How CoinMarketCap's AI Is Impacting Altcoin Prices (MIND, Pepe, Etc.)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

How CoinMarketCap's AI is Impacting Altcoin Prices (MIND, Pepe, etc.)

The cryptocurrency market is notoriously volatile, with altcoin prices often experiencing dramatic swings. Recently, a new factor has emerged that's influencing this volatility: CoinMarketCap's integration of artificial intelligence (AI). While not directly manipulating prices, CoinMarketCap's AI features are subtly yet significantly impacting how investors perceive and react to altcoins like MIND and Pepe, potentially driving price fluctuations. This article delves into how this AI influence is playing out.

CoinMarketCap's Expanding AI Capabilities:

CoinMarketCap, a leading cryptocurrency data aggregator, has been steadily incorporating AI into its platform. These AI tools are designed to enhance user experience and provide more sophisticated data analysis. However, these advancements have unintended consequences, particularly concerning altcoin pricing. Features such as improved trend analysis, sentiment scoring, and even AI-powered price predictions indirectly influence investor behavior.

The Psychological Impact of AI-Driven Data:

The core issue lies in the psychology of investors. AI-generated data, especially price predictions, carries a perceived weight of authority. Investors, particularly those less experienced, may interpret AI-generated insights as more reliable than traditional fundamental or technical analysis. This can lead to herd mentality, where a significant number of investors react similarly to AI-driven signals, potentially inflating or deflating prices.

Case Studies: MIND and Pepe:

Let's examine two examples:

- MIND: A sudden surge in positive sentiment or a bullish AI-driven prediction could trigger a buying frenzy, artificially increasing MIND's price. Conversely, a negative prediction could lead to a sell-off.

- Pepe: The meme coin Pepe, known for its volatile nature, is particularly susceptible to AI-driven sentiment shifts. A change in AI-generated sentiment scores could easily trigger a cascade of buying or selling, creating significant price swings.

The Algorithmic Trading Connection:

The impact isn't limited to individual investors. Algorithmic trading bots, which automatically execute trades based on pre-programmed rules, increasingly rely on data feeds from platforms like CoinMarketCap. If these bots incorporate AI-generated signals into their algorithms, this could amplify the effect, creating self-fulfilling prophecies where AI-driven predictions actually influence the very prices they predict.

H2: Is this Manipulation?

It's crucial to clarify: CoinMarketCap isn't manipulating the market. Their AI features are designed to provide information, not dictate price movements. However, the indirect influence of this information is undeniable, raising ethical considerations and highlighting the need for critical thinking among investors.

H2: Navigating the AI-Influenced Market:

To navigate this new landscape, investors should:

- Remain Skeptical: Don't blindly trust AI-generated predictions. Conduct your own research and consider multiple sources of information.

- Diversify: Spread your investments across various cryptocurrencies to mitigate risk associated with AI-driven sentiment swings.

- Understand the Limitations: AI is a tool, not a crystal ball. Its predictions are based on historical data and may not accurately reflect future market behavior.

H2: The Future of AI in Crypto:

The integration of AI in cryptocurrency data platforms is likely to continue. As AI models become more sophisticated, their influence on market sentiment and price movements will probably increase. This underscores the importance of financial literacy and critical evaluation of all information sources in the dynamic world of cryptocurrency investing.

Call to Action: Stay informed about the evolving role of AI in the crypto market by following reputable news sources and engaging in responsible cryptocurrency trading practices. Remember, due diligence is paramount in mitigating risk.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on How CoinMarketCap's AI Is Impacting Altcoin Prices (MIND, Pepe, Etc.). We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

From Pulp Fiction To Hollywood Quentin Tarantinos Life And Films Explored In New Book Series

May 22, 2025

From Pulp Fiction To Hollywood Quentin Tarantinos Life And Films Explored In New Book Series

May 22, 2025 -

Can Googles Ai Movie Tool Disrupt Netflixs Dominance

May 22, 2025

Can Googles Ai Movie Tool Disrupt Netflixs Dominance

May 22, 2025 -

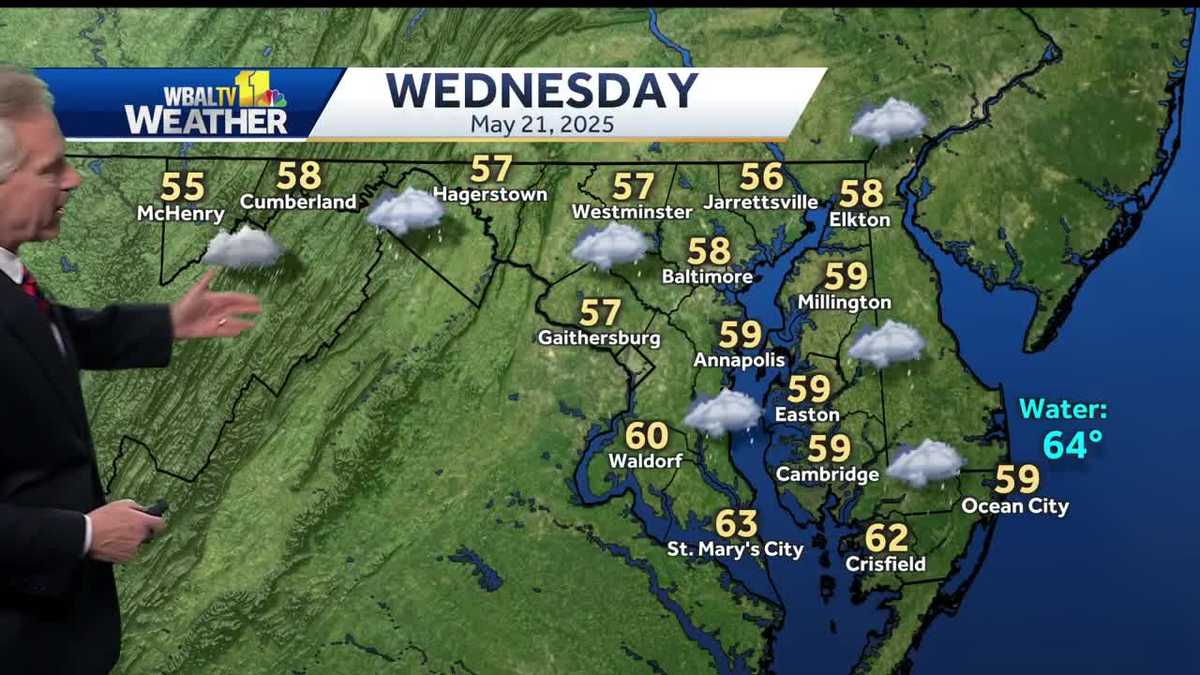

Region Braces For Cold Rain Wednesday

May 22, 2025

Region Braces For Cold Rain Wednesday

May 22, 2025 -

Ny Ag Letitia James Trump Lawsuits And Doj Real Estate Fraud Probe Clash

May 22, 2025

Ny Ag Letitia James Trump Lawsuits And Doj Real Estate Fraud Probe Clash

May 22, 2025 -

Mr Beasts Beast Philanthropy You Tube Stars Charitable Giving And Impact

May 22, 2025

Mr Beasts Beast Philanthropy You Tube Stars Charitable Giving And Impact

May 22, 2025