Hims & Hers (HIMS): Should You Buy, Sell, Or Hold This Healthcare Stock?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

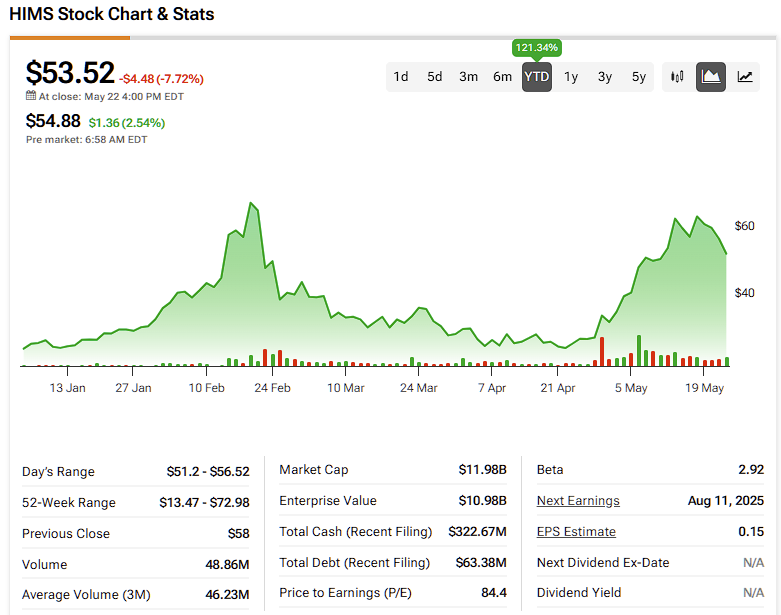

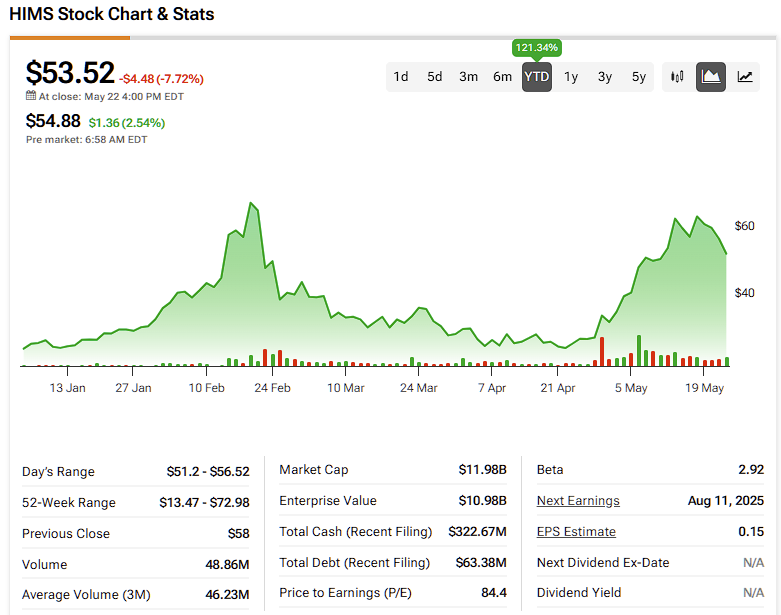

Hims & Hers (HIMS): Should You Buy, Sell, or Hold This Healthcare Stock?

The telehealth industry is booming, and Hims & Hers (HIMS) is a major player. But is this stock a buy, a sell, or should you simply hold onto what you have? This in-depth analysis will help you decide. The company, known for its convenient online platform offering a range of health and wellness products, has experienced both significant growth and considerable volatility. Understanding the current market landscape and HIMS's financial performance is crucial for informed investment decisions.

Hims & Hers: A Quick Overview

Hims & Hers provides convenient access to healthcare services through its telehealth platform. They offer a wide variety of products and services, including treatments for hair loss, sexual health concerns, skincare, and mental wellness. This direct-to-consumer (DTC) approach has disrupted traditional healthcare models, appealing to a younger, tech-savvy demographic. Their business model relies heavily on subscription services, providing recurring revenue streams.

Reasons to Buy HIMS Stock:

-

Market Growth Potential: The telehealth market is experiencing explosive growth. As more consumers seek convenient and accessible healthcare options, companies like HIMS are well-positioned to capitalize on this trend. The increasing adoption of telehealth, especially among younger generations, bodes well for HIMS's long-term prospects.

-

Expanding Product Portfolio: HIMS continues to expand its offerings, adding new products and services to cater to a broader customer base. This diversification reduces reliance on any single product line and strengthens their overall market position.

-

Strong Brand Recognition: Hims & Hers has built a recognizable and trusted brand within the telehealth space. This strong brand equity is a significant asset, facilitating customer acquisition and loyalty.

Reasons to Sell or Hold HIMS Stock:

-

Competition: The telehealth market is becoming increasingly competitive. New entrants and established players are vying for market share, potentially impacting HIMS's growth trajectory. Understanding the competitive landscape is critical.

-

Profitability Concerns: While HIMS has shown significant revenue growth, profitability remains a challenge. Investors should carefully analyze their financial statements and projections to assess their long-term financial health.

-

Regulatory Risks: The healthcare industry is subject to significant regulatory oversight. Changes in regulations could impact HIMS's operations and profitability.

Financial Performance Analysis (Check latest quarterly reports for the most up-to-date information):

To make an informed decision, always review the company's most recent financial reports. Key metrics to consider include:

- Revenue Growth: Is revenue increasing year-over-year and quarter-over-quarter?

- Customer Acquisition Costs (CAC): How much is HIMS spending to acquire each new customer?

- Customer Lifetime Value (CLTV): How much revenue does each customer generate over their relationship with the company?

- Gross Margin: What percentage of revenue remains after deducting the cost of goods sold?

- Net Income/Loss: Is the company profitable or operating at a loss?

Conclusion: The Verdict is Still Out

Whether to buy, sell, or hold HIMS stock depends on your individual risk tolerance and investment strategy. The company shows promise in a rapidly growing market, but faces challenges related to competition and profitability. Thorough due diligence, including a careful review of their financial statements and an understanding of the competitive landscape, is crucial before making any investment decisions. Consult with a qualified financial advisor before making any investment choices. This article is for informational purposes only and does not constitute financial advice.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing in the stock market carries inherent risks, and you could lose money. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Hims & Hers (HIMS): Should You Buy, Sell, Or Hold This Healthcare Stock?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ukraines Crimea Bridge Operation Details Emerge On Underwater Explosive Deployment

Jun 04, 2025

Ukraines Crimea Bridge Operation Details Emerge On Underwater Explosive Deployment

Jun 04, 2025 -

Successions Mountainhead Unveiling The Real Life Tech Executives

Jun 04, 2025

Successions Mountainhead Unveiling The Real Life Tech Executives

Jun 04, 2025 -

Significant Changes For India And Thailand Marquez Previews Friendly Match

Jun 04, 2025

Significant Changes For India And Thailand Marquez Previews Friendly Match

Jun 04, 2025 -

England Women Dominate West Indies Jones And Beaumont Centuries Secure 108 Run Victory

Jun 04, 2025

England Women Dominate West Indies Jones And Beaumont Centuries Secure 108 Run Victory

Jun 04, 2025 -

Rep Ro Khanna Joins Labor Unions In Protest Of Federal Layoffs

Jun 04, 2025

Rep Ro Khanna Joins Labor Unions In Protest Of Federal Layoffs

Jun 04, 2025