How Businesses And Finance Professionals View Climate Change

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

How Businesses and Finance Professionals View Climate Change: A Shifting Landscape

The impact of climate change is no longer a distant threat; it's a present reality reshaping the global economy. How businesses and finance professionals perceive and respond to this challenge is crucial for the future of both the planet and the financial markets. This article explores the evolving perspectives within these sectors, highlighting both the challenges and opportunities presented by a changing climate.

The Growing Awareness of Climate Risk:

For years, climate change was often viewed as a peripheral concern by many in the business and finance worlds. However, mounting evidence of extreme weather events, regulatory pressures, and growing investor activism has forced a significant shift in perspective. The financial implications of climate change are becoming increasingly clear, impacting everything from supply chains and insurance costs to asset valuations and investment strategies. Major institutions like the Bank of England and the International Monetary Fund (IMF) are actively highlighting the systemic risks posed by climate change to the global financial system. [Link to IMF report on climate risk].

Integrating ESG into Investment Strategies:

Environmental, Social, and Governance (ESG) factors are no longer a niche consideration; they're becoming mainstream. Many investors are actively incorporating ESG criteria into their investment decisions, seeking companies demonstrating strong environmental performance and sustainable practices. This shift reflects a growing demand for responsible investing, driven by both ethical concerns and a recognition that companies with robust ESG profiles may be better positioned to navigate future climate-related challenges. This increased focus is leading to the development of new financial instruments, such as green bonds and sustainable investment funds, which are designed to finance climate-friendly projects and initiatives.

Challenges Remain:

Despite this growing awareness, significant challenges remain. Accurately assessing and pricing climate-related risks is complex. The long-term nature of climate change makes it difficult to predict its precise impacts on individual businesses and assets. Furthermore, inconsistencies in climate-related data and reporting standards can hinder effective risk management. Many businesses are still struggling to integrate climate considerations into their core strategies and operations. A lack of standardized metrics and consistent reporting frameworks creates difficulties in comparing companies’ climate performance accurately.

Opportunities for Innovation and Growth:

The transition to a low-carbon economy also presents significant opportunities. The development and deployment of renewable energy technologies, energy efficiency improvements, and sustainable infrastructure projects are creating new markets and driving innovation. Businesses that are proactive in adapting to the changing climate and embracing sustainable practices are likely to gain a competitive advantage, attracting investors and consumers who prioritize environmental responsibility. This presents a significant opportunity for businesses to innovate, create new products and services, and capture market share.

The Role of Regulation and Policy:

Governments worldwide are increasingly implementing policies to mitigate climate change and encourage sustainable business practices. Carbon pricing mechanisms, such as carbon taxes and emissions trading schemes, are being introduced to incentivize emissions reductions. Moreover, stricter environmental regulations are being imposed on businesses across various sectors. These regulatory changes are creating both challenges and opportunities, forcing businesses to adapt and innovate to meet evolving requirements.

Conclusion:

The perspective of businesses and finance professionals on climate change is rapidly evolving. While challenges remain in accurately assessing and managing climate-related risks, the growing awareness of these risks and the increasing demand for responsible investing are driving significant changes. The transition to a low-carbon economy presents both challenges and opportunities, requiring businesses to adapt, innovate, and embrace sustainable practices to thrive in the future. Understanding these evolving perspectives is critical for navigating the complex landscape of climate change and its implications for the global economy. Staying informed about emerging ESG standards and regulations is crucial for businesses and investors alike.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on How Businesses And Finance Professionals View Climate Change. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Financial Industrys Response To Climate Change Risks

May 16, 2025

The Financial Industrys Response To Climate Change Risks

May 16, 2025 -

2025 Pga Championship A Champions Comical Excuse For Missing Quail Hollow

May 16, 2025

2025 Pga Championship A Champions Comical Excuse For Missing Quail Hollow

May 16, 2025 -

Get The Recipe Matteo Lanes Favorite Cheesy Pasta

May 16, 2025

Get The Recipe Matteo Lanes Favorite Cheesy Pasta

May 16, 2025 -

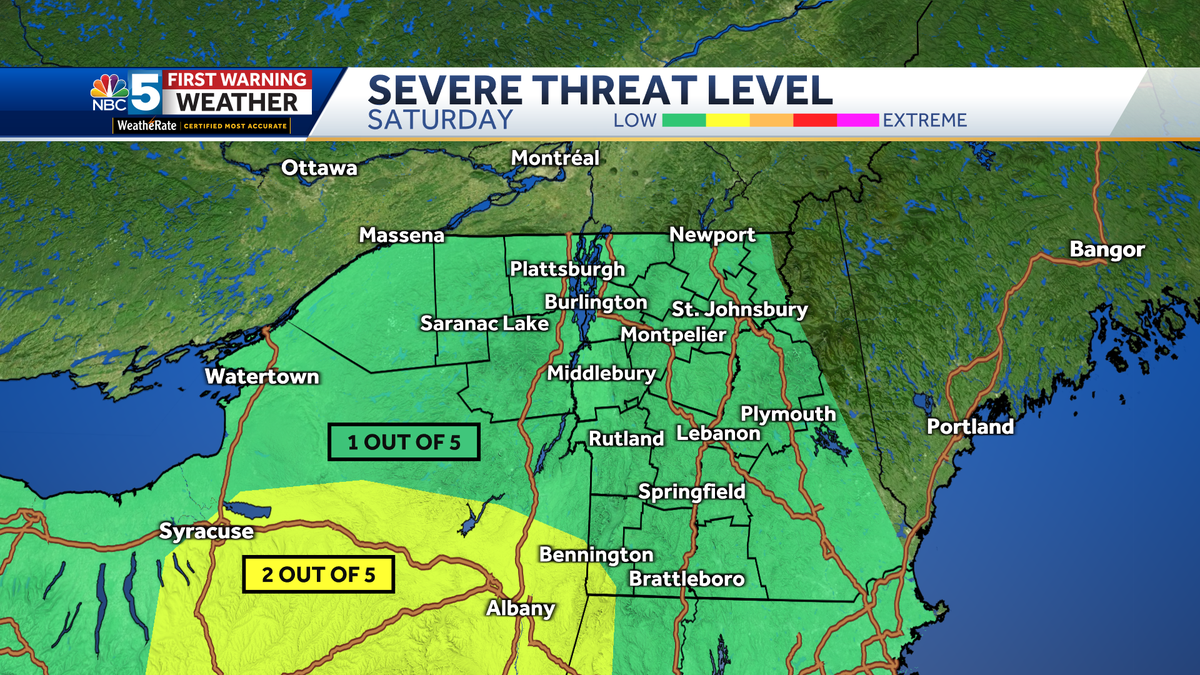

Pop Up Thunderstorms To Impact Vermont And New York Thursday Wet Weekend Forecast

May 16, 2025

Pop Up Thunderstorms To Impact Vermont And New York Thursday Wet Weekend Forecast

May 16, 2025 -

2025 Soccer Prediction Rayo Vallecano Vs Betis Odds And Analysis May 15th

May 16, 2025

2025 Soccer Prediction Rayo Vallecano Vs Betis Odds And Analysis May 15th

May 16, 2025