Impact Of Fed's Rate Cut Projection On US Treasury Yields

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Fed's Rate Cut Projection Sends US Treasury Yields Plunging: What It Means for Investors

The Federal Reserve's unexpected projection of potential rate cuts later this year sent shockwaves through the financial markets, triggering a sharp decline in US Treasury yields. This move, signaling a potential pivot from the aggressive interest rate hikes of the past year, has significant implications for investors and the broader economy. Understanding the nuances of this shift is crucial for navigating the current market landscape.

The Fed's Shift: A Sign of Economic Weakness?

The Fed's projection, unveiled during its June meeting, surprised many analysts who anticipated a pause in rate hikes. This change in stance suggests growing concern within the central bank about the strength of the US economy. While inflation remains stubbornly high, fears of a recession are mounting, prompting the Fed to consider easing monetary policy to stimulate growth and avoid a deeper economic downturn. This cautious approach marks a significant departure from its previous hawkish stance.

Impact on US Treasury Yields: A Deep Dive

The immediate impact of the Fed's announcement was a dramatic fall in US Treasury yields across the maturity spectrum. Yields on 2-year and 10-year Treasury notes, key benchmarks for interest rates, experienced significant drops. This is because lower interest rates typically lead to lower yields on existing bonds. Investors, anticipating lower future interest rates, rushed to buy existing Treasuries, driving up their prices and consequently lowering their yields.

- 2-Year Treasury Yield: Experienced a notable decline, reflecting expectations of near-term rate cuts.

- 10-Year Treasury Yield: Also fell significantly, indicating a shift in longer-term interest rate expectations.

- 30-Year Treasury Yield: Showed a similar downward trend, affecting long-term borrowing costs.

This decline in yields has significant implications for various sectors of the economy.

Implications for Investors and the Broader Economy:

The fall in Treasury yields has several key consequences:

- Lower Borrowing Costs: Lower yields make borrowing cheaper for businesses and consumers, potentially stimulating economic activity. However, this could also fuel inflation if not carefully managed.

- Increased Demand for Bonds: The decline in yields makes bonds more attractive to investors seeking a safe haven asset, potentially diverting funds from riskier investments.

- Impact on Mortgage Rates: Lower Treasury yields often translate to lower mortgage rates, potentially boosting the housing market. However, this effect depends on other factors influencing the mortgage market.

- Currency Volatility: The Fed’s actions can impact the value of the US dollar relative to other currencies, creating potential opportunities and risks for international investors.

Looking Ahead: Uncertainty Remains

While the Fed's projection suggests a potential shift towards easing monetary policy, considerable uncertainty remains. The actual timing and extent of future rate cuts will depend on incoming economic data and the evolving inflation picture. Inflation remains a major concern, and any premature easing could reignite inflationary pressures.

Investors need to closely monitor economic indicators like inflation data, employment figures, and consumer spending to gauge the Fed's next moves. Diversification and a well-defined investment strategy are crucial in navigating this period of market volatility. Consulting with a financial advisor can provide personalized guidance based on your individual risk tolerance and investment goals.

Keywords: US Treasury Yields, Federal Reserve, Interest Rates, Rate Cuts, Bond Market, Economic Outlook, Inflation, Recession, Investment Strategy, Monetary Policy, Treasury Bonds, 2-Year Treasury, 10-Year Treasury, 30-Year Treasury.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Impact Of Fed's Rate Cut Projection On US Treasury Yields. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Lsgs Must Win Game Srhs Marsh And Markram Fuel 206 Run Total

