Institutional Investors Hold 83% Of Alliant Energy Corporation (LNT)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Institutional Investors Hold Tight Grip on Alliant Energy (LNT): What Does It Mean for Investors?

Alliant Energy Corporation (LNT), a prominent player in the energy sector, has seen a significant concentration of its stock ownership within the hands of institutional investors. Recent filings reveal that these large-scale investors now hold a staggering 83% of Alliant Energy's outstanding shares. This significant stake raises important questions about the future direction of the company and the implications for individual investors. Understanding this dynamic is crucial for anyone considering investing in or currently holding LNT stock.

The Dominance of Institutional Investors:

The 83% figure represents a substantial concentration of ownership. This high percentage suggests a strong degree of confidence in Alliant Energy's long-term prospects from these sophisticated investors, who often conduct extensive due diligence before making significant investments. These institutions, including mutual funds, pension funds, and hedge funds, typically base their investment decisions on detailed analysis of financial performance, growth potential, and risk assessment. Their substantial holdings can influence the stock price and overall market perception of the company.

What Drives Institutional Investment in Alliant Energy?

Several factors likely contribute to the high level of institutional investment in Alliant Energy:

- Stable Dividend Payments: Alliant Energy has a history of consistent and growing dividend payouts, making it attractive to income-seeking investors. This reliability is a key factor for institutional investors looking for steady returns.

- Growth in Renewable Energy: Alliant Energy is actively investing in renewable energy sources, aligning with the growing global focus on sustainability and clean energy. This strategic shift is likely appealing to environmentally conscious investors.

- Strong Regulatory Environment: The company operates within a relatively stable regulatory environment, reducing uncertainties associated with government policies. This predictability is crucial for long-term investment planning.

- Consistent Financial Performance: Alliant Energy's track record of consistent financial performance, including revenue growth and profitability, adds to its appeal among institutional investors.

Implications for Individual Investors:

The high level of institutional ownership can influence the stock price in several ways:

- Price Stability: Large institutional investors tend to hold their positions for longer periods, leading to potentially greater price stability compared to stocks with more dispersed ownership.

- Liquidity: The significant trading volume associated with institutional activity generally ensures better liquidity for the stock, making it easier for individual investors to buy and sell shares.

- Potential for Volatility: While institutional investment can lead to stability, substantial selling by these investors could cause significant price fluctuations.

Looking Ahead:

Alliant Energy's future performance will depend on several factors, including the successful execution of its renewable energy initiatives, regulatory developments, and overall economic conditions. Monitoring these factors is crucial for both institutional and individual investors. Staying informed about the company's financial reports, strategic decisions, and industry trends is key to making sound investment choices.

Further Research:

For more in-depth analysis, it's recommended to consult financial news sources, analyst reports, and Alliant Energy's investor relations website. Understanding the company's financial statements and future projections is essential for evaluating the investment potential of LNT.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Institutional Investors Hold 83% Of Alliant Energy Corporation (LNT). We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Shocking Border Statistics Prompt Response From Former Ice Director

