Hims & Hers (HIMS) Stock: A Risk Assessment For Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

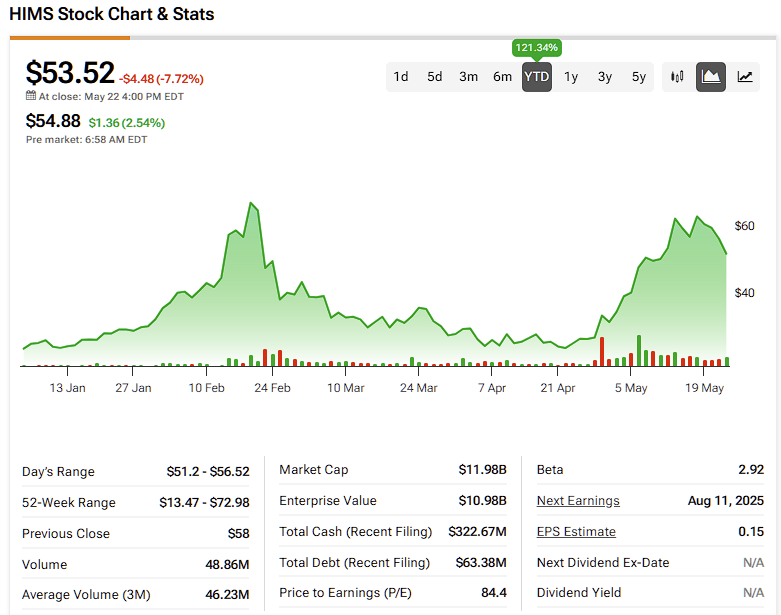

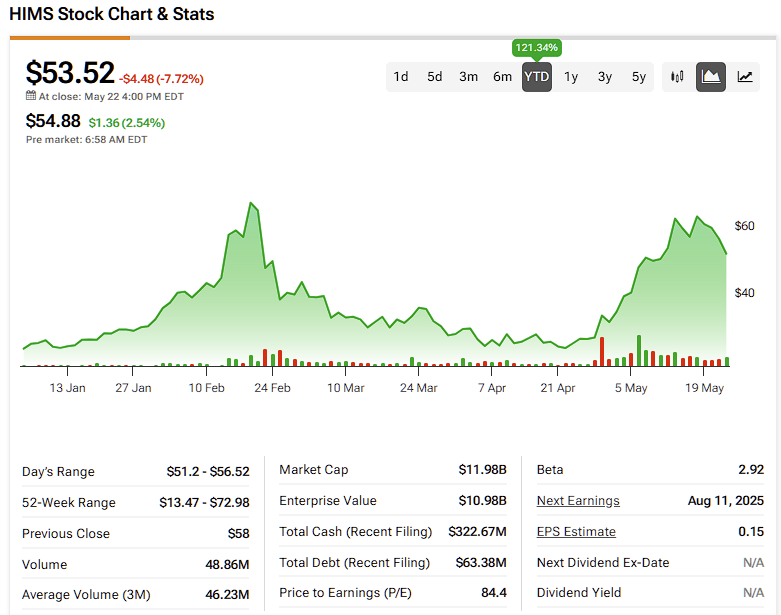

Hims & Hers (HIMS) Stock: A Risk Assessment for Investors

Hims & Hers Health, Inc. (HIMS) has captured significant attention since its IPO, offering telemedicine services for men's and women's health. While the company boasts a convenient and accessible platform, potential investors need to carefully consider the inherent risks before diving in. This article provides a comprehensive risk assessment for HIMS stock, examining both the opportunities and the potential pitfalls.

The Allure of Hims & Hers:

Hims & Hers' success stems from its disruptive model, streamlining access to healthcare through a user-friendly app and online platform. This convenience is particularly attractive to younger demographics who are comfortable with digital health solutions. Their diverse range of products, from hair loss treatments and skincare to sexual health and mental wellness products, caters to a broad market. This broad appeal contributes to the company's growth potential, but it also presents certain challenges.

Market Risks and Competition:

The telehealth market is rapidly expanding, attracting significant investment and increasing competition. Established players and new entrants alike are vying for market share, creating a highly competitive landscape. HIMS faces competition from both large pharmaceutical companies offering similar services and smaller, more specialized telehealth providers. This intense competition could pressure HIMS's pricing and profitability.

Regulatory Risks and Legal Hurdles:

The healthcare industry is heavily regulated, and HIMS operates within a complex regulatory environment. Changes in healthcare regulations, licensing requirements, and reimbursement policies could significantly impact the company's operations and profitability. Furthermore, navigating privacy concerns related to patient data is crucial, and any breach could have severe legal and financial repercussions.

Financial Risks and Sustainability:

HIMS is still a relatively young company with a history of losses. While revenue growth is promising, achieving profitability remains a key challenge. Investors should scrutinize the company's financial statements, paying close attention to operating expenses, marketing costs, and the sustainability of its growth trajectory. A careful review of cash flow and debt levels is also crucial.

Operational Risks and Scalability:

Scaling operations to meet growing demand while maintaining high levels of customer service presents a significant challenge. Any disruptions in the company's supply chain, technology infrastructure, or customer support could negatively impact its performance. Maintaining the quality of service and customer satisfaction is paramount for long-term success.

H2: Assessing the Investment Potential:

Despite the significant risks, HIMS's innovative business model and large addressable market offer potential for long-term growth. However, investors need to carefully weigh these opportunities against the inherent risks. A diversified investment portfolio is recommended, limiting exposure to any single stock, especially in a volatile sector like telehealth.

H3: Due Diligence is Crucial:

Before investing in HIMS stock, thorough due diligence is essential. This includes:

- Analyzing financial statements: Scrutinize revenue growth, profitability, debt levels, and cash flow.

- Researching the competitive landscape: Understand the market dynamics and the competitive threats HIMS faces.

- Evaluating regulatory risks: Assess the potential impact of changes in healthcare regulations.

- Considering operational risks: Evaluate the company's scalability and ability to maintain service quality.

H2: Conclusion:

Hims & Hers (HIMS) presents a compelling investment opportunity for some, but it's crucial to recognize the inherent risks. The company's innovative model and broad market appeal are balanced by significant competition, regulatory hurdles, and the need to achieve sustainable profitability. Thorough research and a conservative investment approach are paramount for navigating the potential rewards and risks associated with HIMS stock. Always consult with a qualified financial advisor before making any investment decisions.

(Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Hims & Hers (HIMS) Stock: A Risk Assessment For Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

New Movie And Console Launch Ballerina And Nintendo Switch 2 Arrive

Jun 04, 2025

New Movie And Console Launch Ballerina And Nintendo Switch 2 Arrive

Jun 04, 2025 -

Crimean Bridge Under Siege Ukraines Underwater Bombing Claims Investigated

Jun 04, 2025

Crimean Bridge Under Siege Ukraines Underwater Bombing Claims Investigated

Jun 04, 2025 -

Chinese Ev Maker Nios Q1 Earnings A Deep Dive Into Delivery Numbers And Tariff Effects

Jun 04, 2025

Chinese Ev Maker Nios Q1 Earnings A Deep Dive Into Delivery Numbers And Tariff Effects

Jun 04, 2025 -

Video Beanie Bishop Stomps On Pitt Logo Following Steelers Practice

Jun 04, 2025

Video Beanie Bishop Stomps On Pitt Logo Following Steelers Practice

Jun 04, 2025 -

Veteran Joe Roots Continued Excellence Harry Brooks Perspective

Jun 04, 2025

Veteran Joe Roots Continued Excellence Harry Brooks Perspective

Jun 04, 2025