HIMS Stock Up 3.02%: Analyzing Hims & Hers Health Inc.'s May 30th Gains

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

HIMS Stock Up 3.02%: Analyzing Hims & Hers Health Inc.'s May 30th Gains

Hims & Hers Health Inc. (HIMS) saw its stock price jump 3.02% on May 30th, leaving many investors wondering about the reasons behind this surge. While a single day's movement doesn't necessarily indicate a long-term trend, understanding the potential contributing factors is crucial for anyone invested in or considering investing in this telehealth company. This analysis delves into possible explanations for HIMS's recent gains.

What Drove the May 30th Increase?

Pinpointing the exact cause of a single day's stock price fluctuation is often difficult, as it's usually a confluence of factors rather than a single event. However, several potential elements could have contributed to HIMS's 3.02% increase on May 30th:

1. Overall Market Sentiment: The broader market's performance significantly impacts individual stocks. A positive day in the overall market can lift many stocks, including HIMS. Examining the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite indices on May 30th would provide context. Were these indices also up, suggesting a general market uptrend that buoyed HIMS?

2. Sector-Specific News: The telehealth sector has experienced periods of both significant growth and volatility. Positive news within the telehealth industry, such as regulatory changes or successful clinical trials by competitors, could have positively influenced investor sentiment towards HIMS. Analyzing news specific to the telehealth sector around May 30th is vital.

3. Company-Specific Developments (though unlikely for a single-day jump): While unlikely to be the sole driver of such a modest increase, any positive company-specific announcements, such as partnerships, product launches, or strong quarterly earnings previews (if any were released), could have contributed. Checking for press releases or SEC filings from HIMS around that date is crucial.

4. Analyst Ratings and Price Target Adjustments: Changes in analyst ratings and price targets can significantly influence a stock's price. If a prominent financial analyst upgraded HIMS's rating or increased their price target, it could have spurred buying activity. Reviewing analyst reports around May 30th will illuminate this possibility.

5. Short Covering: If a significant number of investors had previously shorted HIMS stock (betting on its decline), a sudden shift in sentiment could lead to short covering – investors buying the stock to limit their potential losses – thereby driving up the price.

Analyzing the Long-Term Picture for HIMS Stock:

While a 3.02% increase is positive, it's crucial to avoid drawing hasty conclusions based on a single day's performance. Investors should consider the following for a more comprehensive long-term outlook on HIMS:

- Financial Performance: Review HIMS's financial statements, including revenue growth, profitability, and debt levels.

- Competitive Landscape: Analyze the competitive landscape within the telehealth industry and HIMS's competitive advantages.

- Growth Strategy: Assess HIMS's growth strategy, including its plans for expansion and innovation.

- Risk Factors: Identify and evaluate the potential risks associated with investing in HIMS, such as regulatory changes and competition.

Conclusion:

The 3.02% increase in HIMS stock on May 30th likely resulted from a combination of factors, including broader market sentiment, sector-specific news, and potentially some company-specific developments. While a single day's gain is encouraging, investors should conduct thorough due diligence, considering the long-term prospects and potential risks before making any investment decisions. Always consult with a qualified financial advisor before making any investment choices.

Keywords: HIMS stock, Hims & Hers Health Inc., HIMS stock price, telehealth stock, May 30th HIMS, stock market analysis, investment analysis, telehealth industry, stock market trends.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on HIMS Stock Up 3.02%: Analyzing Hims & Hers Health Inc.'s May 30th Gains. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tractor Accident Doesnt Stop Roseanne Barrs Texas Life

Jun 03, 2025

Tractor Accident Doesnt Stop Roseanne Barrs Texas Life

Jun 03, 2025 -

Green Growth In Brazil Finance Chiefs Vision For Climate Resilient Economy

Jun 03, 2025

Green Growth In Brazil Finance Chiefs Vision For Climate Resilient Economy

Jun 03, 2025 -

Bondis Actions Reduce American Bar Associations Judicial Screening

Jun 03, 2025

Bondis Actions Reduce American Bar Associations Judicial Screening

Jun 03, 2025 -

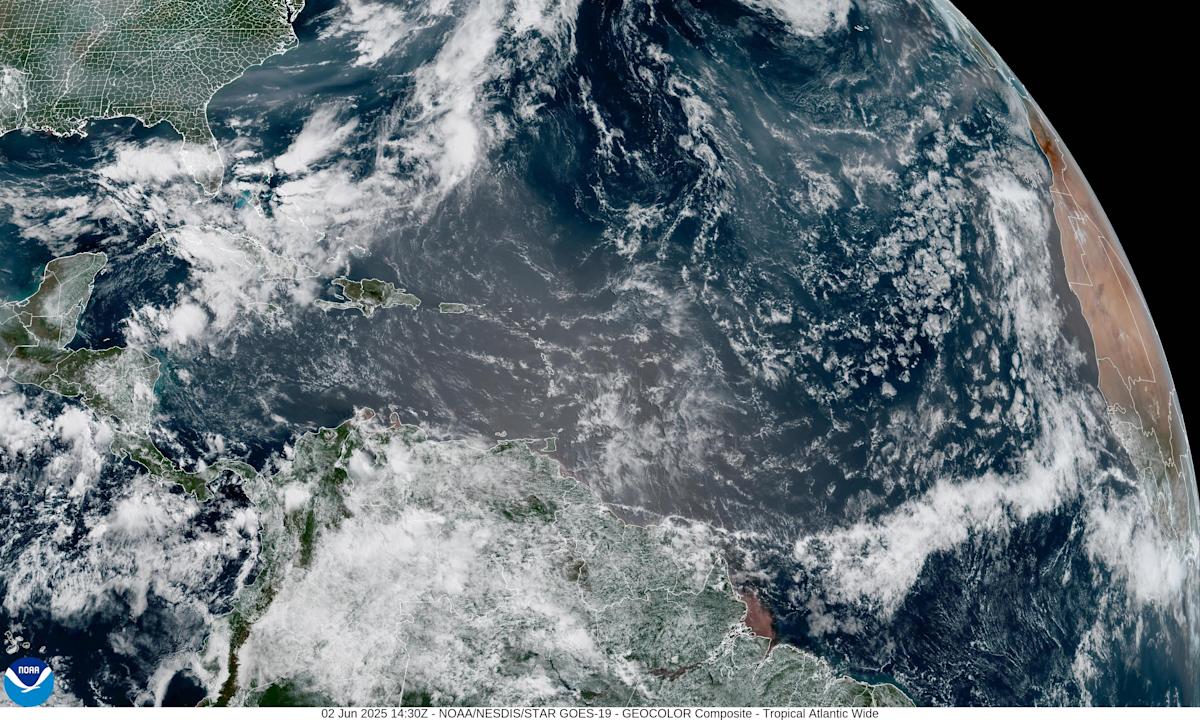

Saharan Dust And Canadian Wildfire Smoke A Florida Air Quality Crisis

Jun 03, 2025

Saharan Dust And Canadian Wildfire Smoke A Florida Air Quality Crisis

Jun 03, 2025 -

Gov Walz Criticizes Trump Pushes For Stronger Democratic Stance

Jun 03, 2025

Gov Walz Criticizes Trump Pushes For Stronger Democratic Stance

Jun 03, 2025