Historic Low: Mortgage Rates Dip To October 2024 Levels

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Historic Low: Mortgage Rates Dip to October 2024 Levels – A Buyer's Market Emerges?

Record-low mortgage rates have plunged to levels unseen since October 2024, sparking excitement in the housing market and potentially signaling a resurgence in home buying activity. This dramatic drop presents a significant opportunity for prospective homebuyers, but understanding the nuances of this shift is crucial. Let's delve into the details and explore what this means for you.

Why the Sudden Drop?

Several factors contribute to this historic low in mortgage rates. The most significant is the recent slowdown in inflation, leading the Federal Reserve to adopt a more dovish monetary policy. This, coupled with ongoing economic uncertainty, has pushed rates down to unprecedented levels. Other influencing factors include:

- Decreased demand: A cooling housing market has reduced competition amongst buyers, creating a more favorable environment for securing lower rates.

- Increased inventory: The current market sees a higher-than-average number of homes available for sale, further empowering buyers to negotiate better terms.

- Government incentives (if applicable): Depending on your location and current government programs, additional incentives might be available to further reduce your mortgage costs. It's crucial to research local and federal housing initiatives.

What Does This Mean for Homebuyers?

This unprecedented drop in mortgage rates translates into significant savings for potential homeowners. Lower monthly payments mean greater affordability and increased purchasing power. For example, a buyer previously priced out of the market might now find themselves within reach of their dream home. This creates a buyer's market, where buyers hold more leverage in negotiations.

H2: Navigating the Market: Tips for Success

While low mortgage rates are enticing, it's vital to approach the market strategically:

- Act quickly: These rates are unlikely to remain this low indefinitely. The window of opportunity may be short-lived.

- Shop around for lenders: Compare rates and fees from multiple lenders to secure the best possible deal. Don't settle for the first offer you receive.

- Get pre-approved: A pre-approval letter demonstrates your financial readiness to lenders and sellers, strengthening your negotiating position.

- Understand the fine print: Carefully review all mortgage documents before signing, ensuring you fully grasp the terms and conditions.

- Consult a financial advisor: A financial professional can help you navigate the complexities of home buying and ensure you make informed decisions.

H2: Looking Ahead: What's the Forecast?

Predicting future mortgage rates is challenging, but experts anticipate continued volatility in the near term. While this drop presents a favorable buying environment, it's essential to remain vigilant and informed about market trends. Staying updated on economic indicators and interest rate forecasts can help you make strategic decisions. You can find reliable information from sources such as the and .

H2: Call to Action:

Don't miss this historic opportunity. Contact a reputable mortgage lender today to discuss your options and take advantage of these record-low rates. This could be your chance to finally achieve your homeownership dreams. Start your search for your dream home now!

(Remember to replace bracketed information with relevant, current data.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Historic Low: Mortgage Rates Dip To October 2024 Levels. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tensions Rise Ice Raid And The Breakdown Of U S Relations

Sep 09, 2025

Tensions Rise Ice Raid And The Breakdown Of U S Relations

Sep 09, 2025 -

Meet The Fan Who Successfully Trolled Bill Belichick

Sep 09, 2025

Meet The Fan Who Successfully Trolled Bill Belichick

Sep 09, 2025 -

Faith Democracy And The Misunderstanding Of Christian Nationalism

Sep 09, 2025

Faith Democracy And The Misunderstanding Of Christian Nationalism

Sep 09, 2025 -

Biff Poggi To Lead Michigan Football Temporarily Following Sherrone Moore Suspension

Sep 09, 2025

Biff Poggi To Lead Michigan Football Temporarily Following Sherrone Moore Suspension

