Institutional Investment In Robinhood: Wellington Management Buys 15,775 Shares

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wellington Management's Robinhood Investment: A Sign of Confidence or Calculated Risk?

Headline: Wellington Management Buys 15,775 Robinhood Shares: What Does It Mean for the Brokerage Platform?

Introduction: The financial world is buzzing after the revelation that Wellington Management, a prominent global investment firm, has acquired a significant stake in Robinhood Markets, Inc. (HOOD). This strategic move, involving 15,775 shares, has sparked considerable debate amongst analysts and investors alike. Is this a vote of confidence in Robinhood's future, a calculated risk on a volatile stock, or something else entirely? Let's delve into the details and explore the potential implications of this investment.

H2: Wellington Management: A Heavyweight Investor

Wellington Management is no small player. Known for its long-term investment strategies and meticulous research, the firm manages trillions of dollars in assets globally. Their investment in Robinhood, therefore, carries significant weight and signals a level of due diligence rarely seen in more impulsive market entries. This isn't a fly-by-night operation; it's a considered decision by a highly respected institution.

H2: Robinhood's Recent Performance and Challenges

Robinhood, the commission-free trading platform that revolutionized retail investing, has had a rollercoaster ride since its IPO. While it attracted millions of users with its user-friendly interface and zero-commission trading, the company has faced challenges including regulatory scrutiny, increased competition, and fluctuating user engagement. The recent investment from Wellington Management might suggest a belief that Robinhood is navigating these challenges successfully and poised for future growth. However, the relatively small number of shares purchased could also point to a cautious approach.

H3: Key Factors Influencing Wellington's Decision

Several factors could have influenced Wellington Management's decision to invest in Robinhood:

- Long-term growth potential: Despite current challenges, Robinhood still holds significant market share and possesses the potential for long-term growth in the evolving fintech landscape.

- Strategic diversification: Adding Robinhood to their portfolio could be part of a broader strategy to diversify investments across different sectors and asset classes.

- Undervalued asset: Wellington may believe Robinhood's current market valuation doesn't fully reflect its long-term potential, presenting a compelling investment opportunity.

H2: What Does This Mean for Robinhood Investors?

While this investment doesn't guarantee immediate price increases, it can be interpreted as a positive sign for several reasons. The presence of a reputable institutional investor like Wellington Management can boost investor confidence and potentially attract further investment. However, it's crucial to remember that stock prices remain inherently volatile and subject to market fluctuations.

H3: Looking Ahead for Robinhood

Robinhood's future success will depend on its ability to adapt to the changing market dynamics, enhance its product offerings, and address regulatory concerns. Continued innovation and strategic partnerships will be vital in maintaining its competitive edge. The company's recent efforts to expand its services beyond trading, such as offering checking and savings accounts, could play a significant role in its long-term growth.

H2: Conclusion:

Wellington Management's investment in Robinhood is a significant development, though the relatively small number of shares purchased suggests a measured approach rather than an aggressive bet. The move certainly adds intrigue to the ongoing Robinhood narrative and could signal a turning point for the company. Whether this signals a broader market shift towards confidence in Robinhood or simply a calculated risk by a savvy investor remains to be seen. The coming months will be crucial in observing the impact of this investment and the overall trajectory of Robinhood’s performance. Keep an eye on HOOD's performance and related news for further insight.

(Optional CTA): Stay informed about the latest developments in the financial markets by subscribing to our newsletter!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Institutional Investment In Robinhood: Wellington Management Buys 15,775 Shares. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Paula Patton On Her New Movie Challenges And Triumphs

Jun 14, 2025

Paula Patton On Her New Movie Challenges And Triumphs

Jun 14, 2025 -

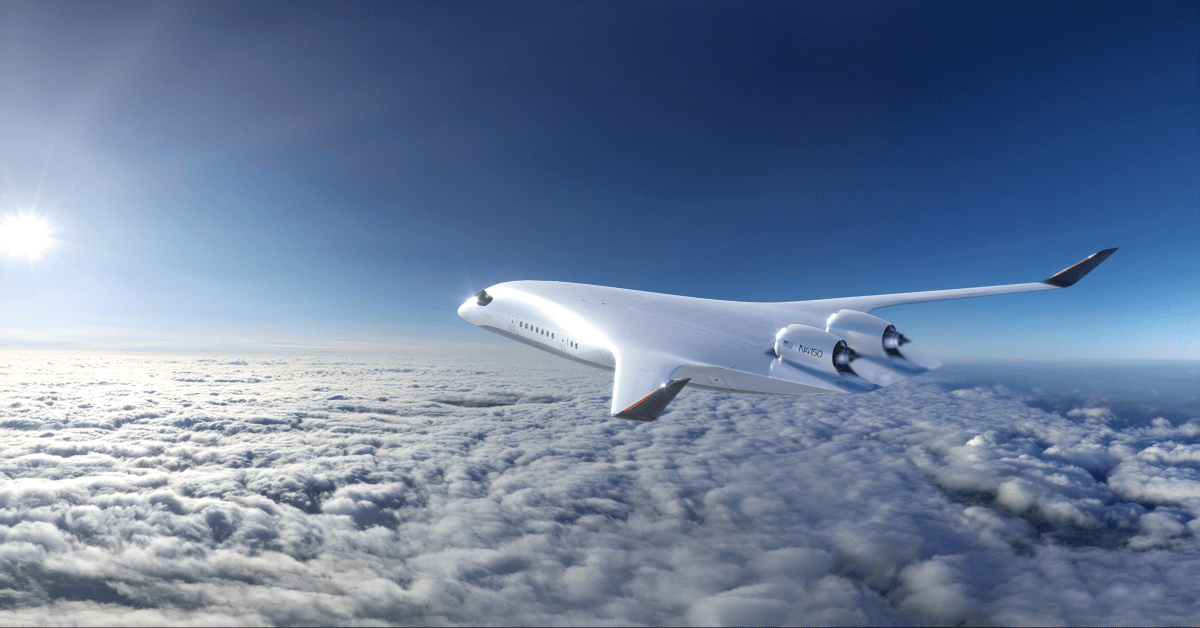

The Future Of Clean Air Travel One Company Leading The Charge

Jun 14, 2025

The Future Of Clean Air Travel One Company Leading The Charge

Jun 14, 2025 -

Burns Blasts Into Contention Historic Low Round At Oakmont

Jun 14, 2025

Burns Blasts Into Contention Historic Low Round At Oakmont

Jun 14, 2025 -

Keys And Anisimova Dominate Navarro Survives At Queens

Jun 14, 2025

Keys And Anisimova Dominate Navarro Survives At Queens

Jun 14, 2025 -

Delaney Rowe Addresses B J Novak Dating Rumors

Jun 14, 2025

Delaney Rowe Addresses B J Novak Dating Rumors

Jun 14, 2025