Impact Of Fed's Rate Cut Prediction: U.S. Treasury Yields Decline

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Fed's Rate Cut Prediction Sends U.S. Treasury Yields Plunging

The Federal Reserve's hinted possibility of a rate cut in the near future has sent shockwaves through the financial markets, leading to a significant decline in U.S. Treasury yields. This unexpected shift signifies a potential change in the economic outlook, leaving investors and analysts scrambling to understand the implications. The move underscores growing concerns about the resilience of the U.S. economy in the face of persistent inflation and potential recessionary pressures.

Understanding the Connection: Interest Rates and Treasury Yields

Before delving into the specifics, it's crucial to understand the relationship between the Federal Reserve's interest rate decisions and U.S. Treasury yields. The Fed's benchmark interest rate, the federal funds rate, influences borrowing costs across the economy. When the Fed lowers rates, it becomes cheaper for the government to borrow money, thus reducing the yield (return) on U.S. Treasury bonds. Conversely, higher rates generally lead to higher yields.

The Fed's Shifting Stance and Market Reaction

Recent statements from Federal Reserve officials have suggested a growing openness to cutting interest rates, a stark contrast to the previous focus on combating inflation. This shift in perspective, driven by concerns about weakening economic data and banking sector instability (such as the recent banking crisis), has fueled speculation about a potential rate cut as early as the next Federal Open Market Committee (FOMC) meeting. This prediction immediately impacted the bond market, resulting in a noticeable drop in Treasury yields across the maturity spectrum.

Impact on Investors and the Broader Economy

This decline in yields has significant implications for various market segments:

- Bond Investors: Lower yields mean lower returns for investors holding U.S. Treasury bonds. However, it also makes bonds relatively more attractive compared to other investments with higher risk.

- Stock Market: The expectation of lower interest rates can boost stock prices, as lower borrowing costs encourage companies to invest and expand. However, the overall impact depends on the economic climate and investor sentiment.

- Mortgages and Loans: Lower interest rates generally translate to lower borrowing costs for consumers and businesses, potentially stimulating economic activity. This could lead to more affordable mortgages and other loans.

Analyzing the Risks and Uncertainties

While lower interest rates can stimulate economic growth, there are potential downsides. A rapid and significant rate cut could potentially exacerbate inflation, if it fuels excessive spending and investment. Moreover, the effectiveness of rate cuts in addressing current economic challenges remains debatable, with some analysts arguing that the current economic slowdown stems from structural issues rather than a simple lack of liquidity.

Looking Ahead: What to Expect

The coming weeks will be critical in gauging the full impact of the Fed's potential rate cut. The next FOMC meeting will be closely scrutinized for any concrete announcements or hints regarding future monetary policy. Investors and economists will continue to monitor economic indicators, inflation data, and any further developments in the banking sector to assess the accuracy of the Fed's predictions and the subsequent implications for the U.S. economy. Further analysis is needed to determine whether this rate cut prediction is a temporary market reaction or the start of a prolonged period of lower interest rates.

Keywords: Fed rate cut, U.S. Treasury yields, interest rates, bond market, inflation, recession, FOMC, economic outlook, monetary policy, investment strategy, banking crisis.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Impact Of Fed's Rate Cut Prediction: U.S. Treasury Yields Decline. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

