Institutional Investment: 15,775 Robinhood Shares Acquired By Wellington Management

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wellington Management Makes Significant Investment in Robinhood: 15,775 Shares Acquired

Headline: Wellington Management Acquires 15,775 Robinhood Shares – A Sign of Confidence in the Brokerage?

Introduction: The investment world is buzzing after prominent asset management firm, Wellington Management, revealed a significant acquisition of 15,775 Robinhood shares. This strategic move has sparked considerable speculation about the future trajectory of the popular commission-free brokerage and the overall sentiment towards the fintech sector. Is this a vote of confidence in Robinhood's recovery, or a calculated gamble on a potentially volatile stock? Let's delve into the details.

H2: Decoding Wellington Management's Investment

Wellington Management, a Boston-based firm managing trillions of dollars in assets, isn't known for impulsive decisions. Their acquisition of Robinhood shares signifies a calculated assessment of the company's potential. While the exact reasons behind this investment remain undisclosed, several factors likely played a role:

- Robinhood's Resurgence: After a turbulent period marked by regulatory scrutiny and market volatility, Robinhood has shown signs of stabilization. Improved financial performance and a renewed focus on core offerings may have influenced Wellington's decision.

- Long-Term Growth Potential: Despite recent challenges, Robinhood retains a massive user base and a strong brand recognition, particularly among younger investors. Wellington Management may be betting on Robinhood's long-term growth prospects in a competitive brokerage market.

- Diversification Strategy: Large asset management firms often diversify their portfolios across various sectors. The addition of Robinhood shares could be part of a broader diversification strategy aimed at mitigating risk and capitalizing on emerging opportunities in the fintech space.

H2: Implications for Robinhood and the Fintech Market

This significant investment from a reputable firm like Wellington Management could have far-reaching implications:

- Increased Investor Confidence: The move could boost investor confidence in Robinhood, potentially leading to increased trading volume and a rise in the stock price.

- Positive Market Sentiment: The news might signal a shift in market sentiment towards fintech companies, potentially attracting further investments into the sector.

- Future Growth Strategies: The influx of capital could enable Robinhood to pursue further growth initiatives, such as expanding its product offerings or investing in technological advancements.

H3: Potential Challenges Remain

While the acquisition is positive news for Robinhood, it's important to acknowledge the ongoing challenges:

- Regulatory Landscape: The fintech sector remains subject to evolving regulations, which could impact Robinhood's operations and profitability.

- Competition: Robinhood faces intense competition from established players and emerging fintech startups. Maintaining its competitive edge will be crucial for long-term success.

- Market Volatility: The overall market environment plays a significant role in the performance of brokerage firms. Sustained market volatility could still pose challenges for Robinhood.

H2: Conclusion: A Cautiously Optimistic Outlook

Wellington Management's acquisition of 15,775 Robinhood shares is a noteworthy development, suggesting a degree of confidence in the brokerage's future. However, it's crucial to view this investment within the broader context of the ongoing challenges and uncertainties facing the fintech industry. Only time will tell if this investment proves to be a shrewd move, but for now, it offers a glimmer of hope for Robinhood's continued growth and recovery. Further analysis and market observation will be necessary to fully assess the long-term implications.

Keywords: Robinhood, Wellington Management, Institutional Investment, Fintech, Stock Market, Brokerage, Investment, Shares, Acquisition, Financial News, Market Analysis, Stock Price, Regulatory Scrutiny, Growth Potential.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Institutional Investment: 15,775 Robinhood Shares Acquired By Wellington Management. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Trumps National Guard Deployment Deemed Illegal By Judge

