Inflation And Tech Woes: Stock Market Slides – Dow, S&P 500, Nasdaq Affected

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Inflation and Tech Woes: Stock Market Slides – Dow, S&P 500, Nasdaq Affected

The stock market experienced a significant downturn this week, with major indices like the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all experiencing substantial losses. This sharp decline can be attributed to a confluence of factors, primarily persistent inflation and ongoing concerns within the technology sector. Investors are grappling with uncertainty, leading to a widespread sell-off.

Persistent Inflation Fuels Investor Anxiety:

The persistent rise in inflation continues to be a major headwind for the market. The latest Consumer Price Index (CPI) report, released [insert date and link to report], showed inflation remaining stubbornly high, exceeding expectations. This fuels concerns about the Federal Reserve's response, with many anticipating further interest rate hikes to combat inflation. Higher interest rates increase borrowing costs for businesses, impacting growth and potentially triggering a recession. This uncertainty is causing investors to reassess their risk tolerance, leading to a flight to safety and a decline in stock prices. Understanding the implications of [link to article explaining current inflation rates] is crucial for navigating the current market climate.

Tech Sector Struggles Add to Market Pressure:

The technology sector, which has been a significant driver of market growth in recent years, is facing its own set of challenges. Concerns about slowing growth, increased competition, and rising interest rates have weighed heavily on tech stocks. Several major tech companies have recently announced disappointing earnings reports, further exacerbating investor anxieties. The Nasdaq Composite, heavily weighted with technology stocks, has been particularly hard hit. This decline reflects a broader reevaluation of the sector's long-term prospects in the face of economic uncertainty. [Link to an article about specific tech company earnings reports] provides further detail on this trend.

Market Indices Take a Hit:

- Dow Jones Industrial Average: Experienced a [percentage]% decline, falling below [value].

- S&P 500: Suffered a [percentage]% drop, closing at [value].

- Nasdaq Composite: Saw the most significant drop, falling [percentage]% to [value].

These declines reflect a widespread sense of unease among investors. The combined impact of inflation and tech sector woes has created a perfect storm, triggering a market correction.

What's Next for Investors?

The current market volatility presents both challenges and opportunities for investors. A cautious approach is recommended, with a focus on diversification and risk management. It's crucial to carefully assess your investment portfolio and adjust your strategy based on your risk tolerance and long-term financial goals. Consulting with a qualified financial advisor is highly recommended during periods of market uncertainty.

Key Takeaways:

- Inflation remains a major concern, impacting business growth and investor sentiment.

- The tech sector faces challenges, contributing to the overall market downturn.

- Diversification and risk management are essential strategies for navigating market volatility.

- Seeking professional financial advice is crucial during periods of uncertainty.

This market downturn highlights the interconnectedness of global economic factors and their impact on investor confidence. While short-term volatility is expected, long-term investors should maintain a balanced perspective and consider this a potential buying opportunity, depending on their individual circumstances and investment strategies. Stay informed about economic developments and consult with a financial professional to make informed decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Inflation And Tech Woes: Stock Market Slides – Dow, S&P 500, Nasdaq Affected. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Rising Healthcare Costs Understanding The Impact On Obamacare

Aug 31, 2025

Rising Healthcare Costs Understanding The Impact On Obamacare

Aug 31, 2025 -

Made It Home Sc Housings Innovative Solution For Affordable Housing

Aug 31, 2025

Made It Home Sc Housings Innovative Solution For Affordable Housing

Aug 31, 2025 -

10 4 Victory For Yankees Recap Of August 28th Game Against White Sox

Aug 31, 2025

10 4 Victory For Yankees Recap Of August 28th Game Against White Sox

Aug 31, 2025 -

Fergie And Josh Duhamels Son Axl Celebrates Another Year See The Unseen Photos

Aug 31, 2025

Fergie And Josh Duhamels Son Axl Celebrates Another Year See The Unseen Photos

Aug 31, 2025 -

Southern California Youth Soccer Players Killed In Horrific Freeway Accident

Aug 31, 2025

Southern California Youth Soccer Players Killed In Horrific Freeway Accident

Aug 31, 2025

Latest Posts

-

Canelo Alvarez And Terence Crawford 10 Fights That Shaped Their Careers

Sep 04, 2025

Canelo Alvarez And Terence Crawford 10 Fights That Shaped Their Careers

Sep 04, 2025 -

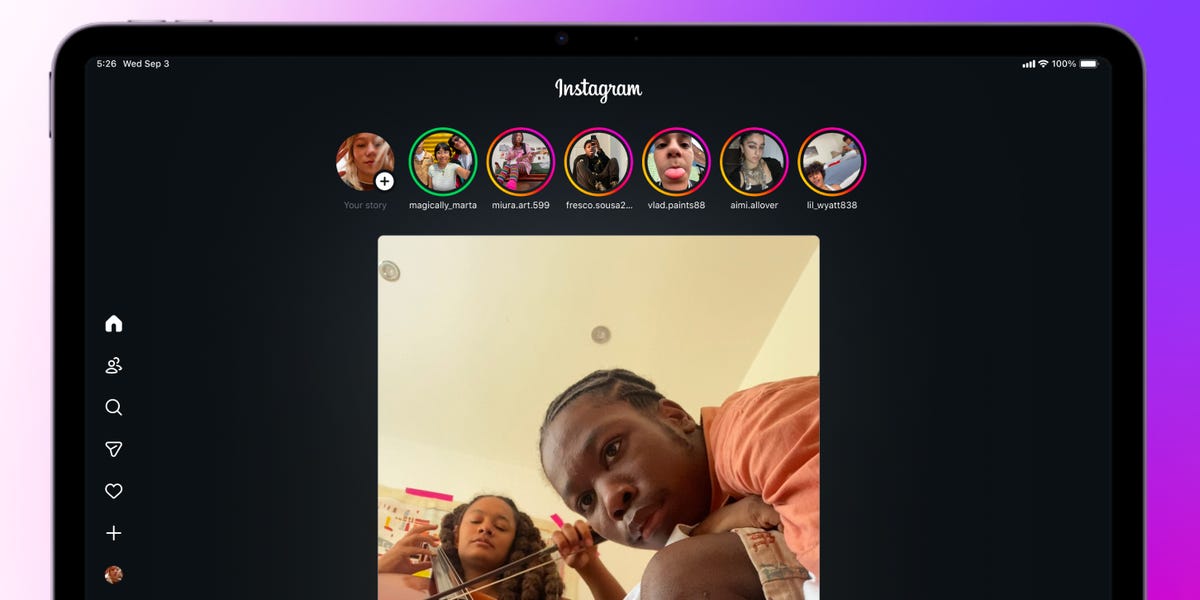

Hands On With Instagrams I Pad App The Good The Bad And The Scrollable

Sep 04, 2025

Hands On With Instagrams I Pad App The Good The Bad And The Scrollable

Sep 04, 2025 -

Mc Ilroy Backs Europe For Ryder Cup Victory At Bethpage Black

Sep 04, 2025

Mc Ilroy Backs Europe For Ryder Cup Victory At Bethpage Black

Sep 04, 2025 -

Jenna Ortegas Dating Life Devin Booker Johnny Depp And The Rumors

Sep 04, 2025

Jenna Ortegas Dating Life Devin Booker Johnny Depp And The Rumors

Sep 04, 2025 -

Indonesia Protests 2024 A Comprehensive Overview

Sep 04, 2025

Indonesia Protests 2024 A Comprehensive Overview

Sep 04, 2025