Jun 24, 2025

Shocking Border Statistics Prompt Response From Former Ice Director

Jun 24, 2025 -

Rogers Second Big League Start Expectations And Key Observations

Jun 24, 2025

Rogers Second Big League Start Expectations And Key Observations

Jun 24, 2025 -

Mlb Orioles Roster Move Handley On Concussion List Catcher Promoted

Jun 24, 2025

Mlb Orioles Roster Move Handley On Concussion List Catcher Promoted

Jun 24, 2025 -

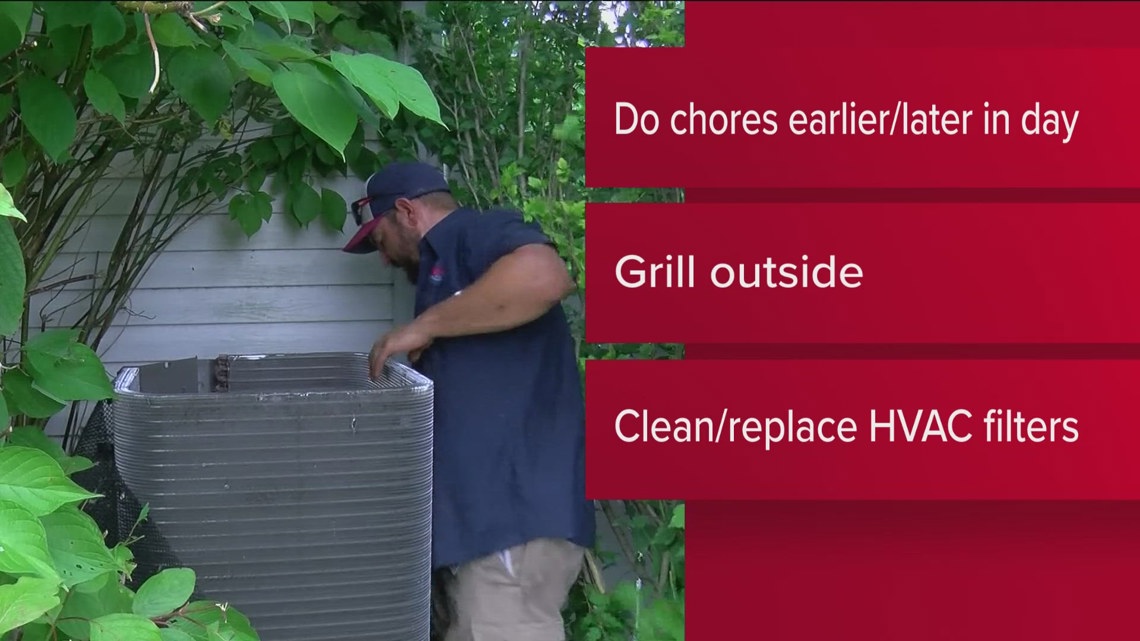

Affordable Heatwave Relief Practical Steps To Save Energy And Money

Jun 24, 2025

Affordable Heatwave Relief Practical Steps To Save Energy And Money

Jun 24, 2025 -

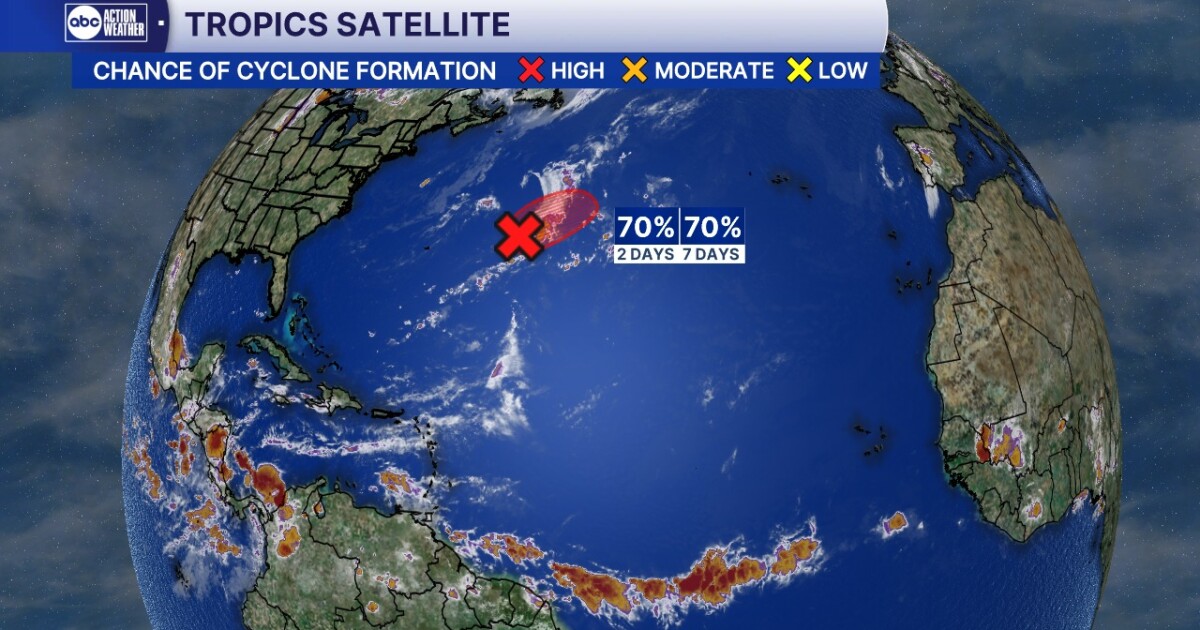

Atlantic Hurricane Season Begins Early Tropical Storm Andrea Threat Looms

Jun 24, 2025

Atlantic Hurricane Season Begins Early Tropical Storm Andrea Threat Looms

Jun 24, 2025