HIMS Stock: Evaluating The Investment Potential Of Hims & Hers Health

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

HIMS Stock: Is Hims & Hers Health a Smart Investment?

Hims & Hers Health (HIMS) has disrupted the telehealth industry, offering convenient access to healthcare services for a range of needs. But is investing in HIMS stock a smart move? This in-depth analysis explores the company's performance, growth potential, and risks to help you evaluate the investment opportunity.

The company's rapid growth, fueled by its direct-to-consumer model and broad range of offerings, has attracted significant attention. However, understanding the nuances of its business model and market position is crucial before making any investment decisions.

Hims & Hers Health: A Business Model Overview

Hims & Hers Health operates a telehealth platform offering personalized healthcare solutions, primarily focused on men's and women's health. Their services cover a wide spectrum, including:

- Hair loss treatment: One of their flagship offerings, utilizing products like minoxidil and finasteride.

- Mental health services: Providing access to licensed therapists and psychiatrists for conditions like anxiety and depression.

- Sexual health: Offering treatments for erectile dysfunction and other sexual health concerns.

- Primary care: Expanding into broader primary care services, further solidifying their position in the telehealth market.

- Skincare: Providing personalized skincare solutions to address various skin concerns.

This diversified approach allows them to capture a larger market share and reduce reliance on any single product or service. This diversification strategy is a key factor to consider when assessing the long-term investment potential of HIMS stock.

Growth Potential and Market Trends

The telehealth market is experiencing explosive growth, driven by increasing consumer demand for convenient and accessible healthcare. Hims & Hers Health is well-positioned to capitalize on this trend, benefiting from:

- Increased adoption of telehealth: The COVID-19 pandemic accelerated the adoption of telehealth, establishing it as a viable and preferred option for many consumers.

- Growing awareness of mental health: Increased societal awareness of mental health issues drives demand for accessible mental health services.

- Expansion into new markets: Hims & Hers Health continues to expand its service offerings and geographic reach, further fueling growth potential.

However, the competitive landscape is intense. Established players and new entrants are vying for market share, posing a challenge to HIMS' continued dominance.

Risks Associated with Investing in HIMS Stock

Despite the growth potential, several risks are associated with investing in HIMS stock:

- Competition: The telehealth market is becoming increasingly crowded, with established healthcare providers and tech companies entering the space.

- Regulatory changes: Changes in healthcare regulations could significantly impact the company's operations and profitability.

- Dependence on marketing: Hims & Hers Health relies heavily on marketing and advertising to acquire new customers, which can be costly and impact profitability.

- Profitability: The company's path to profitability remains a key concern for investors. While revenue growth is impressive, achieving consistent profitability requires careful management of costs and operational efficiency.

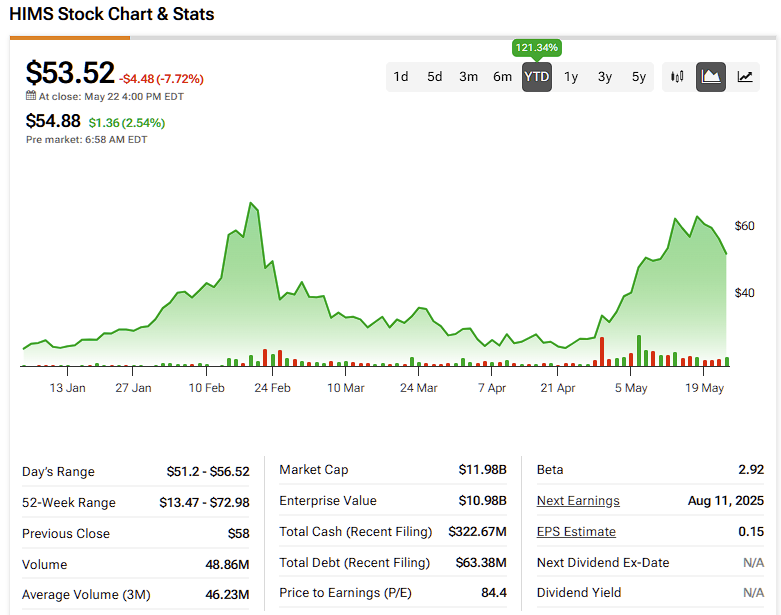

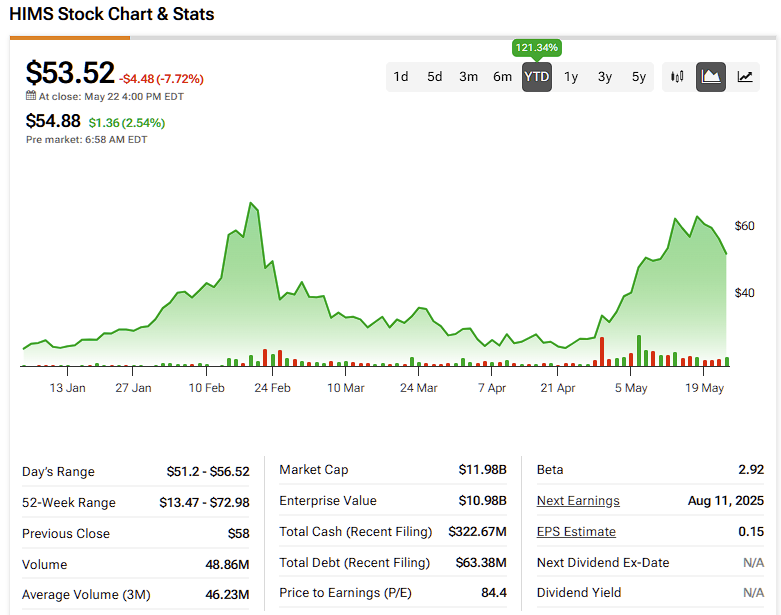

Analyzing HIMS Stock Performance

Before investing, carefully analyze HIMS' financial statements, including revenue growth, profitability margins, and debt levels. Compare its performance to industry benchmarks and competitor data. Consider consulting with a financial advisor to assess the risk tolerance of your investment portfolio before making any decisions. Staying informed about industry news and regulatory updates is crucial for making informed investment decisions. You can find up-to-date information on financial news websites like or .

Conclusion: Is HIMS Stock Right for You?

Investing in HIMS stock presents both opportunities and risks. The company's innovative business model and strong growth potential are attractive, but the competitive landscape and regulatory hurdles pose challenges. Thorough due diligence, including analyzing financial performance and understanding the market dynamics, is crucial before making any investment decisions. Remember to consult with a qualified financial advisor to determine if HIMS stock aligns with your personal investment strategy and risk tolerance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on HIMS Stock: Evaluating The Investment Potential Of Hims & Hers Health. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Actors Son Fights For Life After Henry County Tornado Injury

Jun 03, 2025

Actors Son Fights For Life After Henry County Tornado Injury

Jun 03, 2025 -

Chicago Fires 650 M Soccer Stadium Plan For The 78 Unveiled

Jun 03, 2025

Chicago Fires 650 M Soccer Stadium Plan For The 78 Unveiled

Jun 03, 2025 -

Family First Sheinelle Joness Response To Husbands Death

Jun 03, 2025

Family First Sheinelle Joness Response To Husbands Death

Jun 03, 2025 -

Murder Suspect Arrested Manhunt Concludes Out Of State

Jun 03, 2025

Murder Suspect Arrested Manhunt Concludes Out Of State

Jun 03, 2025 -

Roseanne Barr Tractor Accident Wont Stop Her Texas Dream

Jun 03, 2025

Roseanne Barr Tractor Accident Wont Stop Her Texas Dream

Jun 03, 2025