Holiday Closures Impact China And New Zealand Markets: June 2, 2025

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Holiday Closures Impact China and New Zealand Markets: June 2, 2025

Global markets experienced noticeable shifts on June 2nd, 2025, due to significant holiday closures in both China and New Zealand. These closures led to reduced trading volumes and price fluctuations across various asset classes, highlighting the interconnectedness of the global financial system and the impact of regional holidays on international markets.

The Dragon Boat Festival, a major public holiday in mainland China, resulted in the closure of the Shanghai and Shenzhen stock exchanges. This absence of activity from one of the world's largest and most influential markets created a ripple effect, impacting global sentiment and trading patterns. Many international investors monitor Chinese markets closely, and the temporary shutdown created uncertainty and reduced liquidity in related sectors.

Meanwhile, New Zealand observed Matariki, a significant public holiday celebrating the Māori New Year. This resulted in the closure of the New Zealand Exchange (NZX), similarly reducing trading activity and potentially affecting prices in related commodities and sectors. Matariki's growing prominence as a national holiday is also increasingly impacting international business schedules and market dynamics.

<h3>Impact on Global Markets: A Ripple Effect</h3>

The simultaneous closures in China and New Zealand, albeit for different reasons, amplified their collective influence on global markets. Reduced trading volume meant less price discovery, potentially leading to increased volatility once trading resumed. While the impact wasn't catastrophic, it served as a stark reminder of the interconnectedness of global finance.

- Reduced Trading Volume: The absence of two major markets significantly reduced overall global trading volume, leading to thinner markets and potentially wider bid-ask spreads.

- Increased Volatility: The reduced liquidity could have amplified price swings in response to news or other market events.

- Impact on Specific Sectors: Companies with significant operations or exposure to China and New Zealand likely experienced more pronounced effects. For example, agricultural commodity prices could have shown sensitivity to the NZX closure.

- Currency Fluctuations: Exchange rates between the Chinese Yuan (CNY), New Zealand Dollar (NZD), and other major currencies might have shown increased volatility due to reduced trading activity.

<h3>Looking Ahead: Navigating Global Holiday Impacts</h3>

Businesses operating across international markets need to proactively account for major public holidays in their risk management strategies. Understanding the potential impact of these closures on trading volumes, liquidity, and pricing is crucial for successful global investment and trading. Failing to account for these factors can lead to unforeseen losses and missed opportunities.

Furthermore, the increasing recognition of diverse cultural holidays and their growing impact on global markets underscores the need for greater international coordination and awareness. This includes improved communication channels and greater transparency regarding market closures and their potential consequences.

<h3>Further Research and Resources:</h3>

For more in-depth analysis of global market trends and holiday impacts, we recommend consulting resources such as:

- [Link to a reputable financial news source, e.g., Bloomberg]

- [Link to a reputable economic research institute, e.g., IMF]

Disclaimer: This article provides general information and should not be considered financial advice. Always consult with a qualified financial professional before making any investment decisions. Market conditions and impacts can vary significantly.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Holiday Closures Impact China And New Zealand Markets: June 2, 2025. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

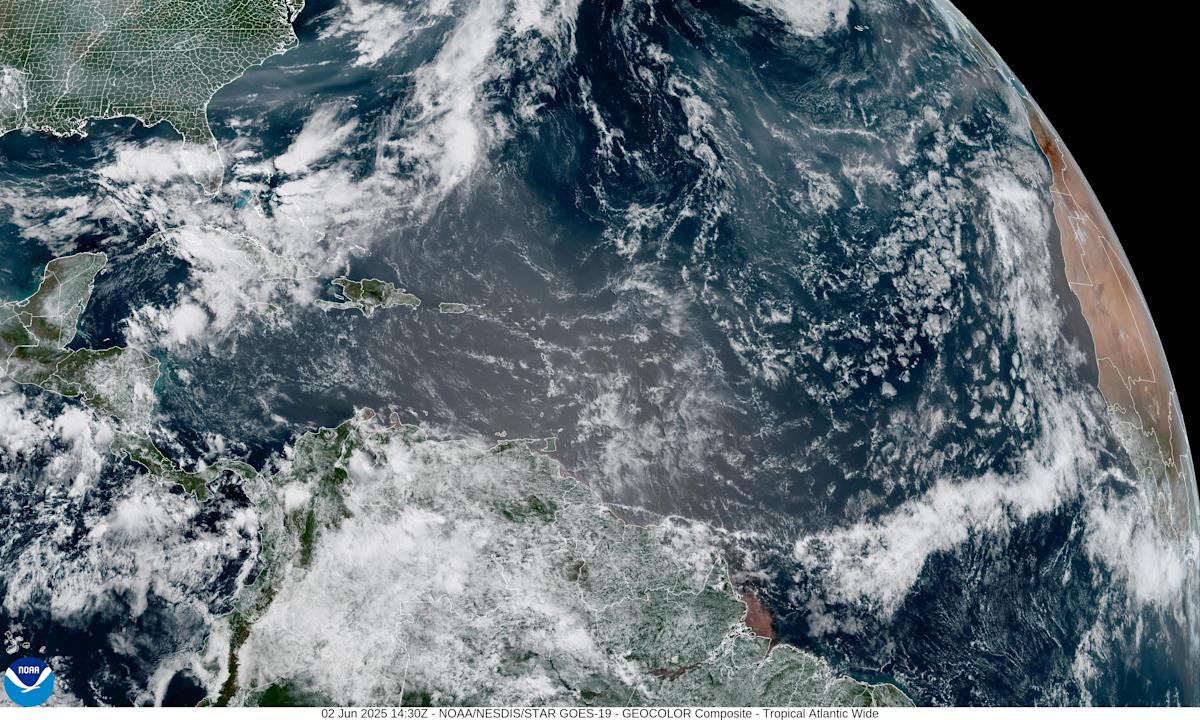

Florida Faces Double Threat Saharan Dust And Canadian Wildfire Smoke Impact Analysis

Jun 03, 2025

Florida Faces Double Threat Saharan Dust And Canadian Wildfire Smoke Impact Analysis

Jun 03, 2025 -

The Trump Walker Relationship Examining A Recent Public Rift

Jun 03, 2025

The Trump Walker Relationship Examining A Recent Public Rift

Jun 03, 2025 -

How Al Roker Kept Off 100 Pounds Two Decades Of Healthy Habits

Jun 03, 2025

How Al Roker Kept Off 100 Pounds Two Decades Of Healthy Habits

Jun 03, 2025 -

Is Selling Used Bathwater A New Trend The Sydney Sweeney Example

Jun 03, 2025

Is Selling Used Bathwater A New Trend The Sydney Sweeney Example

Jun 03, 2025 -

Explosion Rocks Crimea Bridge Casualties And Investigations Underway

Jun 03, 2025

Explosion Rocks Crimea Bridge Casualties And Investigations Underway

Jun 03, 2025