Jun 14, 2025

Trumps National Guard Deployment Deemed Illegal By Judge

Jun 14, 2025 -

Delaney Rowes Target Unraveling The Mystery Behind Her Recent Remarks

Jun 14, 2025

Delaney Rowes Target Unraveling The Mystery Behind Her Recent Remarks

Jun 14, 2025 -

Mac Intyre Eyes Us Open Glory A Wild Horse Ride To Championship Contention

Jun 14, 2025

Mac Intyre Eyes Us Open Glory A Wild Horse Ride To Championship Contention

Jun 14, 2025 -

Deconstructing Taylor Jenkins Reids Publishing Empire Strategies And Success

Jun 14, 2025

Deconstructing Taylor Jenkins Reids Publishing Empire Strategies And Success

Jun 14, 2025 -

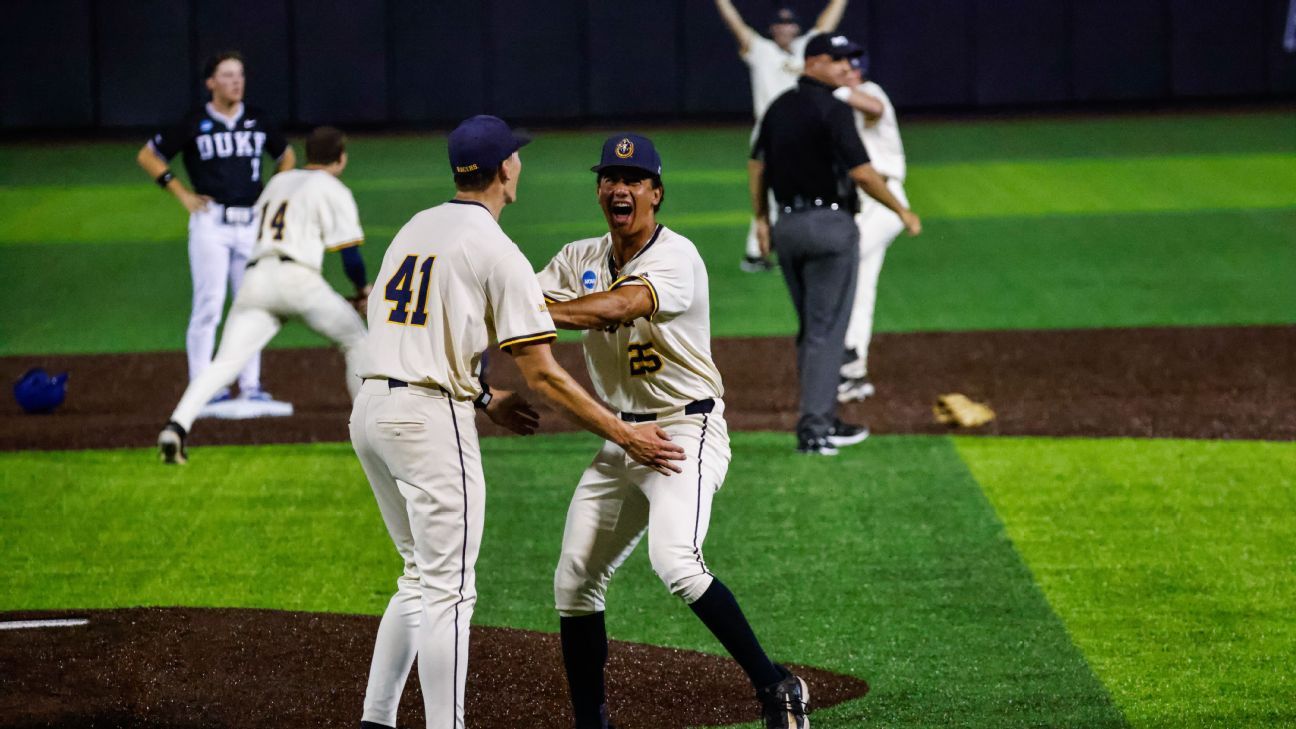

Cinderella Story Murray State Baseballs Journey From Small Town Roots To Omaha

Jun 14, 2025

Cinderella Story Murray State Baseballs Journey From Small Town Roots To Omaha

Jun 14, 2025