Impact Of Fed's Rate Cut Outlook On U.S. Treasury Yields

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Fed's Rate Cut Outlook: A Deep Dive into the Impact on U.S. Treasury Yields

The Federal Reserve's (Fed) recent shift towards a potential rate cut has sent ripples throughout the financial markets, significantly impacting U.S. Treasury yields. This move, driven by concerns about banking sector stability and slowing economic growth, marks a considerable change from the aggressive interest rate hikes of the past year. Understanding the interplay between Fed policy and Treasury yields is crucial for investors and economists alike. This article delves into the complexities of this relationship, exploring the current situation and potential future scenarios.

Understanding the Inverse Relationship

Treasury yields and interest rates share an inverse relationship. When the Fed cuts interest rates, it generally becomes less expensive for the government to borrow money. This increased affordability reduces demand for existing Treasury bonds, causing their prices to rise. As bond prices increase, yields (the return an investor receives) fall. Conversely, rate hikes increase borrowing costs, driving up Treasury yields.

The Current Market Landscape: A Shift in Expectations

Prior to the recent banking sector turmoil, market expectations leaned towards continued interest rate hikes by the Fed. This anticipation fueled relatively high Treasury yields. However, the collapse of Silicon Valley Bank (SVB) and Signature Bank dramatically altered the outlook. The Fed's emergency lending measures and increasingly dovish rhetoric signaled a potential pivot towards rate cuts to ease financial market stress and support economic growth.

This shift in expectations immediately impacted Treasury yields. The 10-year Treasury yield, a key benchmark, experienced a noticeable decline, reflecting investor confidence in the Fed's ability to prevent a broader financial crisis. This drop signals a flight to safety, with investors seeking the relative security of U.S. government bonds.

Factors Influencing Treasury Yields Beyond the Fed:

While the Fed's actions are a primary driver, other factors influence U.S. Treasury yields:

- Inflation: Persistent inflation can lead the Fed to maintain or even increase interest rates, pushing Treasury yields higher. Conversely, declining inflation can support lower yields.

- Economic Growth: Strong economic growth often leads to higher yields as investors anticipate increased borrowing and higher inflation. Conversely, slowing growth can depress yields.

- Global Economic Conditions: Global events, such as geopolitical instability or international financial crises, can impact investor sentiment and influence Treasury yields.

- Supply and Demand: The overall supply of Treasury bonds and the level of investor demand play a crucial role in determining yields.

Looking Ahead: Uncertainty and Potential Scenarios

Predicting the future trajectory of Treasury yields remains challenging. Several scenarios are possible:

- Continued Rate Cuts: If the Fed continues to cut rates to stimulate the economy and maintain financial stability, Treasury yields are likely to remain relatively low.

- Pause and Re-evaluation: The Fed might pause rate cuts to assess the impact of its actions on inflation and economic growth. This could lead to yield stabilization or a modest increase.

- Inflationary Pressures: If inflation remains stubbornly high despite rate cuts, the Fed might be forced to resume rate hikes, potentially driving Treasury yields upward.

Conclusion: Navigating the Unpredictability

The impact of the Fed's rate cut outlook on U.S. Treasury yields is a dynamic and complex issue. While the inverse relationship between Fed policy and Treasury yields is generally well-established, the interplay of various economic and geopolitical factors creates considerable uncertainty. Investors and economists must carefully monitor economic indicators, Fed pronouncements, and global events to navigate this evolving landscape effectively. Staying informed through reputable financial news sources and consulting with financial advisors is crucial for making informed decisions in this volatile market.

Keywords: Fed rate cut, U.S. Treasury yields, interest rates, bond yields, inflation, economic growth, financial markets, investment strategy, Silicon Valley Bank, market volatility, 10-year Treasury yield, Federal Reserve policy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Impact Of Fed's Rate Cut Outlook On U.S. Treasury Yields. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Taylor Jenkins Reids Publishing Empire Strategy Success And Storytelling

May 21, 2025

Taylor Jenkins Reids Publishing Empire Strategy Success And Storytelling

May 21, 2025 -

How Climate Change Impacts Healthy Pregnancies Risks And Implications

May 21, 2025

How Climate Change Impacts Healthy Pregnancies Risks And Implications

May 21, 2025 -

The Last Of Us Season 2 Exploring The Evolved Relationship Between Joel And Ellie

