Inflation Reduction Act: Impact On Social Security Taxes Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Inflation Reduction Act: How It (Slightly) Impacts Your Social Security Taxes

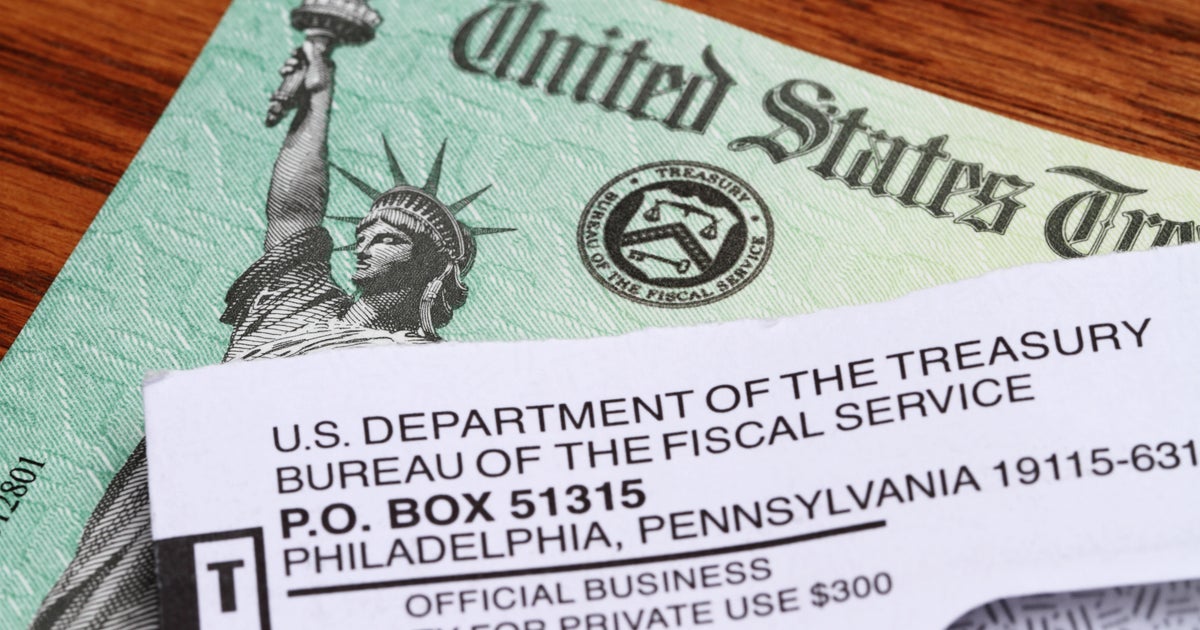

The Inflation Reduction Act (IRA), signed into law in August 2022, made waves with its climate and healthcare provisions. But tucked within its expansive text are subtle changes that affect Social Security – specifically, a small but notable impact on the amount of income subject to Social Security taxes. Understanding these changes is crucial for taxpayers, especially those nearing retirement or already receiving benefits.

This article breaks down the IRA's impact on Social Security taxes, explaining what changed, who it affects, and what it means for your wallet.

What Did the IRA Change Regarding Social Security Taxes?

Before the IRA, the amount of earnings subject to Social Security tax (officially known as OASDI taxes – Old-Age, Survivors, and Disability Insurance) had a cap. This cap, adjusted annually for inflation, limits the amount of income on which Social Security taxes are levied. The IRA subtly altered the timeline for adjusting this cap. Previously, the cap was adjusted based on the national average wage index (AWI) from two years prior. The IRA shifted this to one year prior, meaning the adjustments now reflect more recent wage growth.

While seemingly minor, this change could mean slightly higher Social Security taxes in the coming years, particularly if wage growth continues at a healthy pace. The difference isn't drastic, but it's a significant alteration to a fundamental aspect of the Social Security system.

Who is Affected by This Change?

The change primarily affects higher-income earners. Those whose income exceeds the annual Social Security tax cap will see a slightly larger portion of their earnings subject to the tax. For those earning below the cap, there is no direct impact on their Social Security taxes.

What Does This Mean for the Future of Social Security?

This change, while not a major overhaul of the system, is a small step towards addressing the long-term solvency challenges facing Social Security. By slightly increasing the revenue generated through Social Security taxes, the IRA contributes to a more financially stable system. However, it's important to note that this is only a minor adjustment; larger, more comprehensive reforms would likely be necessary to address the system's long-term funding needs. For more in-depth information on Social Security's financial future, consult resources from the Social Security Administration (SSA) directly.

Key Takeaways:

- The Inflation Reduction Act subtly altered the timing of Social Security tax cap adjustments.

- This change primarily impacts higher-income earners.

- The change contributes minimally to the long-term financial health of Social Security.

- For detailed information on Social Security, visit the official .

Looking Ahead:

While the IRA's impact on Social Security taxes might seem insignificant in the short term, understanding this change is crucial for financial planning. Staying informed about Social Security updates is essential, especially as you approach retirement age. Regularly reviewing your tax obligations and consulting with a financial advisor can help you navigate these changes effectively. Understanding these subtle shifts in policy ensures you are prepared for the financial landscape ahead.

This subtle change, while perhaps overshadowed by other aspects of the IRA, highlights the ongoing need for careful consideration of Social Security's long-term viability. It also underscores the importance of staying informed about all aspects of tax legislation and their potential impact on personal finances.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Inflation Reduction Act: Impact On Social Security Taxes Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

New Drake Song What Did I Miss Details The Fallout From His Kendrick Lamar Beef

Jul 07, 2025

New Drake Song What Did I Miss Details The Fallout From His Kendrick Lamar Beef

Jul 07, 2025 -

Discrepancy In Us Jobs Data Cnbc Daily Open Explores Adp And Official Report Differences

Jul 07, 2025

Discrepancy In Us Jobs Data Cnbc Daily Open Explores Adp And Official Report Differences

Jul 07, 2025 -

Doping Ban To Wimbledon 2025 Kamil Majchrzaks Journey Back

Jul 07, 2025

Doping Ban To Wimbledon 2025 Kamil Majchrzaks Journey Back

Jul 07, 2025 -

Dont Miss It Christian Bales Anniversary Movie On Paramount

Jul 07, 2025

Dont Miss It Christian Bales Anniversary Movie On Paramount

Jul 07, 2025 -

Ea Sports College Football 2026 Predicting Iowas Top Performers

Jul 07, 2025

Ea Sports College Football 2026 Predicting Iowas Top Performers

Jul 07, 2025

Latest Posts

-

Trumps Tax Bill Increased Hunger Concerns For Iowa Food Pantries

Jul 07, 2025

Trumps Tax Bill Increased Hunger Concerns For Iowa Food Pantries

Jul 07, 2025 -

Dogecoin Price Holds Steady 0 16 Support Level Key For Bulls

Jul 07, 2025

Dogecoin Price Holds Steady 0 16 Support Level Key For Bulls

Jul 07, 2025 -

Israeli Air Force Targets Yemeni Ports And Galaxy Leader Vessel Idf Statement

Jul 07, 2025

Israeli Air Force Targets Yemeni Ports And Galaxy Leader Vessel Idf Statement

Jul 07, 2025 -

Cancer Free Jim Ross Confirmed For All In Wrestling Event In Texas

Jul 07, 2025

Cancer Free Jim Ross Confirmed For All In Wrestling Event In Texas

Jul 07, 2025 -

Wrestling News Jim Ross All In 2025 Commentary Role Announced

Jul 07, 2025

Wrestling News Jim Ross All In 2025 Commentary Role Announced

Jul 07, 2025