Increased Cybercrime In SWFL: How To Protect Your Bank Accounts

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Increased Cybercrime in SWFL: How to Protect Your Bank Accounts

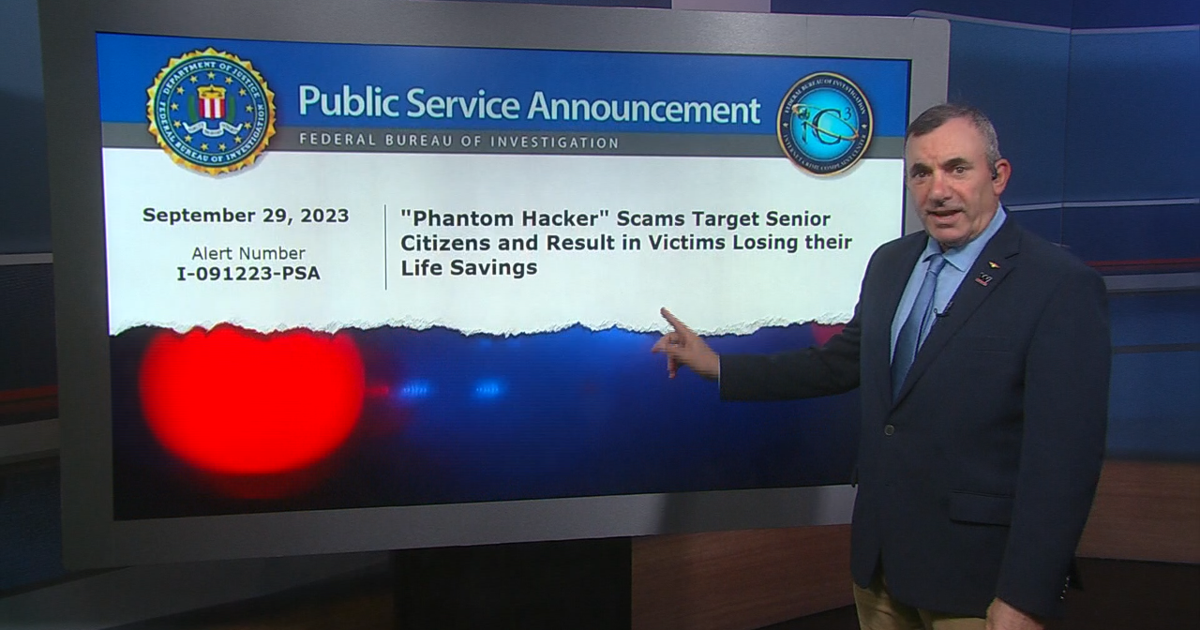

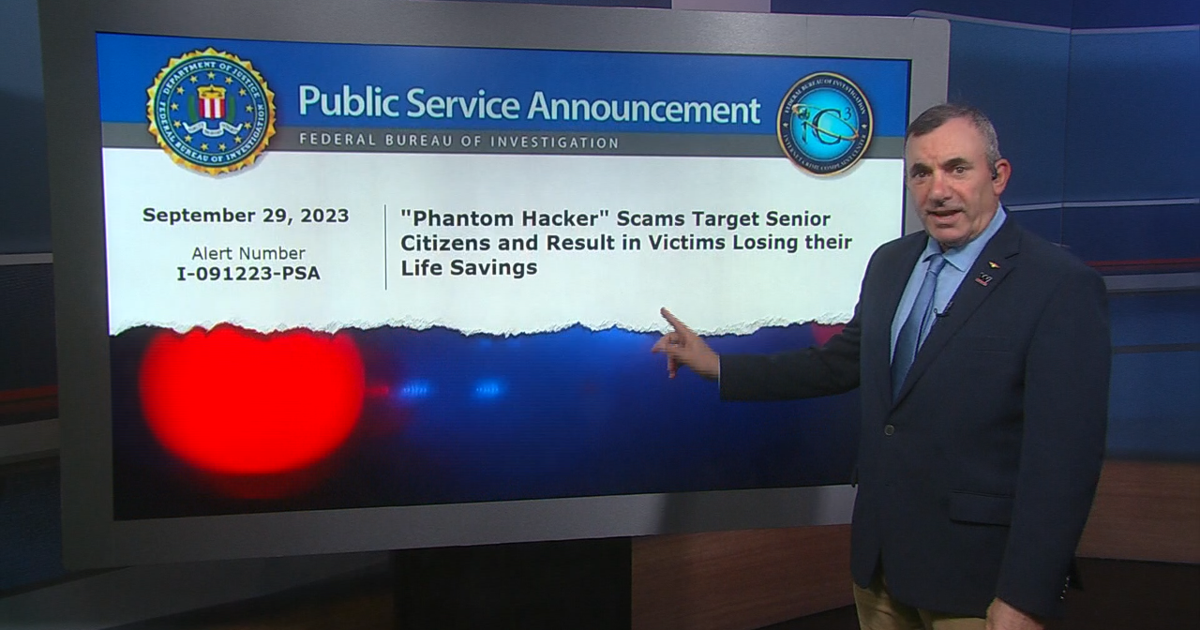

Southwest Florida (SWFL) is experiencing a surge in cybercrime, with bank accounts becoming increasingly vulnerable to sophisticated attacks. Residents and businesses alike need to be vigilant and proactive in protecting their financial information. This article will outline the rising threats and provide practical steps to safeguard your bank accounts from cybercriminals.

