How The Trump Tax Cuts Impact Healthcare: 5 Key Limitations

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

How the Trump Tax Cuts Impact Healthcare: 5 Key Limitations

The 2017 Tax Cuts and Jobs Act, spearheaded by the Trump administration, significantly altered the US tax code. While touted as a boon for the economy, its impact on healthcare access and affordability remains a complex and often debated topic. While some argued it would stimulate economic growth leading to better healthcare outcomes, a closer look reveals several key limitations. This article delves into five significant ways the tax cuts fell short of improving healthcare for many Americans.

1. Increased National Debt & Reduced Healthcare Spending: A primary criticism of the tax cuts is their contribution to the burgeoning national debt. By significantly lowering corporate and individual tax rates, the government sacrificed substantial revenue. This reduction in government revenue directly impacts the ability to fund crucial healthcare initiatives, including Medicare, Medicaid, and the Affordable Care Act (ACA). [Link to Congressional Budget Office report on the impact of the tax cuts]. Less funding inevitably translates to reduced access to care, particularly for vulnerable populations relying on government assistance programs.

2. Weakening of the ACA: The tax cuts repealed the individual mandate penalty – a key component of the ACA designed to encourage enrollment and maintain a stable risk pool. The elimination of this penalty led to a decline in ACA enrollment, impacting the affordability and sustainability of the marketplace. [Link to Kaiser Family Foundation data on ACA enrollment]. This directly resulted in higher premiums for those remaining in the system and reduced coverage overall.

3. Limited Impact on Healthcare Costs: While proponents argued the tax cuts would stimulate economic growth, leading to lower healthcare costs, this prediction largely failed to materialize. The tax cuts primarily benefited corporations and high-income individuals, with limited trickle-down effects on healthcare affordability for the average American. In fact, healthcare costs continued to rise, exacerbating the burden on individuals and families.

4. Exacerbation of Health Inequalities: The benefits of the tax cuts were not evenly distributed. High-income earners received a disproportionately larger tax break, further widening the gap in healthcare access between socioeconomic groups. Low-income individuals and families, already struggling to afford healthcare, saw little to no benefit, leaving them more vulnerable to financial hardship due to medical expenses.

5. Uncertainty and Instability in the Healthcare Market: The tax cuts created uncertainty within the healthcare market, impacting investment in healthcare infrastructure and innovation. The repeal of the individual mandate and the overall reduction in government funding created instability, impacting the long-term sustainability of the healthcare system. [Link to an article discussing the instability in the healthcare market post-tax cuts]. This uncertainty further hindered efforts to improve healthcare access and affordability.

Conclusion:

The Trump tax cuts, while intended to boost the economy, had unintended and largely negative consequences for the US healthcare system. The increased national debt, weakening of the ACA, limited impact on healthcare costs, exacerbation of health inequalities, and overall market instability all contributed to a less accessible and less affordable healthcare landscape for many Americans. Understanding these limitations is crucial for future policy decisions aimed at improving healthcare access and affordability for all. Further research and analysis are needed to fully understand the long-term consequences of these tax cuts on the health and well-being of the nation.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on How The Trump Tax Cuts Impact Healthcare: 5 Key Limitations. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Morning Commute Chaos Fremont Traffic Collision Impacts Drivers

Jul 04, 2025

Morning Commute Chaos Fremont Traffic Collision Impacts Drivers

Jul 04, 2025 -

Boston Red Sox Great Recalls Famous Sports Illustrated Photo Shoot With Pirate Legend Dave Parker

Jul 04, 2025

Boston Red Sox Great Recalls Famous Sports Illustrated Photo Shoot With Pirate Legend Dave Parker