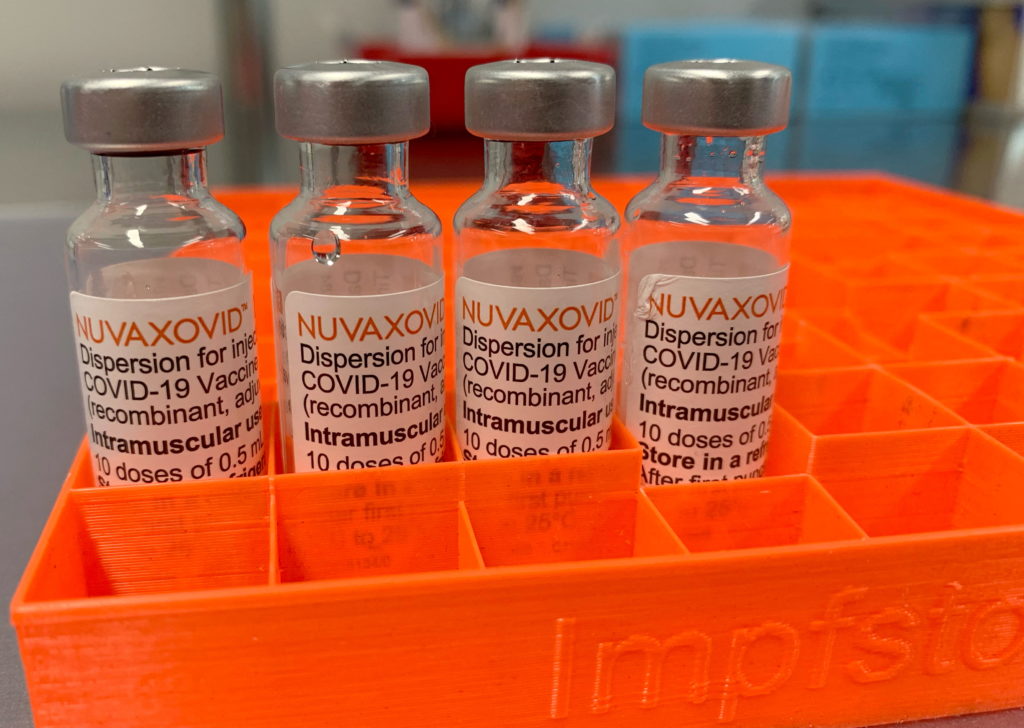

Novavax Covid 19 Vaccine Gets Fda Nod Specific Use Restrictions Apply

May 20, 2025

Novavax Covid 19 Vaccine Gets Fda Nod Specific Use Restrictions Apply

May 20, 2025 -

Peaky Blinders Returns Confirmed New Series And A Big Twist

May 20, 2025

Peaky Blinders Returns Confirmed New Series And A Big Twist

May 20, 2025 -

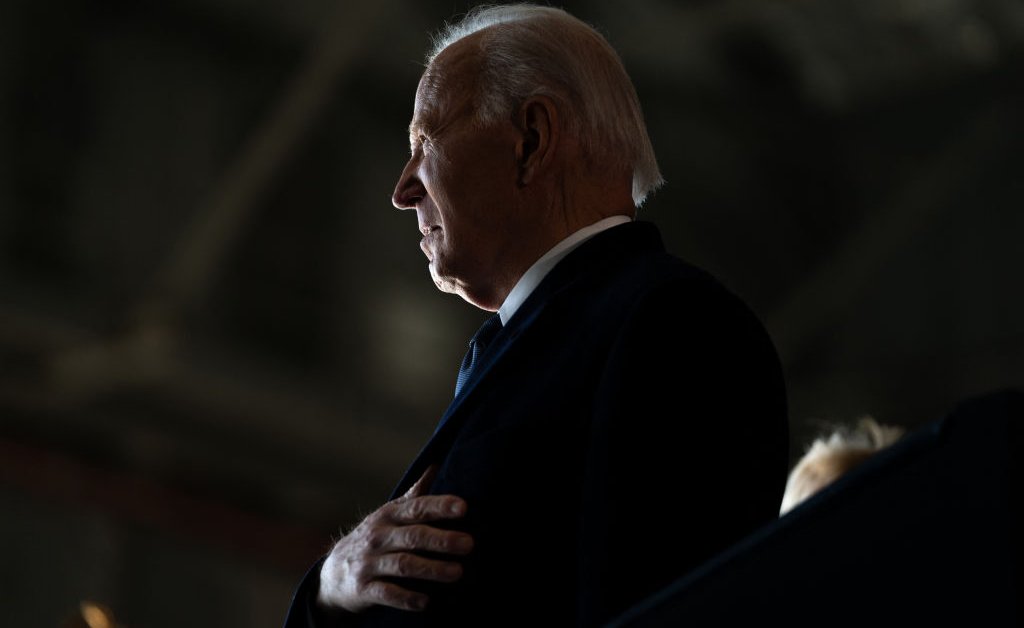

Messages Of Solidarity Pour In For President Biden After Cancer Announcement

May 20, 2025

Messages Of Solidarity Pour In For President Biden After Cancer Announcement

May 20, 2025 -

Beyond The Screen Jamie Lee Curtis Discusses Her Real Life Connection To Lindsay Lohan

May 20, 2025

Beyond The Screen Jamie Lee Curtis Discusses Her Real Life Connection To Lindsay Lohan

May 20, 2025 -

The Last Of Us Season 2 Diverges Exploring The Evolution Of Joel And Ellies Dynamic

May 20, 2025

The Last Of Us Season 2 Diverges Exploring The Evolution Of Joel And Ellies Dynamic

May 20, 2025