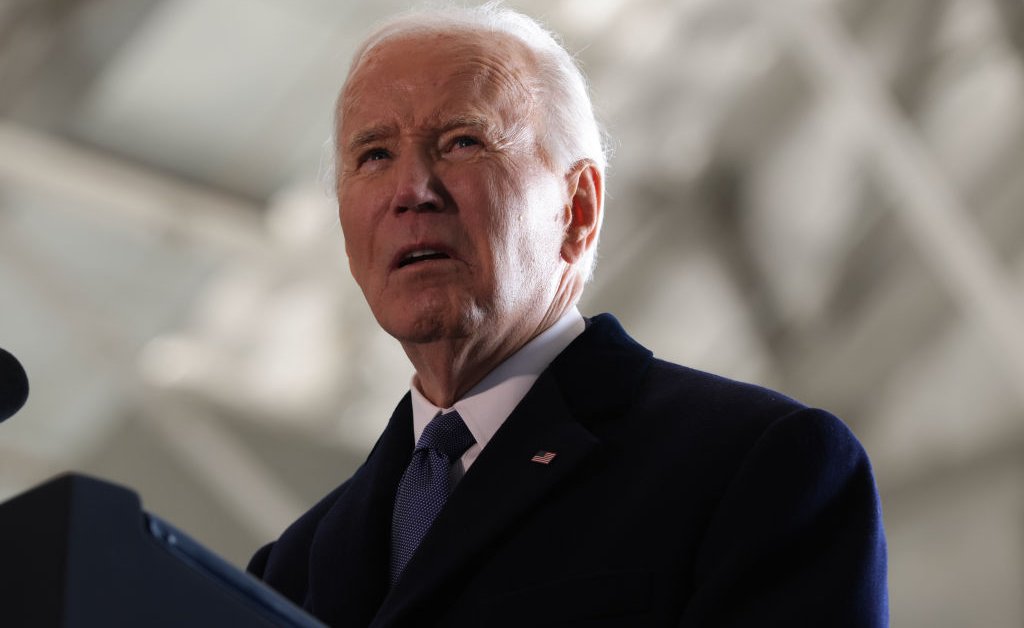

J D Vance Challenges Bidens Ability To Lead After Cancer Announcement

May 21, 2025

J D Vance Challenges Bidens Ability To Lead After Cancer Announcement

May 21, 2025 -

Popular Webtoon Solo Leveling Receives First Industry Recognition

May 21, 2025

Popular Webtoon Solo Leveling Receives First Industry Recognition

May 21, 2025 -

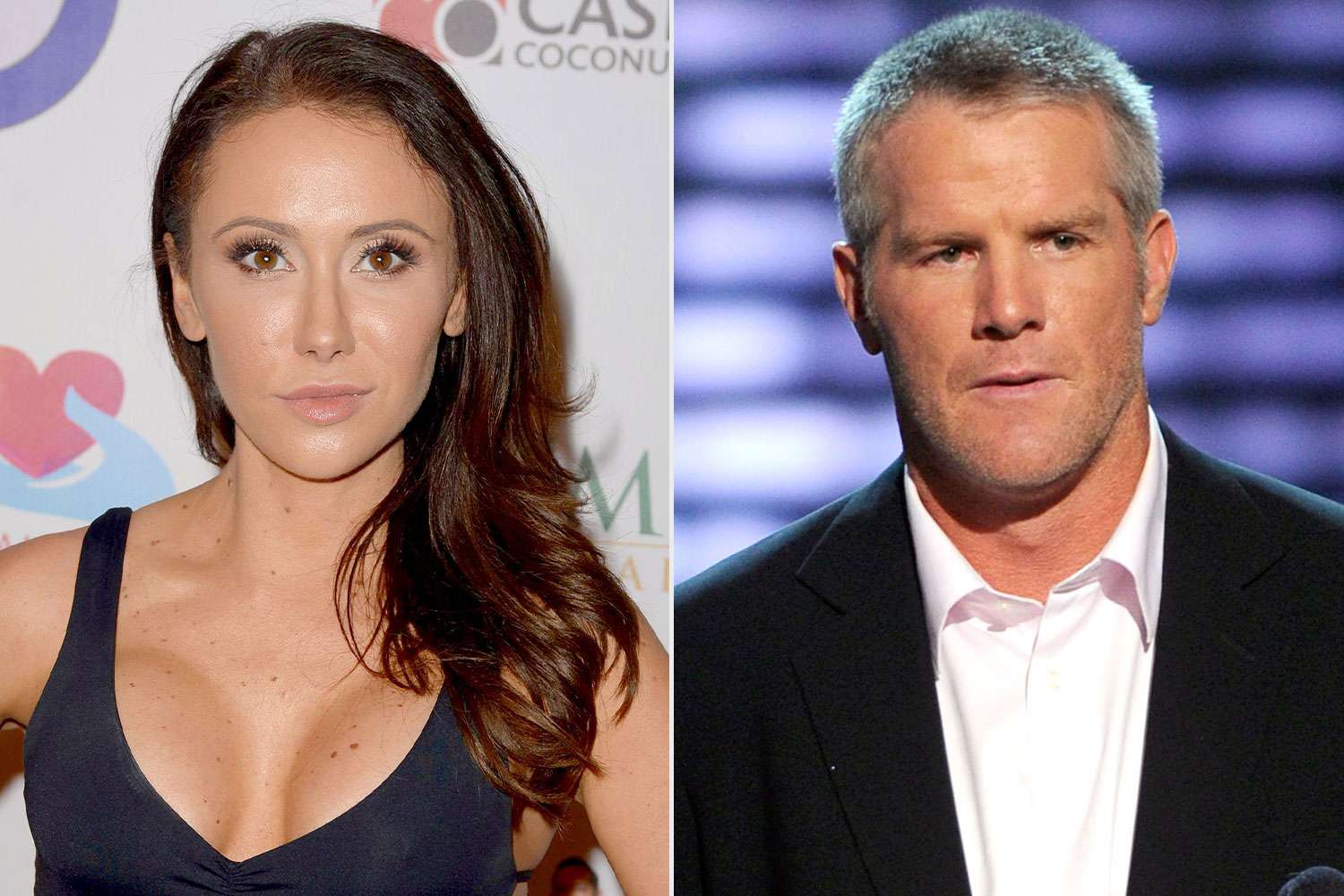

Jenn Sterger Details The Aftermath Of The Brett Favre Scandal A Personal Account

May 21, 2025

Jenn Sterger Details The Aftermath Of The Brett Favre Scandal A Personal Account

May 21, 2025 -

Ufc Fans React Jon Jones Future In Jeopardy Amidst Aspinall Contract Delay

May 21, 2025

Ufc Fans React Jon Jones Future In Jeopardy Amidst Aspinall Contract Delay

May 21, 2025