May 20, 2025

Lsgs Must Win Game Srhs Marsh And Markram Fuel 206 Run Total

May 20, 2025 -

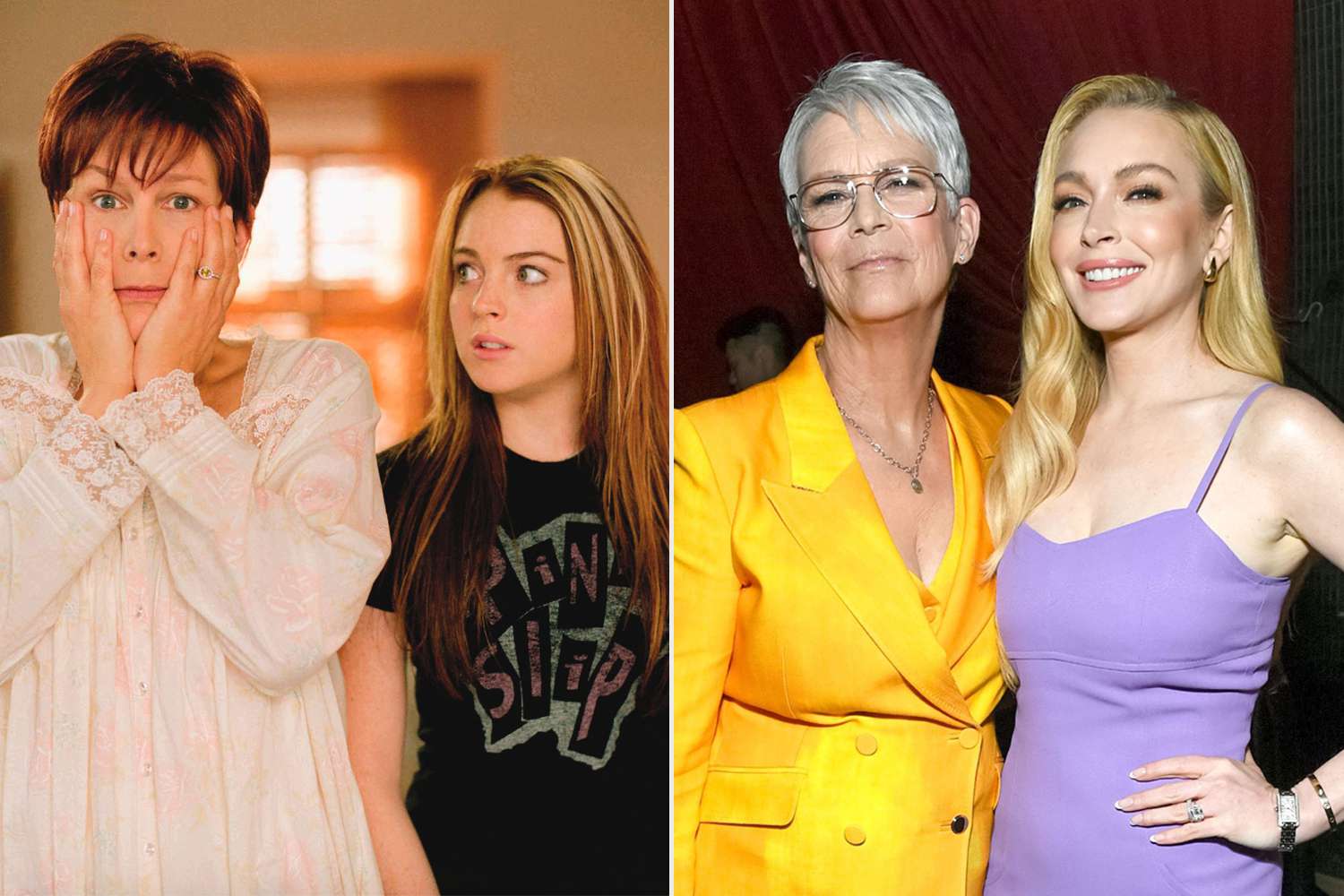

Freaky Friday Reunion Jamie Lee Curtis Talks Post Film Relationship With Lindsay Lohan Exclusive

May 20, 2025

Freaky Friday Reunion Jamie Lee Curtis Talks Post Film Relationship With Lindsay Lohan Exclusive

May 20, 2025 -

Heartbreaking Loss My 600 Lb Lifes Latonya Pottain Dies At 40

May 20, 2025

Heartbreaking Loss My 600 Lb Lifes Latonya Pottain Dies At 40

May 20, 2025 -

Beyond The Game Exploring The Evolved Dynamic Between Joel And Ellie In The Last Of Us Season 2

May 20, 2025

Beyond The Game Exploring The Evolved Dynamic Between Joel And Ellie In The Last Of Us Season 2

May 20, 2025 -

Record Bitcoin Etf Investment A Deeper Dive Into The Current Market Trend

May 20, 2025

Record Bitcoin Etf Investment A Deeper Dive Into The Current Market Trend

May 20, 2025