May 21, 2025

The Last Of Us Season 2 Exploring The Evolved Relationship Between Joel And Ellie

May 21, 2025 -

Riot Games Announces 2025 League Of Legends Hall Of Fame Inductee

May 21, 2025

Riot Games Announces 2025 League Of Legends Hall Of Fame Inductee

May 21, 2025 -

Police Investigate Church Break In Two Boys Suspected Of Defecation

May 21, 2025

Police Investigate Church Break In Two Boys Suspected Of Defecation

May 21, 2025

Latest Posts

-

Fans Erupt As Ellen De Generes Returns To Social Media Post Loss

May 21, 2025

Fans Erupt As Ellen De Generes Returns To Social Media Post Loss

May 21, 2025 -

Church Vandalism In Santa Rosa Arrests Made In Defecation And Urination Case

May 21, 2025

Church Vandalism In Santa Rosa Arrests Made In Defecation And Urination Case

May 21, 2025 -

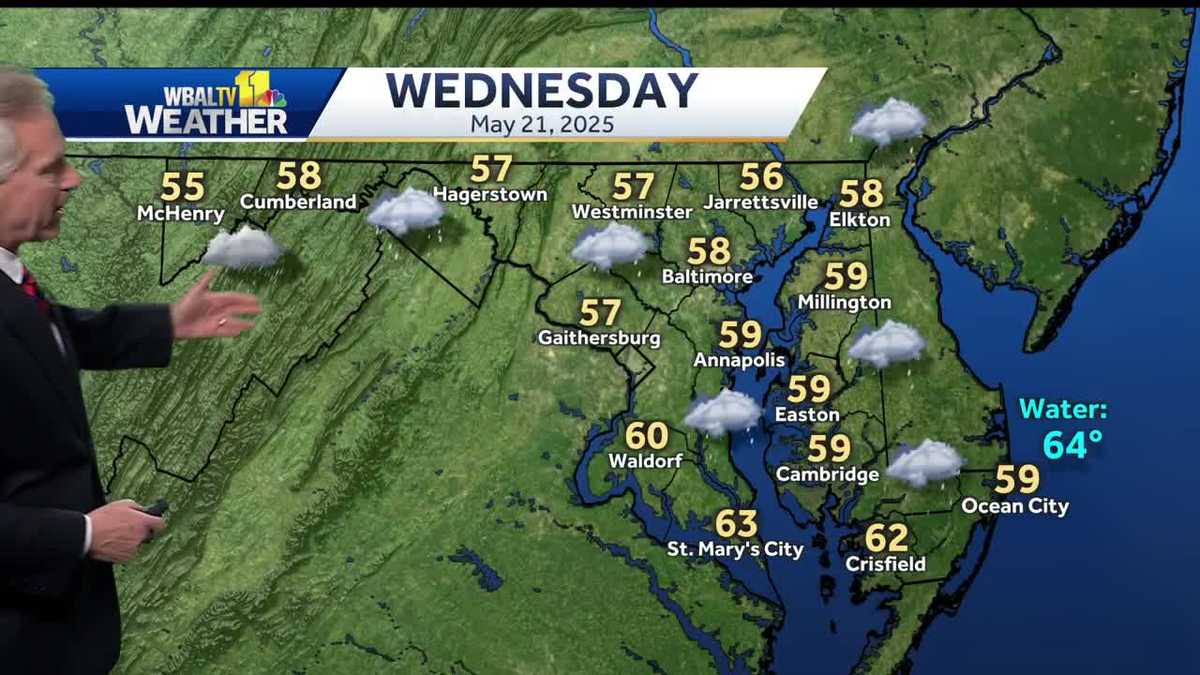

Wednesday Weather Alert Rain And Unseasonably Cold Temperatures

May 21, 2025

Wednesday Weather Alert Rain And Unseasonably Cold Temperatures

May 21, 2025 -

Uzis Luxurious New Ride A Mercedes Benz Electric G Wagon

May 21, 2025

Uzis Luxurious New Ride A Mercedes Benz Electric G Wagon

May 21, 2025 -

Irreplaceable Loss Ellen De Generes Moving Message Of Grief

May 21, 2025

Irreplaceable Loss Ellen De Generes Moving Message Of Grief

May 21, 2025