Hims & Hers (HIMS) Stock: High Growth Potential Or Overheated Market?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Hims & Hers (HIMS) Stock: High Growth Potential or Overheated Market?

Introduction: Hims & Hers (HIMS), the telehealth company disrupting the men's and women's health market, has seen its stock price fluctuate wildly since its IPO. Is this volatility a sign of a high-growth opportunity, or is the market simply overheated? Let's delve into the factors influencing HIMS stock and explore its potential for future growth.

The Allure of Telehealth: The telehealth industry experienced explosive growth during the COVID-19 pandemic, and HIMS capitalized on this trend. Offering convenient and discreet access to treatments for hair loss, sexual health, and other conditions, HIMS attracted a large and rapidly growing customer base. This accessibility is a key driver of its potential for continued expansion. The shift towards virtual healthcare isn't just a pandemic trend; it's a lasting change in consumer behavior, fueling HIMS' long-term prospects.

HIMS' Business Model: Strengths and Weaknesses:

HIMS' subscription-based model provides predictable recurring revenue, a crucial factor for investor confidence. However, reliance on this model also presents risks. Customer churn and competition from established players and new entrants pose challenges to maintaining sustained growth.

- Strengths: Convenient online platform, broad range of offerings, recurring revenue model, strong brand recognition.

- Weaknesses: Competition in the telehealth market, dependence on marketing spend, potential for regulatory changes.

Market Analysis: Competition and Growth Potential:

The telehealth market is becoming increasingly competitive. While HIMS holds a significant market share, it faces competition from both established pharmaceutical companies and newer telehealth startups. This competition is likely to intensify, placing pressure on pricing and margins. However, the overall market continues to show strong growth potential, offering opportunities for HIMS to expand its product offerings and target new customer segments.

Financial Performance and Stock Valuation:

Analyzing HIMS' financial statements is crucial for assessing its investment potential. Key metrics to consider include revenue growth, profitability, customer acquisition costs, and churn rates. Comparing these metrics to industry averages and competitors helps determine whether the current stock valuation is justified. A thorough review of their quarterly earnings reports and SEC filings offers a clearer picture of the company's financial health. [Link to HIMS Investor Relations page].

Risks to Consider:

Investing in HIMS stock carries inherent risks. These include:

- Market Volatility: The stock price can fluctuate significantly based on market sentiment and news.

- Regulatory Uncertainty: Changes in healthcare regulations could negatively impact HIMS' operations.

- Competition: Intense competition could erode market share and profitability.

- Dependence on Marketing: HIMS' marketing expenses are substantial, and reduced effectiveness could hurt growth.

Is HIMS Stock a Buy?

Whether HIMS stock is a worthwhile investment depends on your individual risk tolerance and investment strategy. While the company shows promising growth potential within the expanding telehealth market, the competitive landscape and inherent risks require careful consideration. Conduct thorough due diligence, consult with a financial advisor, and diversify your portfolio before making any investment decisions.

Conclusion:

HIMS presents an intriguing case study in the telehealth industry. Its success hinges on navigating competitive pressures, maintaining customer loyalty, and adapting to the evolving regulatory landscape. While the potential for high growth is evident, investors should proceed with caution, weighing the potential rewards against the inherent risks before investing in HIMS stock. Remember to always conduct your own research and consult with a financial professional before making any investment choices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Hims & Hers (HIMS) Stock: High Growth Potential Or Overheated Market?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Can Nio Overcome Tariff Challenges Q1 Earnings Preview

Jun 03, 2025

Can Nio Overcome Tariff Challenges Q1 Earnings Preview

Jun 03, 2025 -

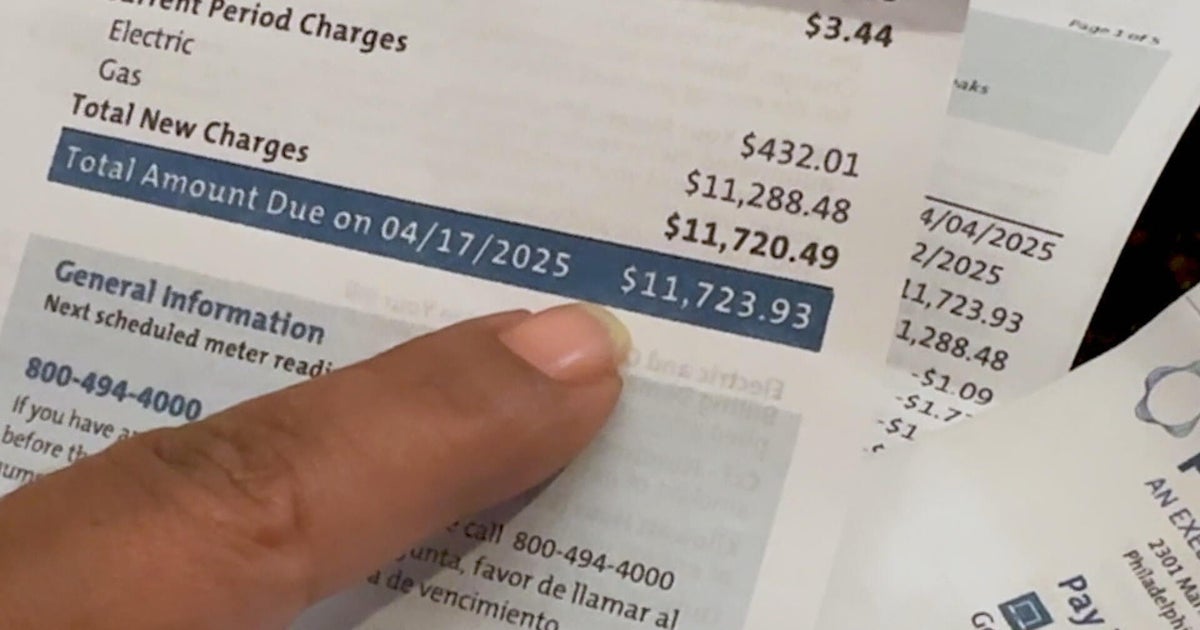

Peco Customers Face 12 000 Bills Months Of Missing Statements Spark Outrage

Jun 03, 2025

Peco Customers Face 12 000 Bills Months Of Missing Statements Spark Outrage

Jun 03, 2025 -

Ahead Of Mpsc Town Hall Detroit Lawmaker Demands Dte Energy Accountability

Jun 03, 2025

Ahead Of Mpsc Town Hall Detroit Lawmaker Demands Dte Energy Accountability

Jun 03, 2025 -

Sheinelle Jones Focuses On Family After Husbands Death A Source Reports

Jun 03, 2025

Sheinelle Jones Focuses On Family After Husbands Death A Source Reports

Jun 03, 2025 -

Actor Tray Chaney Seeks Prayers For Son Injured In Georgia Tornado

Jun 03, 2025

Actor Tray Chaney Seeks Prayers For Son Injured In Georgia Tornado

Jun 03, 2025