The Growing Threat in SWFL

Recent reports indicate a significant increase in phishing scams, malware infections, and other cyberattacks targeting SWFL residents. Law enforcement agencies are working to combat this trend, but individual vigilance remains crucial. The ease of access to online banking and the increasing reliance on digital transactions make SWFL, like many other regions, a prime target for cybercriminals. These criminals often employ increasingly sophisticated techniques, making it harder for the average person to identify and avoid these threats.

Understanding the Tactics Used Against SWFL Bank Accounts

Cybercriminals employ a variety of methods to gain access to bank accounts. Some common tactics include:

- Phishing Emails: These emails often appear to be from legitimate banks or financial institutions, urging recipients to click on links or download attachments that contain malware. These emails may try to trick you into providing your login credentials, account numbers, or other sensitive information.

- Malware Infections: Viruses and other malicious software can be downloaded unknowingly through infected websites or email attachments. Once installed, malware can steal your banking information, monitor your online activity, and even control your computer remotely.

- Smishing and Vishing: These scams involve fraudulent text messages (smishing) or phone calls (vishing) that attempt to trick you into revealing personal financial information.

- Skimming: This involves using a device to steal your credit or debit card information at ATMs or point-of-sale terminals.

Protecting Your SWFL Bank Accounts: A Practical Guide

Taking proactive measures is the best defense against cybercrime. Here's how to protect your bank accounts:

- Strong Passwords: Use strong, unique passwords for all your online accounts, including your bank accounts. Avoid using easily guessable information such as birthdays or pet names. Consider using a password manager to help you generate and manage complex passwords.

- Multi-Factor Authentication (MFA): Enable MFA whenever possible. This adds an extra layer of security by requiring a second form of verification, such as a code sent to your phone, in addition to your password.

- Software Updates: Keep your computer's operating system, antivirus software, and web browser up to date. Regular updates often include security patches that protect against known vulnerabilities.

- Suspicious Emails and Links: Be wary of unsolicited emails or text messages asking for your banking information. Never click on links or download attachments from unknown sources. If you are unsure about the legitimacy of an email, contact your bank directly using their official website or phone number.

- Secure Wi-Fi: Avoid using public Wi-Fi networks to access your bank accounts. Public Wi-Fi networks are often unsecured, making your information vulnerable to interception.

- Regular Account Monitoring: Regularly review your bank statements for any unauthorized transactions. Report any suspicious activity immediately to your bank.

- Phishing Awareness Training: Familiarize yourself with common phishing tactics and learn how to identify suspicious emails and messages. Consider online resources and training offered by your bank or financial institutions.

Reporting Cybercrime in SWFL

If you believe you have been a victim of cybercrime, report it immediately to your local law enforcement agency and your bank. The FBI's Internet Crime Complaint Center (IC3) is another valuable resource for reporting online fraud. [Link to IC3 website]

Conclusion:

The rise of cybercrime in SWFL necessitates a proactive approach to online banking security. By following these guidelines, you can significantly reduce your risk of becoming a victim and protect your hard-earned money. Staying informed and vigilant is key to maintaining the security of your bank accounts in today's digital landscape. Remember, your financial well-being depends on it.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Increased Cybercrime In SWFL: How To Protect Your Bank Accounts. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ok Ja Yeon Concludes The Effect Discusses Acting Journey

Sep 01, 2025

Ok Ja Yeon Concludes The Effect Discusses Acting Journey

Sep 01, 2025 -

Ai Powered Dolls Offer Emotional Support For Senior Citizens

Sep 01, 2025

Ai Powered Dolls Offer Emotional Support For Senior Citizens

Sep 01, 2025 -

Russias Kyiv Assault European Union Responds To Putins Bloodshed

Sep 01, 2025

Russias Kyiv Assault European Union Responds To Putins Bloodshed

Sep 01, 2025 -

Dow S And P 500 Nasdaq Drop Tech Sector Leads Losses After Inflation Report

Sep 01, 2025

Dow S And P 500 Nasdaq Drop Tech Sector Leads Losses After Inflation Report

Sep 01, 2025 -

The Rise Of Ai Caregivers Chat Gpt Dolls In South Korean Nursing Homes

Sep 01, 2025

The Rise Of Ai Caregivers Chat Gpt Dolls In South Korean Nursing Homes

Sep 01, 2025

Latest Posts

-

What To Expect From Apples September Event 7 Potential Product Launches

Sep 02, 2025

What To Expect From Apples September Event 7 Potential Product Launches

Sep 02, 2025 -

Gta Vi Rockstars 300 Million Water Technology Revealed

Sep 02, 2025

Gta Vi Rockstars 300 Million Water Technology Revealed

Sep 02, 2025 -

Apples September Event Unveiling 7 Groundbreaking Devices

Sep 02, 2025

Apples September Event Unveiling 7 Groundbreaking Devices

Sep 02, 2025 -

Syko Stu Recovering After Raja Jackson Assault Released From Hospital

Sep 02, 2025

Syko Stu Recovering After Raja Jackson Assault Released From Hospital

Sep 02, 2025