Inflation Reduction Act: Social Security Tax Changes And Their Implications

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Inflation Reduction Act: Unpacking the Changes to Social Security Taxes and Their Impact

The Inflation Reduction Act (IRA), signed into law in August 2022, made significant changes across various sectors, including healthcare and climate change. While not directly amending Social Security itself, a lesser-known provision within the IRA subtly impacts Social Security taxes for certain high-income earners. This article delves into these changes, exploring their implications for individuals and the broader Social Security system.

Understanding the IRA's Impact on Social Security Taxes:

The IRA's influence on Social Security taxes is indirect. It doesn't alter the existing tax rates or the earnings base subject to Social Security taxes. Instead, it focuses on the taxability of certain income streams, effectively increasing the tax burden for some high-income individuals. This is achieved through adjustments to the applicable tax thresholds for certain individuals and married couples.

Key Changes Introduced by the IRA:

-

Increased Taxability of High-Income Individuals: The IRA modifies the rules surrounding the taxation of high-income individuals' Social Security benefits. Previously, a complex formula determined the taxability of benefits based on a combined income threshold (AGI). The IRA, while not directly altering this formula, affects the AGI calculation for some individuals, leading to a higher percentage of their benefits becoming taxable. This means more high-income retirees will see a larger portion of their Social Security benefits subject to federal income tax.

-

No Change to Social Security Tax Rates or Earnings Base: It's crucial to emphasize that the IRA does not change the standard Social Security tax rate of 6.2% for employees (matched by employers) or the annual earnings base subject to the tax. These remain unchanged. This aspect is often misunderstood, leading to confusion about the bill's overall impact on the Social Security system.

Implications for High-Income Earners:

The changes brought about by the IRA primarily affect individuals and married couples with higher adjusted gross incomes (AGI). For these individuals, a larger portion of their Social Security benefits will now be considered taxable income, potentially increasing their overall tax liability. This could lead to:

- Reduced Disposable Income: Higher taxes on Social Security benefits translate to less disposable income for retirees in higher income brackets. Careful financial planning is crucial to navigate this potential reduction.

- Increased Tax Complexity: Understanding the tax implications of Social Security benefits is already complex. The IRA's modifications further complicate this process, potentially requiring professional tax advice for accurate calculations.

Long-Term Effects on Social Security:

The IRA's impact on Social Security is primarily fiscal, affecting tax revenue rather than the long-term solvency of the program. While increased tax revenue from higher-income retirees is beneficial, it doesn't address the fundamental challenges facing the Social Security system, such as its long-term funding gap. Separate legislative action is required to tackle these broader issues.

Looking Ahead:

Understanding the intricacies of the IRA's impact on Social Security taxes is crucial for both high-income earners and financial planners. As the tax implications unfold, careful financial planning and potentially seeking professional tax advice are recommended to navigate the changes effectively. Staying informed about any future legislative actions regarding Social Security remains essential for all retirees. Consult with a qualified financial advisor to discuss your specific circumstances and develop a sound financial strategy.

Keywords: Inflation Reduction Act, IRA, Social Security, Social Security Taxes, Tax Changes, High-Income Earners, Retirement, Tax Implications, Tax Planning, Social Security Benefits, AGI, Federal Income Tax.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Inflation Reduction Act: Social Security Tax Changes And Their Implications. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Mulder Impresses As Stand In Test Captain On Opening Day

Jul 08, 2025

Mulder Impresses As Stand In Test Captain On Opening Day

Jul 08, 2025 -

Michael Rosenbaums Impact The Smallville Star Who Shaped Nicholas Hoults Career

Jul 08, 2025

Michael Rosenbaums Impact The Smallville Star Who Shaped Nicholas Hoults Career

Jul 08, 2025 -

Superman Vs Lex Luthor Exploring Their Complex History On The Dc Studios Showcase Podcast

Jul 08, 2025

Superman Vs Lex Luthor Exploring Their Complex History On The Dc Studios Showcase Podcast

