Hims & Hers (HIMS) Stock: Evaluating The Hype And The Long-Term Outlook.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Hims & Hers (HIMS) Stock: Evaluating the Hype and the Long-Term Outlook

The telehealth boom catapulted Hims & Hers (HIMS) into the spotlight, offering convenient access to healthcare services for men and women. But is the hype surrounding HIMS stock justified? This in-depth analysis explores the company's performance, market position, and future prospects, helping investors navigate the complexities of this dynamic sector.

The Rise of Telehealth and HIMS's Position:

The COVID-19 pandemic accelerated the adoption of telehealth, creating a fertile ground for companies like Hims & Hers. Offering a discreet and accessible platform for addressing men's and women's health concerns, HIMS quickly gained popularity. Their business model, focusing on subscription-based services for hair loss treatment, skincare, sexual health, and mental wellness, resonated with a digitally savvy consumer base. This convenience factor, coupled with a strong marketing strategy, fueled significant growth in the early stages.

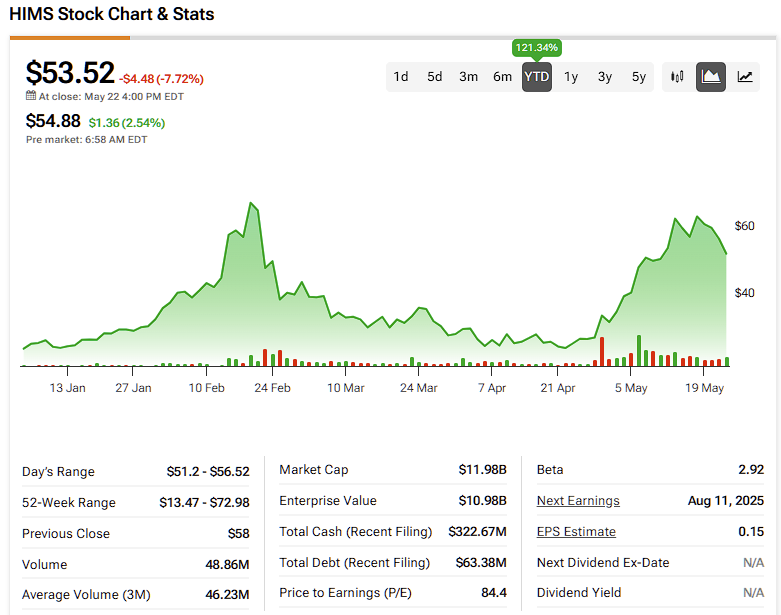

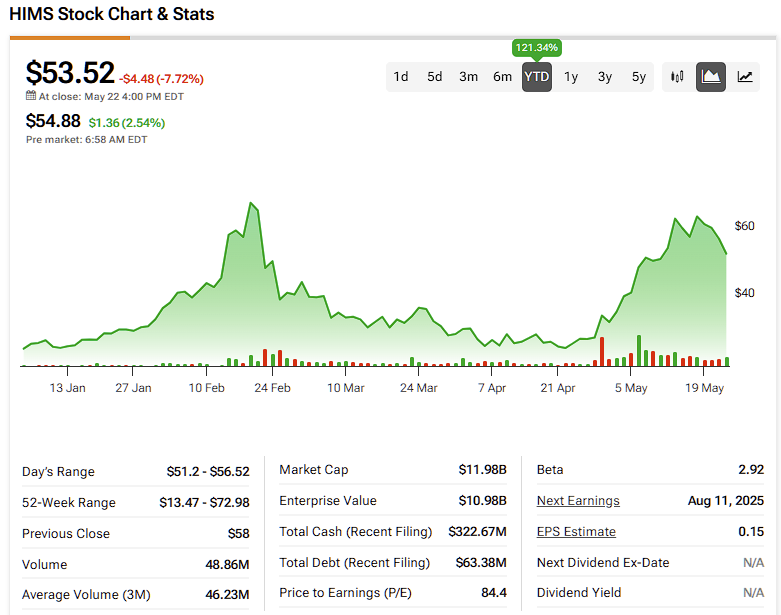

Analyzing HIMS's Financial Performance:

While HIMS has shown impressive revenue growth, profitability remains a challenge. Investors need to carefully scrutinize the company's financial statements, looking beyond top-line numbers. Key metrics to consider include:

- Revenue Growth: Has the rate of growth been consistent, or are there signs of slowing down? Understanding the trajectory of revenue is crucial for projecting future performance.

- Gross Margin: Analyzing the gross margin reveals the efficiency of HIMS's operations and its ability to manage costs.

- Operating Expenses: High marketing and administrative expenses can significantly impact profitability. A thorough examination of these expenses is essential.

- Customer Acquisition Cost (CAC): A high CAC can be a red flag, indicating the difficulty in acquiring new subscribers and potentially impacting long-term profitability.

Challenges and Opportunities:

HIMS faces several challenges in the competitive telehealth landscape:

- Increasing Competition: The telehealth market is becoming increasingly crowded, with both established players and new entrants vying for market share.

- Regulatory Scrutiny: The healthcare industry is heavily regulated, and HIMS needs to navigate these complexities effectively.

- Maintaining Customer Retention: Retaining subscribers over the long term is crucial for sustainable growth. High churn rates can negatively impact profitability.

However, opportunities abound:

- Expansion into New Markets: HIMS can expand its service offerings and target new demographics. Diversification can reduce reliance on existing products and services.

- Strategic Partnerships: Collaborations with other healthcare providers and insurance companies can enhance market reach and increase access to a wider customer base.

- Technological Innovation: Investing in technology and improving the user experience can enhance customer satisfaction and retention.

Long-Term Outlook: A Cautious Approach?

The long-term outlook for HIMS stock requires a cautious assessment. While the company occupies a promising position in the growing telehealth market, profitability and sustained growth remain key concerns. Investors should conduct thorough due diligence, analyzing financial reports and considering the competitive landscape before making investment decisions. It's crucial to remember that investing in the stock market always involves risk.

Conclusion:

HIMS stock presents both exciting opportunities and significant risks. The company's success hinges on its ability to navigate the competitive landscape, manage costs effectively, and maintain sustainable growth. Investors should carefully consider the factors outlined in this analysis and make informed decisions based on their individual risk tolerance and investment goals. Further research and consultation with a financial advisor are recommended before investing in any stock.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Hims & Hers (HIMS) Stock: Evaluating The Hype And The Long-Term Outlook.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Watch England Womens Cricket Vs West Indies Second Odi Live Coverage

Jun 04, 2025

Watch England Womens Cricket Vs West Indies Second Odi Live Coverage

Jun 04, 2025 -

Sudden Death Of Jonathan Joss Remembering The Talented Actors Legacy

Jun 04, 2025

Sudden Death Of Jonathan Joss Remembering The Talented Actors Legacy

Jun 04, 2025 -

St Louis Tornado Damage Demolition Of Nearly 200 Properties Approved

Jun 04, 2025

St Louis Tornado Damage Demolition Of Nearly 200 Properties Approved

Jun 04, 2025 -

Sheinelle Jones And The Today Show A Community In Grief For Uche Ojeh

Jun 04, 2025

Sheinelle Jones And The Today Show A Community In Grief For Uche Ojeh

Jun 04, 2025 -

Ballerina Director Clarifies Its Relationship To John Wick

Jun 04, 2025

Ballerina Director Clarifies Its Relationship To John Wick

Jun 04, 2025