Institutional Investing: Wellington Management Buys 15,775 Robinhood (HOOD) Shares

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wellington Management Bets on Robinhood: 15,775 Shares Acquired

Headline: Wellington Management, a prominent institutional investor, recently purchased a significant stake in Robinhood Markets (HOOD), signaling potential confidence in the discounted brokerage's future. This move has sparked renewed interest in the volatile stock.

Introduction: The financial world is buzzing after Wellington Management, a renowned investment firm managing trillions of dollars, disclosed a new position in Robinhood Markets (HOOD). Their purchase of 15,775 shares suggests a degree of optimism towards the controversial yet popular trading platform, particularly given Robinhood's recent struggles. This strategic move raises questions about the future trajectory of HOOD stock and the overall sentiment towards the discount brokerage sector.

Wellington Management: A Heavyweight Investor

Wellington Management is not your average investor. Known for its long-term, value-oriented investment strategy, the firm manages assets exceeding $1 trillion. Their decision to invest in Robinhood, a company that has faced significant regulatory scrutiny and market volatility, is noteworthy. This investment signals a potential shift in perception regarding the company’s long-term prospects. [Link to Wellington Management's website]

Robinhood's Recent Performance and Challenges

Robinhood's stock price has experienced considerable fluctuation since its initial public offering (IPO). Factors contributing to this volatility include:

- Regulatory Scrutiny: Robinhood has faced increased regulatory scrutiny regarding its business practices and handling of user data.

- Market Competition: The discount brokerage sector is highly competitive, with established players and new entrants vying for market share.

- Revenue Diversification: Robinhood's reliance on transaction-based revenue has been a point of concern for some analysts. Their efforts to diversify revenue streams are crucial for long-term sustainability.

Why the Investment in Robinhood?

While Wellington Management hasn't publicly commented on the specific reasons behind their investment, several factors may be at play:

- Undervalued Asset: Some analysts believe Robinhood's current stock price undervalues its potential for growth.

- Long-Term Growth Potential: Despite its challenges, Robinhood boasts a large user base and potential for expansion into new financial services.

- Strategic Positioning: Wellington Management's investment could be a strategic play, anticipating future growth in the fintech sector.

What Does This Mean for HOOD Stock?

The acquisition of 15,775 shares by Wellington Management might be viewed as a vote of confidence in Robinhood's future. However, it's important to remember that this is just one piece of the puzzle. Investors should conduct thorough research and consider their own risk tolerance before making any investment decisions based on this news. The long-term performance of HOOD stock will depend on a variety of factors, including regulatory developments, market conditions, and the company's ability to execute its strategic plan.

Conclusion:

Wellington Management's investment in Robinhood is a significant development, sparking renewed interest in the company's stock. While the future remains uncertain, this move highlights the potential that some investors see in Robinhood's long-term prospects. It's crucial for investors to stay informed and make informed decisions based on their own due diligence.

Keywords: Robinhood, HOOD, Wellington Management, Institutional Investing, Stock Market, Discount Brokerage, Fintech, Investment, Stock Purchase, Market Volatility, Regulatory Scrutiny, Financial News, Investment Strategy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Institutional Investing: Wellington Management Buys 15,775 Robinhood (HOOD) Shares. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Hsbc Championships 2025 A Comprehensive Overview Of The Tournament

Jun 14, 2025

Hsbc Championships 2025 A Comprehensive Overview Of The Tournament

Jun 14, 2025 -

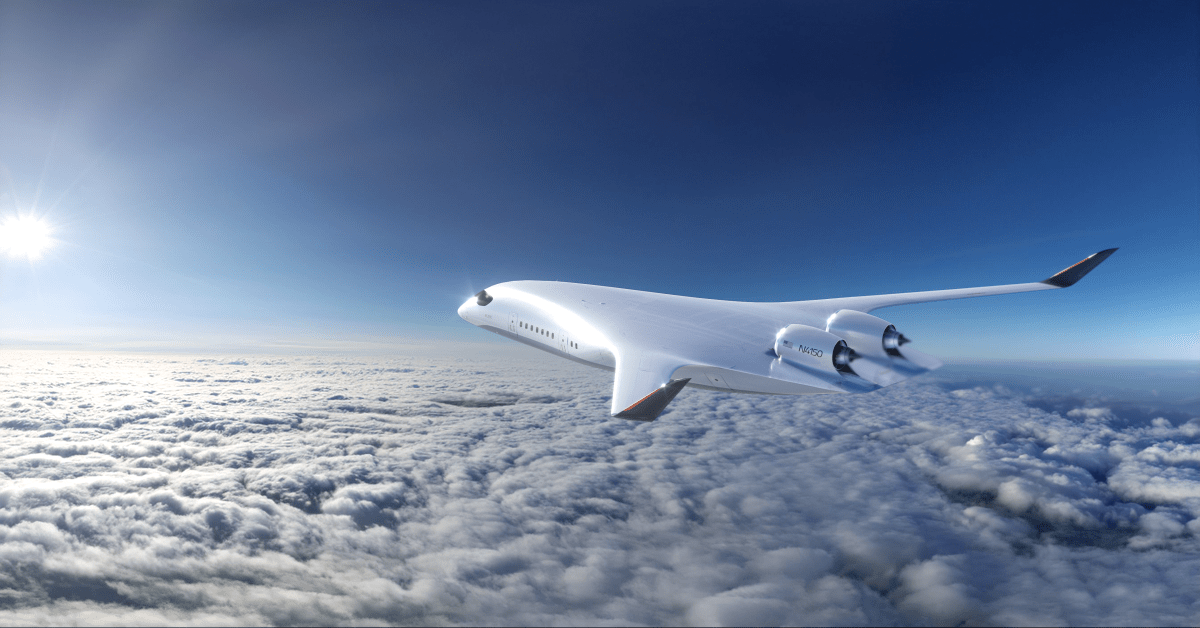

Green Aviation Takes Flight This Companys Impact On Low Carbon Air Travel

Jun 14, 2025

Green Aviation Takes Flight This Companys Impact On Low Carbon Air Travel

Jun 14, 2025 -

Second Night Of Curfew Fails To Halt L A Protests

Jun 14, 2025

Second Night Of Curfew Fails To Halt L A Protests

Jun 14, 2025 -

Air India Disaster A Survivors Tale Of Resilience And Survival

Jun 14, 2025

Air India Disaster A Survivors Tale Of Resilience And Survival

Jun 14, 2025 -

From Hollywood To Holiness Paula Pattons Spiritual Journey

Jun 14, 2025

From Hollywood To Holiness Paula Pattons Spiritual Journey

Jun 14, 2025