Historic Low Volatility Fuels Bitcoin Price Breakout Speculation

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Historic Low Volatility Fuels Bitcoin Price Breakout Speculation

Bitcoin's recent price action has sent ripples through the cryptocurrency market, with unusually low volatility sparking intense speculation about an impending breakout. After a period of relative calm, many analysts are questioning whether this tranquility is the prelude to a significant price surge or simply a deceptive lull before further consolidation. The low volatility, a historically rare occurrence, presents a fascinating scenario for both seasoned investors and newcomers alike.

The Calm Before the Storm? Analyzing Bitcoin's Recent Stability

For months, Bitcoin’s price has traded within a relatively tight range, exhibiting significantly lower volatility than typically seen. This subdued activity, while seemingly uneventful, has ignited a debate amongst market experts. Some argue that this period of low volatility represents accumulated energy, poised to unleash a powerful price breakout. Others remain cautious, suggesting that the lack of significant price movement might indicate a market still searching for direction.

This unusual quiet period is particularly intriguing given Bitcoin's historically volatile nature. Traditional market indicators often struggle to predict Bitcoin's movements accurately, making the current situation even more perplexing. The absence of major catalysts, such as regulatory announcements or significant technological upgrades, adds to the mystery surrounding the low volatility.

Technical Indicators Point to Potential Breakout

Several technical indicators are fueling the breakout speculation. The Relative Strength Index (RSI), a momentum indicator frequently used in technical analysis, has been hovering in oversold territory for a period. This suggests that the current price levels might be unsustainable, potentially leading to a rapid upward correction. Furthermore, the accumulation of Bitcoin by large institutional investors, as evidenced by on-chain data, further supports the argument for a potential bull run.

- RSI Suggests Oversold Conditions: The prolonged period in oversold territory suggests a potential price reversal.

- Institutional Accumulation: Evidence suggests significant buying pressure from large investors.

- Low Volume Consolidation: The low trading volume during this period of low volatility might indicate accumulation before a significant price movement.

Risks and Considerations: A Cautious Approach

While the prospect of a Bitcoin price breakout is enticing, it's crucial to approach the situation with caution. The cryptocurrency market remains highly speculative, and past performance is not indicative of future results. Unexpected news or regulatory changes could easily disrupt any potential upward trend.

It's important to remember that:

- Volatility is inherent in crypto: Even with recent calm, sharp price swings can still occur.

- Market sentiment can shift rapidly: Positive expectations can easily turn negative, impacting price.

- Diversification is crucial: Don't put all your eggs in one basket. Diversify your investment portfolio.

What's Next for Bitcoin? The Outlook Remains Uncertain

The current market situation presents a classic example of the unpredictable nature of the cryptocurrency market. While the low volatility and technical indicators suggest a potential breakout, it's impossible to predict with certainty what the future holds for Bitcoin. Continuous monitoring of market trends, technical indicators, and news developments is crucial for informed decision-making. Stay informed and engage with reliable sources to navigate the complexities of the Bitcoin market.

Further Reading:

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies carries significant risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Historic Low Volatility Fuels Bitcoin Price Breakout Speculation. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Analyzing The Current Crypto Crash What Investors Need To Know

Sep 23, 2025

Analyzing The Current Crypto Crash What Investors Need To Know

Sep 23, 2025 -

Dollar Remains Strong But Btc Xrp Sol And Doge Inch Higher

Sep 23, 2025

Dollar Remains Strong But Btc Xrp Sol And Doge Inch Higher

Sep 23, 2025 -

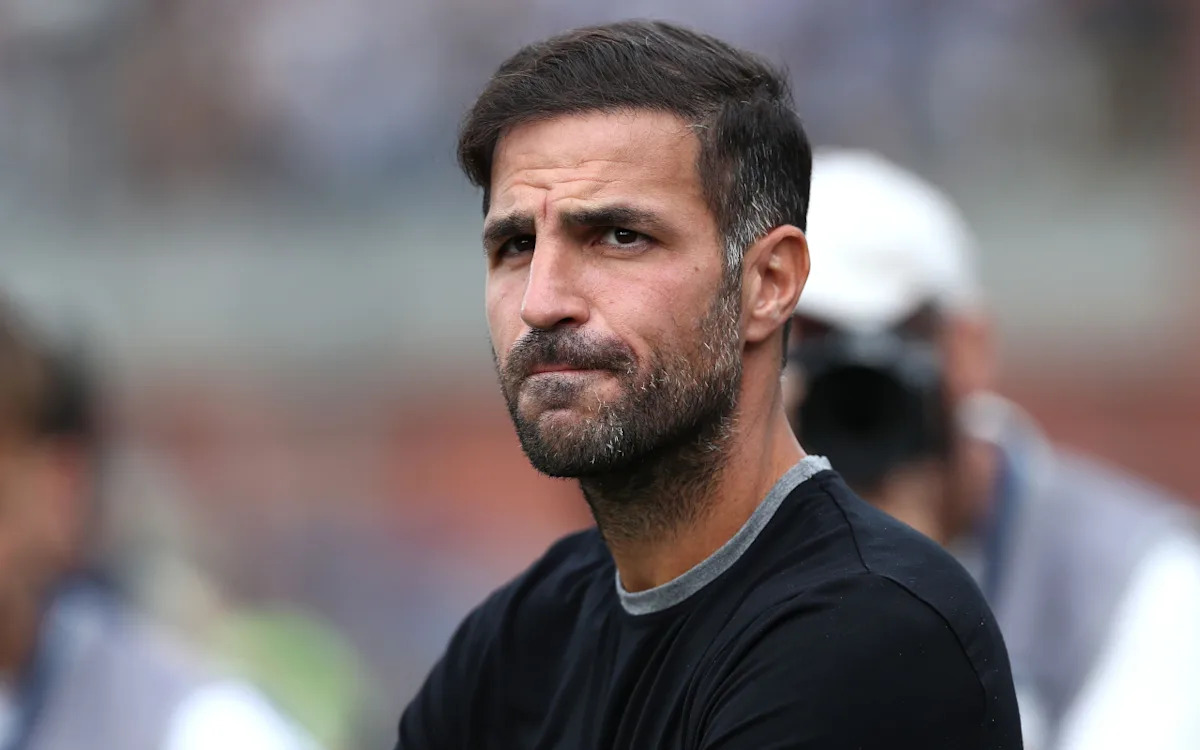

Cesc Fabregas And Comos Generous Donation After Recent Floods

Sep 23, 2025

Cesc Fabregas And Comos Generous Donation After Recent Floods

Sep 23, 2025 -

Ethereums Freefall Is 4 000 The Next Support Level

Sep 23, 2025

Ethereums Freefall Is 4 000 The Next Support Level

Sep 23, 2025 -

26 Years Of Influence The Sopranos Impact On Modern Television Dramas

Sep 23, 2025

26 Years Of Influence The Sopranos Impact On Modern Television Dramas

Sep 23, 2025