Jul 04, 2025 -

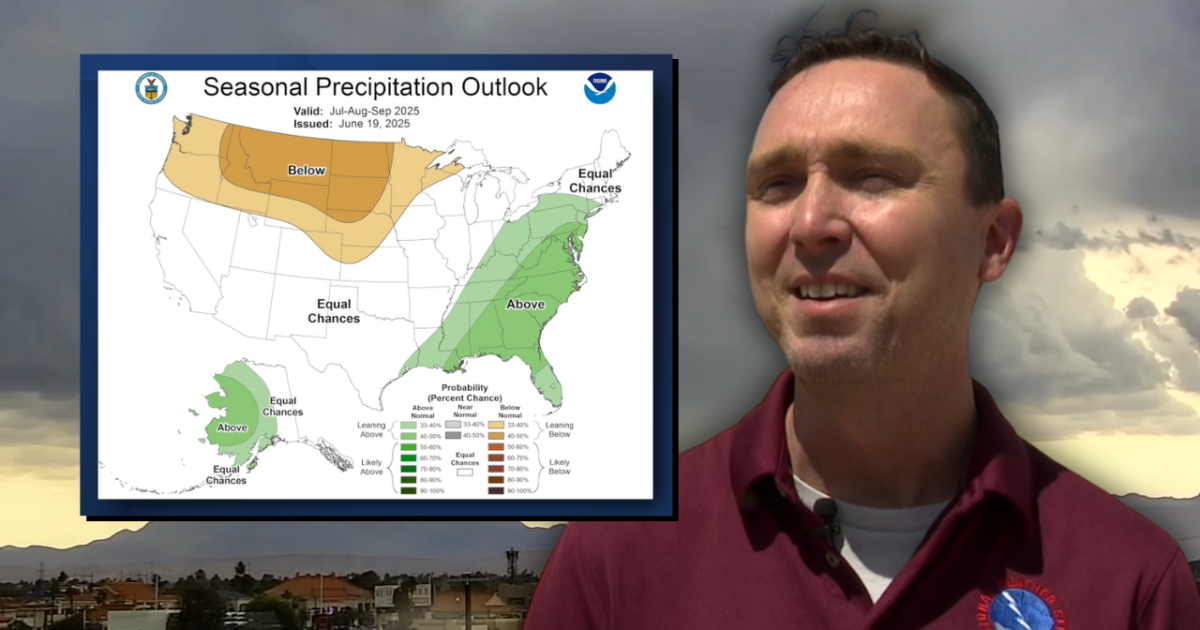

Is A Southern Nevada Monsoon On The Horizon Expert Analysis

Jul 04, 2025

Is A Southern Nevada Monsoon On The Horizon Expert Analysis

Jul 04, 2025 -

Snap Benefits Under Threat Analyzing The Impact Of Trumps Tax Bill

Jul 04, 2025

Snap Benefits Under Threat Analyzing The Impact Of Trumps Tax Bill

Jul 04, 2025 -

Indonesia Ferry Capsizes Near Bali Leaving Six Dead And Dozens Missing

Jul 04, 2025

Indonesia Ferry Capsizes Near Bali Leaving Six Dead And Dozens Missing

Jul 04, 2025

Latest Posts

-

Live Stream Details France Vs Iceland World Cup Qualifier Match Today

Sep 10, 2025

Live Stream Details France Vs Iceland World Cup Qualifier Match Today

Sep 10, 2025 -

France Vs Iceland 2026 World Cup Qualifying Live Stream And Tv Guide

Sep 10, 2025

France Vs Iceland 2026 World Cup Qualifying Live Stream And Tv Guide

Sep 10, 2025 -

Portugals World Cup Dream Can They Win It All

Sep 10, 2025

Portugals World Cup Dream Can They Win It All

Sep 10, 2025 -

Mundial 2026 Francia Vs Islandia Horario Y Canales De Tv

Sep 10, 2025

Mundial 2026 Francia Vs Islandia Horario Y Canales De Tv

Sep 10, 2025 -

Preventing Racist Abuse Englands Plan To Protect Kane And Other Players

Sep 10, 2025

Preventing Racist Abuse Englands Plan To Protect Kane And Other Players

Sep 10, 2025