Hims & Hers (HIMS) Stock: High Growth Potential Or An Overheated Market?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

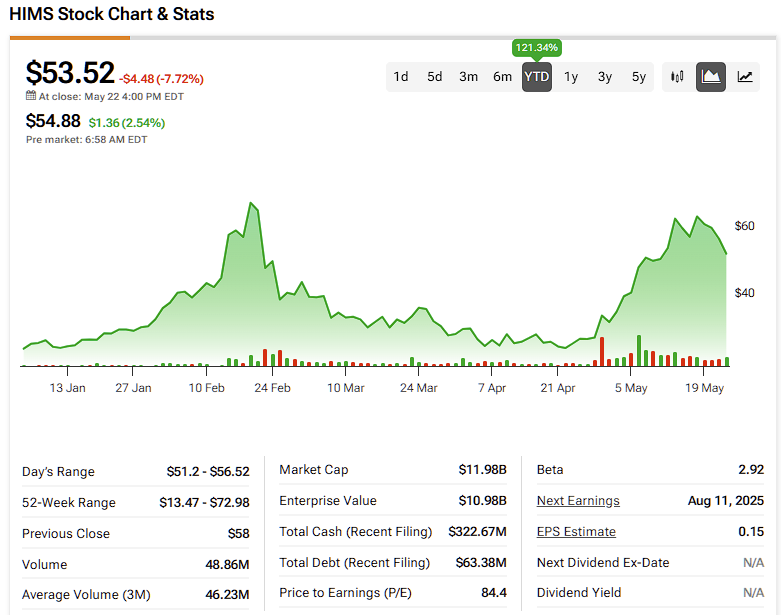

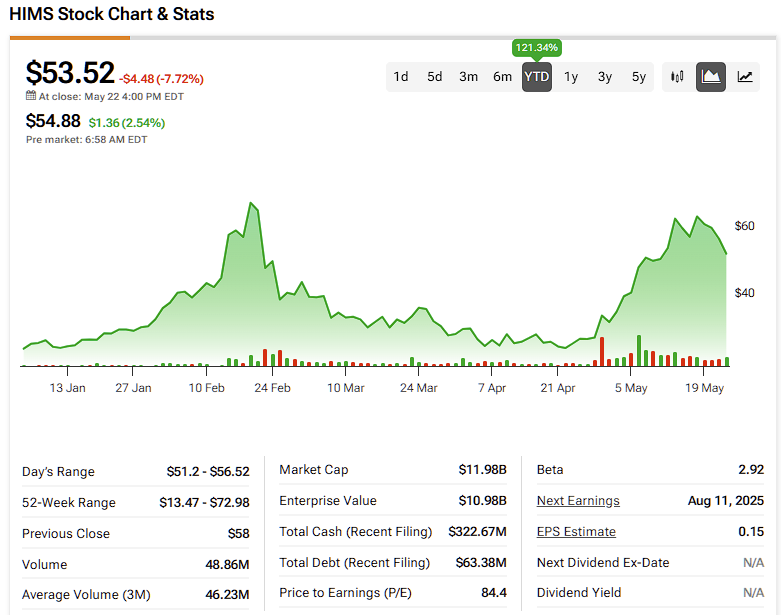

Hims & Hers (HIMS) Stock: High Growth Potential or an Overheated Market?

The telehealth market is booming, and Hims & Hers (HIMS) sits squarely in the middle of it, offering convenient access to skincare, hair loss treatments, sexual health products, and more. But with its stock price experiencing significant fluctuations, investors are left wondering: is HIMS a high-growth opportunity or simply an overheated market darling? This article delves into the potential and pitfalls of investing in Hims & Hers stock.

Hims & Hers: A Telehealth Giant in the Making?

Hims & Hers has carved a niche for itself by offering a discreet and accessible platform for various health concerns. Their direct-to-consumer model, combined with a strong online presence and aggressive marketing, has attracted a substantial customer base. This accessibility is a key factor driving their growth, particularly among younger demographics who are comfortable using telehealth services. The company’s expansion into new areas, such as mental health services, further broadens its appeal and potential revenue streams.

Growth Drivers and Potential:

- Expanding Market: The telehealth market is experiencing exponential growth, driven by increased consumer demand for convenience and affordability. This presents a significant tailwind for HIMS.

- Brand Recognition: Hims & Hers has built a recognizable brand, particularly among younger consumers, giving them a competitive edge in a crowded market.

- Diversification: The company's strategy of diversifying its product offerings beyond its initial focus reduces reliance on any single product line, mitigating risk.

- Technological Advancements: Hims & Hers leverages technology to streamline operations and improve customer experience, providing a competitive advantage.

However, Challenges Remain:

- Competition: The telehealth market is increasingly competitive, with established players and new entrants vying for market share. HIMS faces stiff competition from companies offering similar services.

- Regulatory Hurdles: The healthcare industry is heavily regulated, and HIMS must navigate complex regulatory landscapes, potentially impacting its growth trajectory.

- Profitability: While HIMS is experiencing significant revenue growth, achieving consistent profitability remains a challenge, raising concerns for some investors. Careful scrutiny of their financial statements is crucial.

- Stock Volatility: HIMS stock has displayed significant volatility, making it a riskier investment compared to more established companies in the sector.

Analyzing the Valuation:

Determining whether HIMS is overvalued requires a thorough assessment of its financials, including revenue growth, profitability margins, and future projections. Comparing its valuation metrics (such as Price-to-Sales ratio) to competitors in the telehealth space can offer valuable insights. Investors should consider consulting with a financial advisor before making any investment decisions. Remember to perform your due diligence and consider your own risk tolerance.

Is HIMS Right for You?

Investing in HIMS stock presents both significant opportunities and considerable risks. Its position in the rapidly expanding telehealth market is undeniably attractive, but the intense competition and challenges associated with profitability must be carefully considered. The high volatility of the stock makes it unsuitable for risk-averse investors.

Before investing in HIMS or any other stock, consider:

- Your investment timeline: Are you a long-term or short-term investor? HIMS's long-term growth potential might outweigh its short-term volatility.

- Your risk tolerance: How much risk are you willing to accept? HIMS is a higher-risk investment compared to many others.

- Diversification: Don't put all your eggs in one basket. Diversifying your investment portfolio can mitigate risk.

Ultimately, the decision of whether to invest in Hims & Hers stock is a personal one. Thorough research, understanding the company's business model, and assessing your own risk tolerance are crucial steps before making any investment. Consult with a qualified financial advisor for personalized guidance.

(Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Hims & Hers (HIMS) Stock: High Growth Potential Or An Overheated Market?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

How Al Roker Kept Off 100 Pounds A Look At His Long Term Weight Management

Jun 04, 2025

How Al Roker Kept Off 100 Pounds A Look At His Long Term Weight Management

Jun 04, 2025 -

Squad Overhaul Manolo Marquez Previews Indias Friendly Against Thailand

Jun 04, 2025

Squad Overhaul Manolo Marquez Previews Indias Friendly Against Thailand

Jun 04, 2025 -

West Indies Fall To England Jones And Beaumont Centuries Seal 108 Run Defeat

Jun 04, 2025

West Indies Fall To England Jones And Beaumont Centuries Seal 108 Run Defeat

Jun 04, 2025 -

Crimea Bridge Targeted Analyzing The Impact Of The Attack

Jun 04, 2025

Crimea Bridge Targeted Analyzing The Impact Of The Attack

Jun 04, 2025 -

Protecting Federal Workers The Evolving Landscape Of Collective Bargaining

Jun 04, 2025

Protecting Federal Workers The Evolving Landscape Of Collective Bargaining

Jun 04, 2025