Institutional Investment: 15,775 Robinhood (HOOD) Shares Purchased By Wellington

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wellington's Big Bet: 15,775 Robinhood (HOOD) Shares Acquired

Investment giant Wellington Management boosted its holdings in Robinhood Markets, Inc. (HOOD) by a significant margin, signaling potential confidence in the online brokerage's future. The purchase of 15,775 shares represents a noteworthy move in the market and has sparked renewed interest in the company's prospects. This strategic investment comes at a crucial time for Robinhood, as it navigates a challenging financial landscape and works to regain investor trust.

<h3>Decoding Wellington's Investment in Robinhood</h3>

Wellington Management, a prominent global investment firm managing trillions of dollars in assets, doesn't make decisions lightly. Their acquisition of a substantial number of Robinhood shares suggests a belief in the company's long-term potential. Several factors could be influencing this decision:

-

Robinhood's Expanding Services: Beyond its core brokerage services, Robinhood is diversifying its offerings. The introduction of new features like crypto trading and a growing selection of investment products could be attracting institutional investors like Wellington. This diversification strategy aims to reduce reliance on trading revenue and cultivate a more resilient business model. [Link to Robinhood's investor relations page]

-

Potential for Market Recovery: The recent market volatility has presented both challenges and opportunities. Wellington may view the current price as an attractive entry point, anticipating a rebound in Robinhood's stock price as market sentiment improves.

-

Long-Term Growth Potential: Despite recent setbacks, Robinhood continues to attract a large and engaged user base, particularly among younger investors. Wellington's investment could reflect a long-term perspective on Robinhood's potential to capture a larger share of the burgeoning online brokerage market.

<h3>Analyzing the Impact on HOOD Stock</h3>

While the impact of a single institutional investment is never solely determinative of a stock's price, Wellington's purchase does contribute to a positive narrative surrounding HOOD. This news could potentially influence other investors, leading to increased trading volume and a potential upward pressure on the stock price. However, it's crucial to remember that market conditions remain dynamic, and several factors beyond this investment will affect Robinhood's future performance.

<h3>What This Means for Investors</h3>

This development underscores the importance of conducting thorough due diligence before making any investment decisions. While Wellington's investment is encouraging, it doesn't guarantee future success for Robinhood. Investors should carefully consider their risk tolerance and investment goals before investing in HOOD or any other stock. [Link to a reputable financial news source for market analysis]

<h3>Looking Ahead: Robinhood's Challenges and Opportunities</h3>

Robinhood still faces significant hurdles, including regulatory scrutiny and competition from established players in the financial services industry. However, its ongoing efforts to improve its platform, expand its services, and enhance its regulatory compliance could pave the way for future growth. The company's ability to adapt to the evolving financial landscape will be crucial to its long-term success.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing in the stock market involves inherent risks, and it is essential to conduct your own research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Institutional Investment: 15,775 Robinhood (HOOD) Shares Purchased By Wellington. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ongoing L A Protests Curfew Remains In Effect For Second Consecutive Night