Jul 08, 2025 -

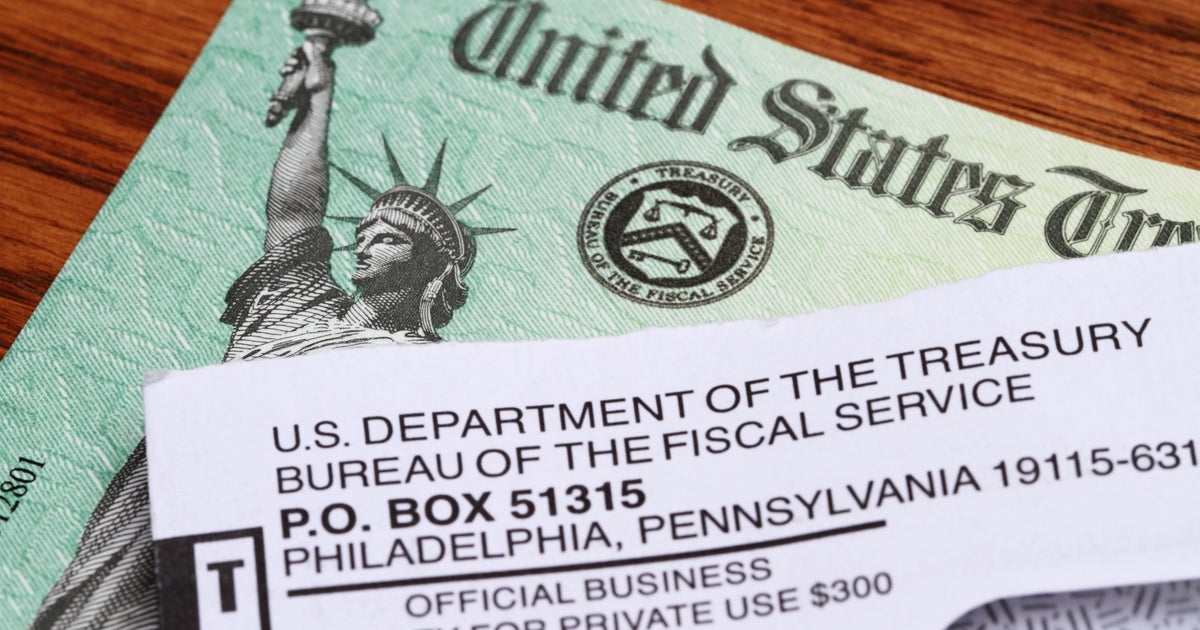

Wwe Legend Jim Ross To Attend All In In Texas After Cancer Battle

Jul 08, 2025

Wwe Legend Jim Ross To Attend All In In Texas After Cancer Battle

Jul 08, 2025 -

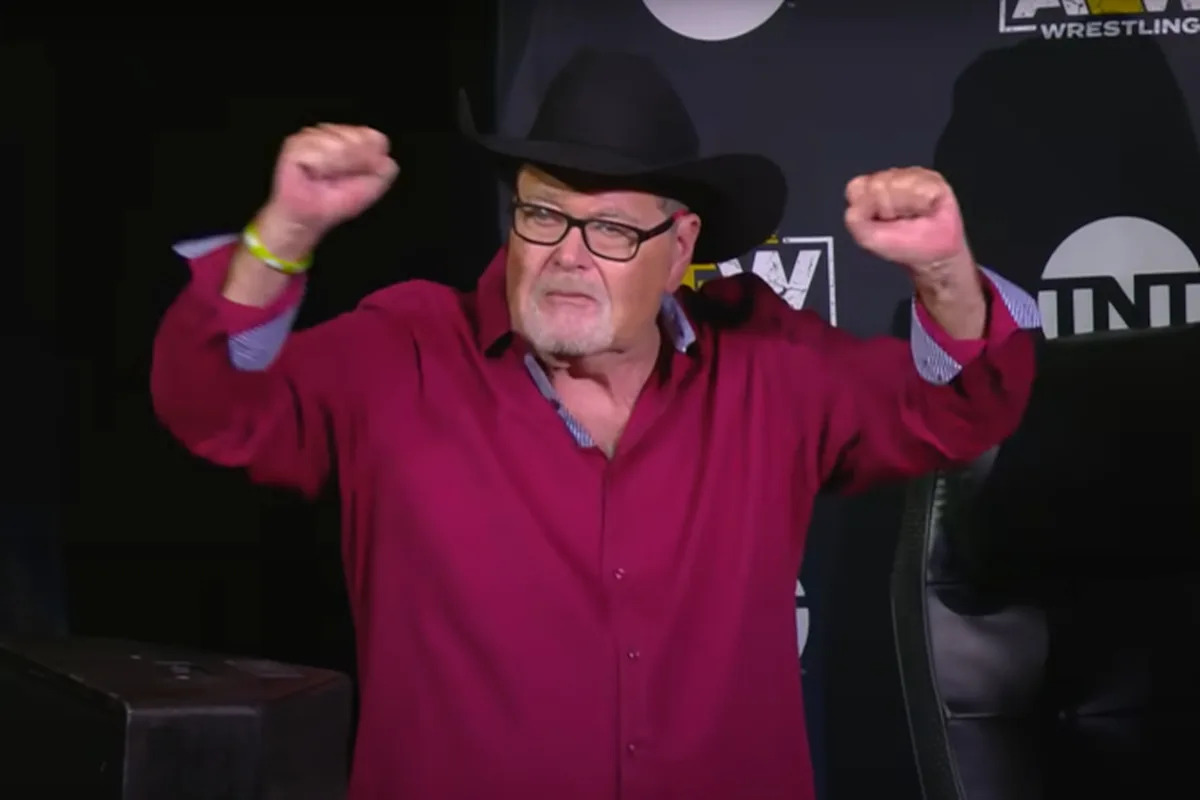

Minnesota Shooting Suspect Identified What We Know About Vance L Boelter

Jul 08, 2025

Minnesota Shooting Suspect Identified What We Know About Vance L Boelter

Jul 08, 2025