How Business And Finance Leaders View Climate Change Risk

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

How Business and Finance Leaders View Climate Change Risk: A Shifting Paradigm

The impact of climate change is no longer a distant threat; it's a present-day reality reshaping business strategies and financial markets. From intensifying weather events to stricter environmental regulations, the risks associated with a changing climate are forcing business and finance leaders to re-evaluate their approaches. This article explores how these leaders perceive and are responding to these escalating challenges.

The Growing Awareness of Climate Risk

For years, climate change was often viewed as a peripheral concern, relegated to the realm of environmental activists and long-term projections. However, this perception is rapidly changing. A growing body of evidence, including devastating natural disasters and increasingly stringent environmental regulations, is compelling businesses and financial institutions to acknowledge the significant financial implications of climate change. This shift is driven by several key factors:

-

Increased Regulatory Scrutiny: Governments worldwide are implementing stricter environmental regulations, including carbon pricing mechanisms and mandatory climate-related financial disclosures. This regulatory pressure forces companies to assess and mitigate their climate-related risks to maintain compliance and avoid penalties. The is a prime example of this growing regulatory landscape.

-

Investor Demand for ESG Integration: Environmental, Social, and Governance (ESG) investing is gaining significant momentum. Investors are increasingly demanding transparency and accountability regarding companies' climate-related risks and strategies. This pressure is pushing businesses to prioritize climate action to attract investment and maintain their market value. Learn more about .

-

Physical and Transition Risks: Businesses are facing both physical risks (e.g., damage from extreme weather events) and transition risks (e.g., costs associated with shifting to a low-carbon economy). These risks can significantly impact supply chains, operations, and profitability, demanding proactive mitigation strategies.

Strategies for Managing Climate Risk

In response to these challenges, business and finance leaders are adopting a range of strategies:

-

Carbon Footprint Reduction: Many companies are actively working to reduce their carbon footprint through initiatives like renewable energy adoption, energy efficiency improvements, and supply chain optimization. This not only reduces environmental impact but also contributes to cost savings and enhances brand reputation.

-

Climate-Related Financial Disclosures: Companies are increasingly disclosing their climate-related risks and strategies in accordance with frameworks like the Task Force on Climate-related Financial Disclosures (TCFD). This transparency helps investors assess climate-related risks and opportunities.

-

Investment in Green Technologies: Investment in renewable energy, energy storage, and other green technologies is accelerating, driven by both environmental concerns and economic opportunities. This shift towards a sustainable economy presents significant investment potential.

-

Climate Risk Modeling and Scenario Planning: Sophisticated climate risk modeling and scenario planning are becoming essential tools for businesses and financial institutions to assess and manage their exposure to climate-related risks.

The Future of Climate Risk Management

The evolving understanding of climate change risk is transforming the business and finance landscape. As regulations become stricter, investor pressure intensifies, and the physical impacts of climate change become more evident, proactive climate risk management will be crucial for long-term success. Companies that fail to adequately address climate risks will face increasing financial and reputational challenges. The integration of climate considerations into core business strategy is no longer a choice, but a necessity for sustainable growth and resilience in the 21st century.

Call to Action: Learn more about how your organization can effectively manage climate-related risks by researching relevant resources and engaging with industry best practices. The future of business depends on it.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on How Business And Finance Leaders View Climate Change Risk. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Trade War Eases Us And China Agree On Temporary Tariff Suspension

May 13, 2025

Trade War Eases Us And China Agree On Temporary Tariff Suspension

May 13, 2025 -

Massive Layoffs Hit Seattle Tech Sector Impact On Workers And Economy

May 13, 2025

Massive Layoffs Hit Seattle Tech Sector Impact On Workers And Economy

May 13, 2025 -

South African Exodus White Refugees Begin Us Resettlement Program

May 13, 2025

South African Exodus White Refugees Begin Us Resettlement Program

May 13, 2025 -

Rome R3 Tennis Analyzing Sinner Vs De Jong And Mensik Vs Marozsan Matches

May 13, 2025

Rome R3 Tennis Analyzing Sinner Vs De Jong And Mensik Vs Marozsan Matches

May 13, 2025 -

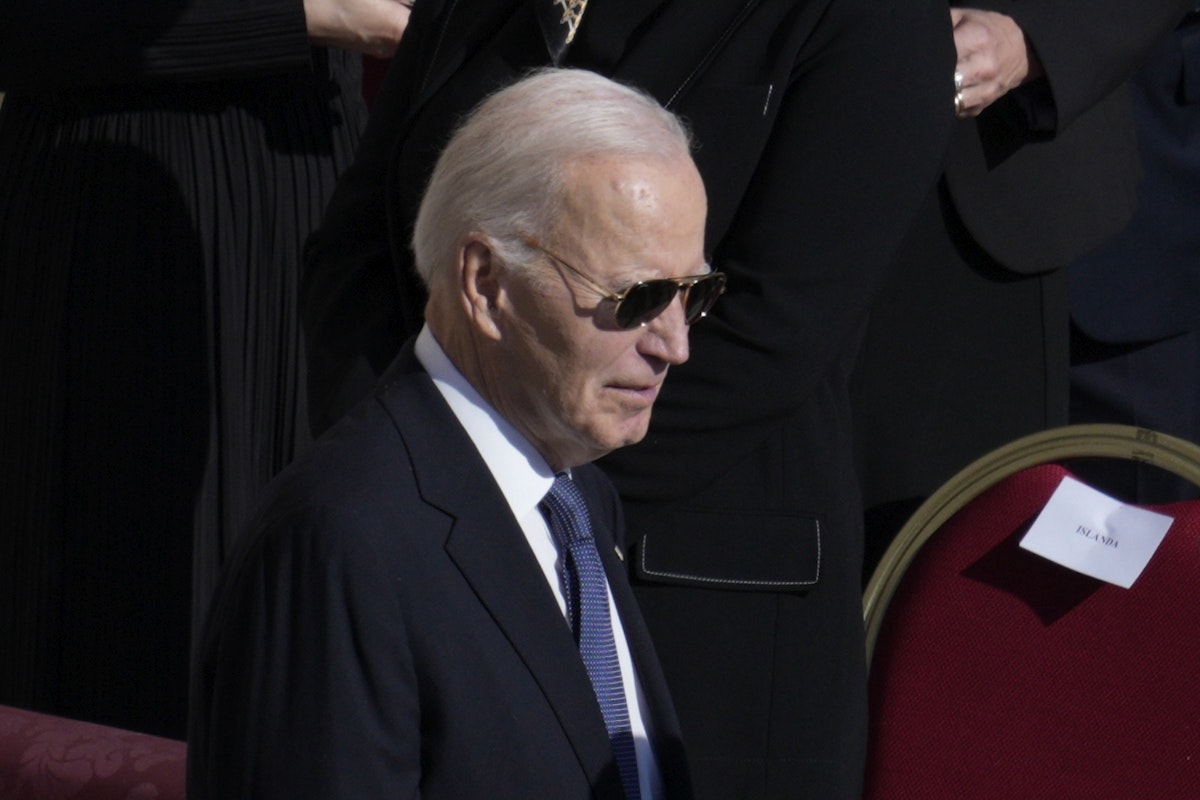

Reports Indicate Bidens Staff Unaware Of Severity Of Health Issues

May 13, 2025

Reports Indicate Bidens Staff Unaware Of Severity Of Health Issues

May 13, 2025