Sep 09, 2025 -

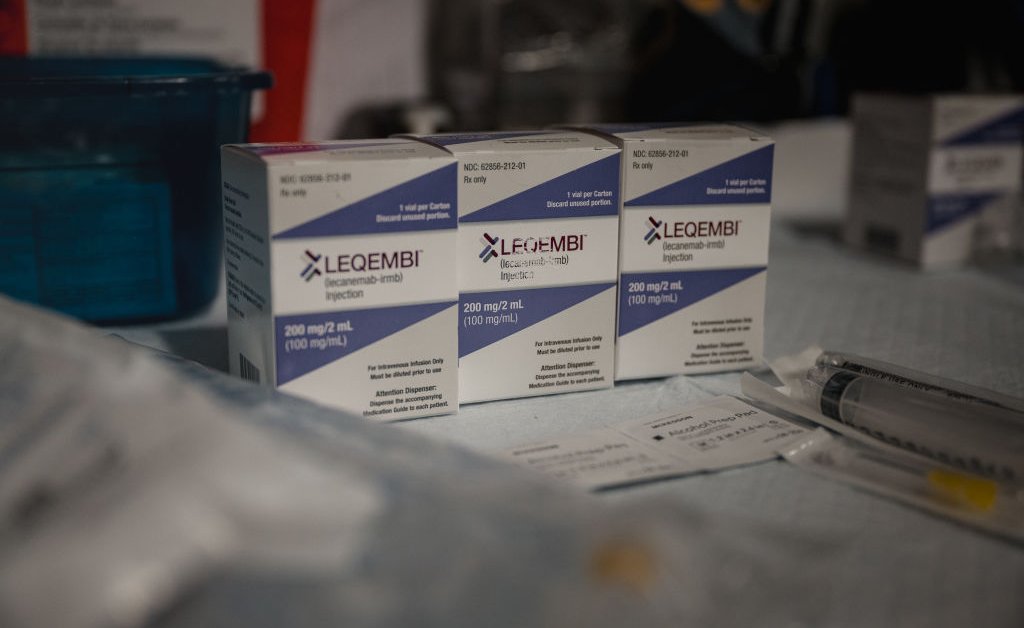

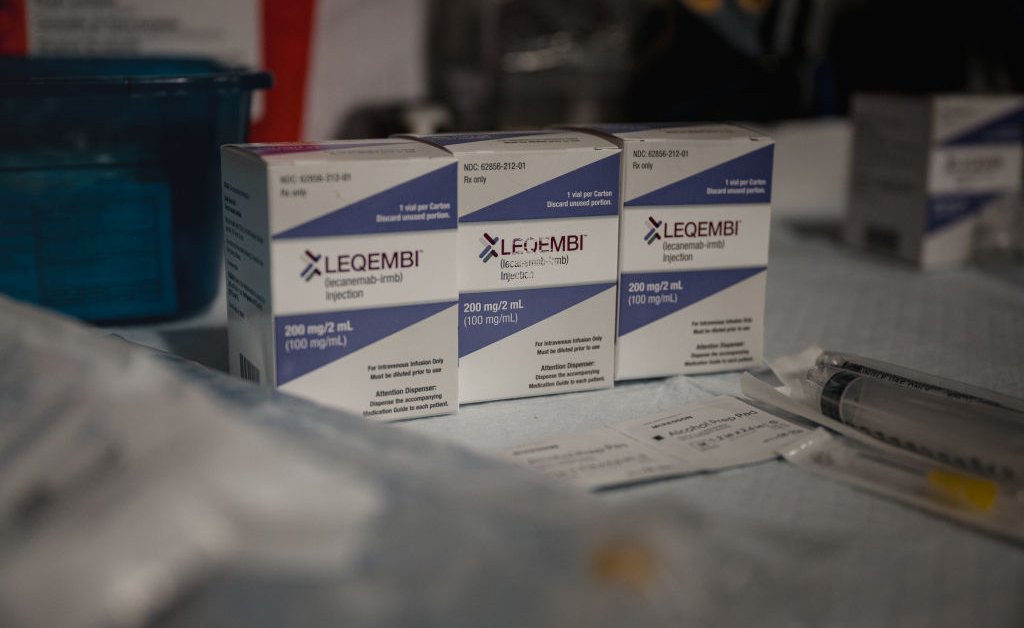

Home Injection Therapy For Alzheimer S A Comprehensive Guide

Sep 09, 2025

Home Injection Therapy For Alzheimer S A Comprehensive Guide

Sep 09, 2025

Latest Posts

-

Home Administration Of Alzheimers Medication A New Era Of Treatment

Sep 09, 2025

Home Administration Of Alzheimers Medication A New Era Of Treatment

Sep 09, 2025 -

From Gridiron To Green Screen J J Watts Transition To Cbs And The Lessons From Romo

Sep 09, 2025

From Gridiron To Green Screen J J Watts Transition To Cbs And The Lessons From Romo

Sep 09, 2025 -

Sherrone Moore Suspended Biff Poggi Takes The Helm For Michigan

Sep 09, 2025

Sherrone Moore Suspended Biff Poggi Takes The Helm For Michigan

Sep 09, 2025 -

Wall Street Rallies S And P 500 Nasdaq And Dow Higher Ahead Of Inflation Data

Sep 09, 2025

Wall Street Rallies S And P 500 Nasdaq And Dow Higher Ahead Of Inflation Data

Sep 09, 2025 -

Supreme Court Upholds Trump Era Immigration Raids Live Updates

Sep 09, 2025

Supreme Court Upholds Trump Era Immigration Raids Live Updates

Sep 09, 2025