Jun 14, 2025

Ongoing L A Protests Curfew Remains In Effect For Second Consecutive Night

Jun 14, 2025 -

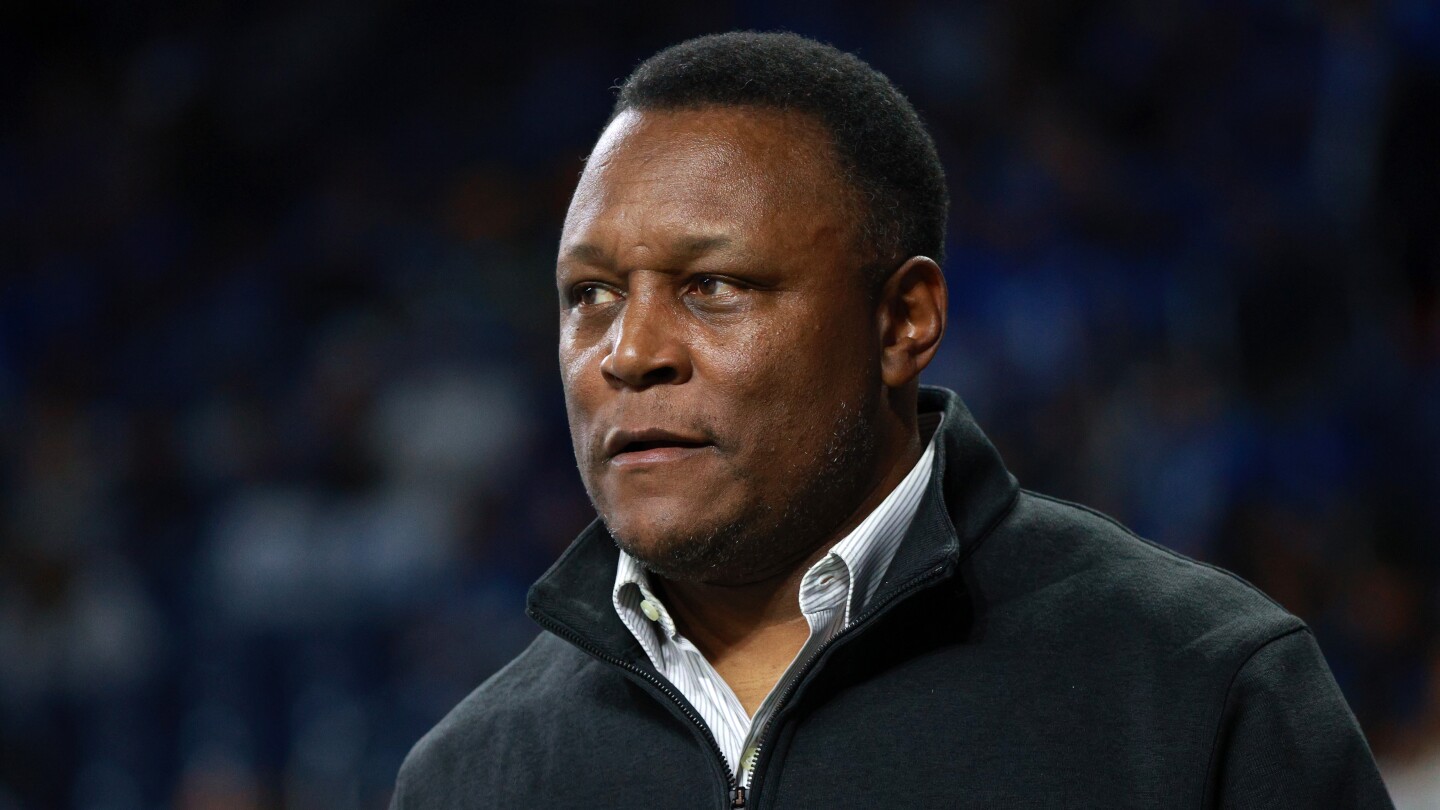

Barry Sanders Journey From Football Field To Heart Health Advocate

Jun 14, 2025

Barry Sanders Journey From Football Field To Heart Health Advocate

Jun 14, 2025 -

Barry Sanders Heart Attack Documentary Aims To Raise Awareness

Jun 14, 2025

Barry Sanders Heart Attack Documentary Aims To Raise Awareness

Jun 14, 2025 -

49ers Tight End George Kittle Backs Deebo Samuel Following Backlash

Jun 14, 2025

49ers Tight End George Kittle Backs Deebo Samuel Following Backlash

Jun 14, 2025 -

Pacote Eleitoral Em Debate Presidente Lourenco Propoe Discussao Abrangente No Parlamento

Jun 14, 2025

Pacote Eleitoral Em Debate Presidente Lourenco Propoe Discussao Abrangente No Parlamento

Jun 14, 2025