Important Asian Economic Data Releases: Monday, June 2, 2025

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Important Asian Economic Data Releases: Monday, June 2, 2025 – Key Indicators to Watch

Monday, June 2nd, 2025, promises a busy day for investors and economists focused on the Asian market. Several key economic data releases are scheduled, offering valuable insights into the region's economic health and future trajectory. Understanding these releases is crucial for navigating the complexities of Asian financial markets. Let's delve into the most important announcements and their potential implications.

1. China's Manufacturing PMI (Purchasing Managers' Index):

The China Manufacturing PMI, a leading indicator of the country's manufacturing sector performance, is arguably the most anticipated release of the day. This index provides a snapshot of the health of China's factories, measuring factors like production, new orders, employment, and supplier deliveries. A reading above 50 indicates expansion, while a reading below 50 suggests contraction. Analysts will be closely monitoring this figure for signs of continued recovery or potential slowdown in the world's second-largest economy. Any significant deviation from expectations could trigger significant market volatility.

Keywords: China Manufacturing PMI, China Economy, Asian Economy, Economic Indicators, Purchasing Managers' Index, Market Volatility

2. Japan's Unemployment Rate:

Japan's unemployment rate for May 2025 will also be closely watched. This indicator reflects the labor market's strength and overall economic health. A low unemployment rate generally signals a strong economy, while a rising unemployment rate suggests potential economic challenges. The Bank of Japan's monetary policy decisions are often influenced by the unemployment rate, making this release particularly significant for investors tracking Japanese government bonds and the Yen.

Keywords: Japan Unemployment Rate, Japanese Economy, Bank of Japan, Yen, Monetary Policy, Labor Market

3. India's Inflation Rate:

India's inflation rate, a crucial measure of the change in the average price level of goods and services, will be released on Monday. High inflation can erode purchasing power and impact consumer spending, potentially hindering economic growth. The Reserve Bank of India (RBI) will scrutinize this data to inform its monetary policy decisions, potentially influencing interest rate adjustments. Investors will be particularly interested in any surprises that might deviate from the RBI's inflation targets.

Keywords: India Inflation Rate, Indian Economy, Reserve Bank of India, RBI, Monetary Policy, Consumer Spending

4. South Korea's Industrial Production:

South Korea's industrial production figures provide valuable insight into the performance of its manufacturing and industrial sectors. This data can indicate the country's overall economic momentum and potential for future growth. A decline in industrial production can signal weakening demand both domestically and internationally, impacting investor sentiment.

Keywords: South Korea Industrial Production, South Korean Economy, Industrial Sector, Economic Growth, Investor Sentiment

Impact and Analysis:

The combined impact of these data releases could significantly influence Asian stock markets, currency exchange rates, and investor confidence. Analysts will be dissecting the data to assess the overall health of the Asian economies and to anticipate future trends. Unexpected results in any of these key indicators could lead to significant market fluctuations. It's essential to consult with financial professionals for personalized investment advice based on these announcements.

Further Research:

For more in-depth analysis, consider exploring resources such as the websites of the respective central banks (People's Bank of China, Bank of Japan, Reserve Bank of India, Bank of Korea), reputable financial news outlets, and economic research firms.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in financial markets involves risks, and past performance is not indicative of future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Important Asian Economic Data Releases: Monday, June 2, 2025. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jamie Dimon On Trumps Priorities Navigating A World In Transition

Jun 03, 2025

Jamie Dimon On Trumps Priorities Navigating A World In Transition

Jun 03, 2025 -

Decoding Taylor Jenkins Reids Publishing Dominance Strategies And Insights

Jun 03, 2025

Decoding Taylor Jenkins Reids Publishing Dominance Strategies And Insights

Jun 03, 2025 -

Sheinelle Joness Family Her Focus After Tragedy

Jun 03, 2025

Sheinelle Joness Family Her Focus After Tragedy

Jun 03, 2025 -

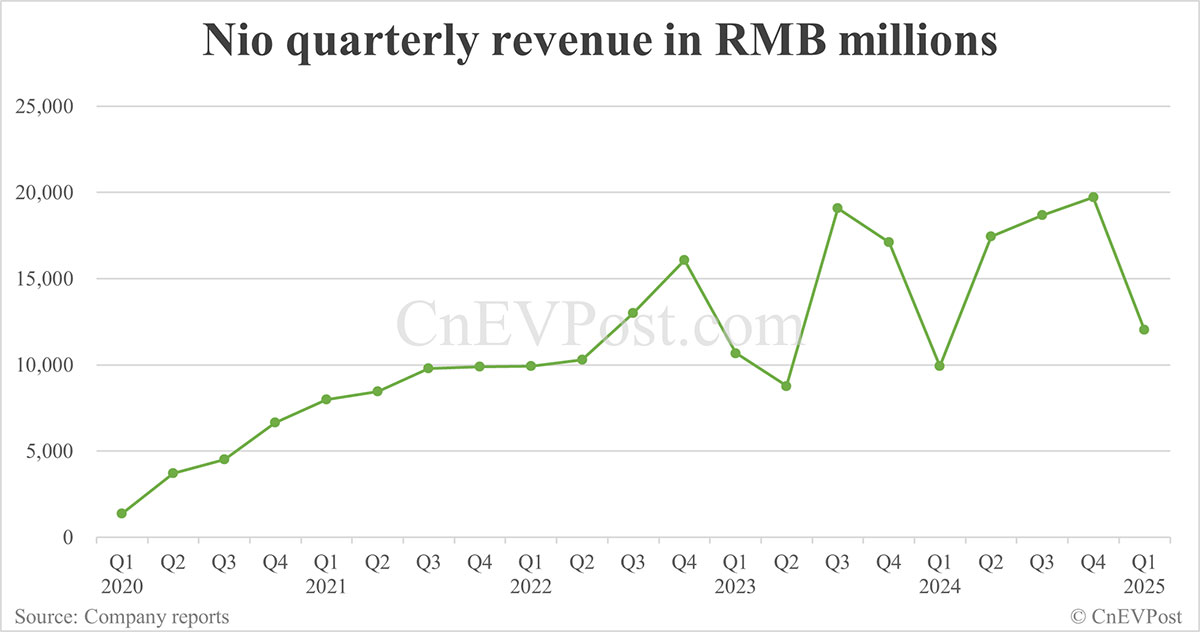

Nio Reports Strong Q1 2024 Revenue Growth A 21 Increase

Jun 03, 2025

Nio Reports Strong Q1 2024 Revenue Growth A 21 Increase

Jun 03, 2025 -

Billy Ray Cyrus And Miley Cyrus Relationship Positive Developments Reported

Jun 03, 2025

Billy Ray Cyrus And Miley Cyrus Relationship Positive Developments Reported

Jun 03, 2025