Increased Tender Offer: Lincoln Financial Responds To Investor Interest With $45 Million Boost

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lincoln Financial Sweetens the Pot: $45 Million Increase to Tender Offer

Lincoln Financial Group (LNC) has announced a significant boost to its previously announced tender offer, increasing the total amount available by $45 million. This move signals a strong response to investor interest and underscores the company's commitment to optimizing its capital structure. The increased offer reflects Lincoln Financial's proactive approach to managing its balance sheet and enhancing shareholder value.

This development comes on the heels of [mention previous announcement date and relevant details, linking to previous news article if available]. The initial offer, while substantial, clearly underestimated the level of investor participation. This upward revision demonstrates Lincoln Financial's willingness to adapt to market dynamics and meet the demands of its investor base.

Why the Increase? Decoding Lincoln Financial's Strategy

Several factors likely contributed to Lincoln Financial's decision to increase its tender offer by a substantial $45 million. These include:

- Strong Investor Demand: The initial response to the tender offer likely exceeded expectations, prompting the company to increase the available funds to accommodate a larger volume of tendered securities.

- Capital Optimization: By repurchasing its own shares, Lincoln Financial can improve its earnings per share (EPS), potentially boosting investor confidence and driving up the stock price. This is a common strategy employed by companies to enhance shareholder value.

- Strategic Positioning: The repurchase program might be part of a broader strategic plan to optimize the company's capital structure and position itself for future growth and acquisitions.

What Does This Mean for Investors?

The increased tender offer presents a potentially attractive opportunity for existing shareholders. The higher offer price provides a more compelling incentive to tender shares, allowing investors to realize a potentially higher return on their investment. However, investors should carefully review the terms and conditions of the offer before making a decision. Seeking professional financial advice is always recommended.

Analyzing the Implications for the Market

This significant increase in Lincoln Financial's tender offer sends a positive signal to the broader market, suggesting confidence in the company's future prospects and financial health. This move could influence investor sentiment toward other companies in the financial services sector, potentially encouraging similar capital allocation strategies.

Looking Ahead: What to Expect from Lincoln Financial

While this increased tender offer represents a significant development, it’s important to monitor Lincoln Financial's future actions and announcements. Investors should keep an eye on the company's future financial reports and any further strategic initiatives. The impact of this increased tender offer on the company's long-term financial performance will unfold over time.

Call to Action: Stay informed about Lincoln Financial Group's activities by following their investor relations website and subscribing to relevant financial news sources. Understanding the nuances of such corporate actions is crucial for making informed investment decisions.

Keywords: Lincoln Financial, LNC, tender offer, stock repurchase, investor interest, capital optimization, shareholder value, financial services, stock market, investment strategy, EPS, earnings per share.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Increased Tender Offer: Lincoln Financial Responds To Investor Interest With $45 Million Boost. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Penguins Coaching Shakeup A Look At Roest And Kuokkanens Impact

May 29, 2025

Penguins Coaching Shakeup A Look At Roest And Kuokkanens Impact

May 29, 2025 -

Enjoy A Mild Day In Metro Detroit Before Temperatures Drop

May 29, 2025

Enjoy A Mild Day In Metro Detroit Before Temperatures Drop

May 29, 2025 -

Despues De Tom Cruise Angela Marmol Conquista Tik Tok Con Su Ultimo Video

May 29, 2025

Despues De Tom Cruise Angela Marmol Conquista Tik Tok Con Su Ultimo Video

May 29, 2025 -

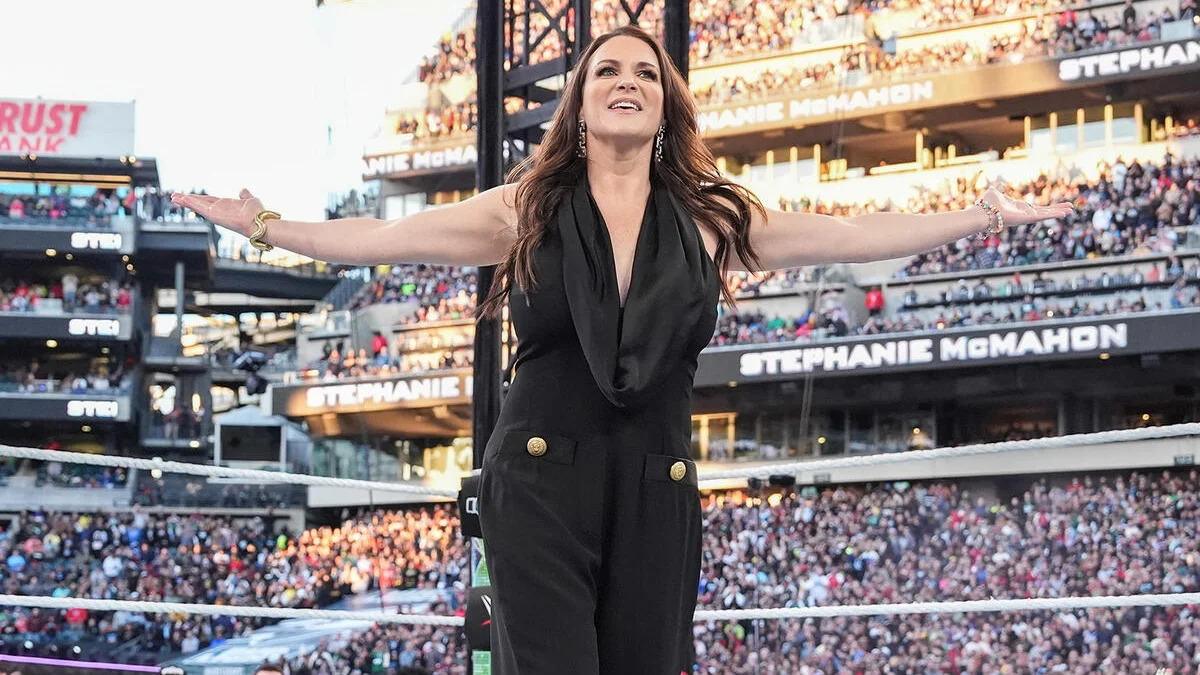

Stephanie Mc Mahon Reveals Tattoo Regret Thank God I Didnt Get It

May 29, 2025

Stephanie Mc Mahon Reveals Tattoo Regret Thank God I Didnt Get It

May 29, 2025 -

Transfer News Arsenals Viktor Gyokeres Pursuit Faces Sporting Cp Obstacle

May 29, 2025

Transfer News Arsenals Viktor Gyokeres Pursuit Faces Sporting Cp Obstacle

May 29, 2025