Hims & Hers (HIMS): Evaluating The Risks And Rewards Of This Healthcare Stock.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Hims & Hers (HIMS): Weighing the Risks and Rewards of This Telehealth Stock

The telehealth industry exploded during the pandemic, and Hims & Hers (HIMS) rode that wave to prominence. But is this digitally-native healthcare company a smart investment? This article dives into the risks and rewards of investing in HIMS stock, offering a balanced perspective for potential investors.

Hims & Hers offers a convenient way to access healthcare services, focusing on dermatology, primary care, and mental health, all through a user-friendly app. This business model has attracted considerable attention, but understanding the complexities before investing is crucial.

The Allure of Hims & Hers: What Makes it Attractive?

- Convenient Access: The ease of accessing healthcare through a smartphone app is a significant draw for busy individuals. This accessibility is a major selling point in a market increasingly demanding convenience.

- Expanding Market Share: The telehealth market continues to grow, presenting significant opportunities for companies like Hims & Hers to expand their reach and market share. This growth potential is a key factor driving investor interest.

- Diverse Product Portfolio: Hims & Hers offers a range of products and services catering to diverse health needs, reducing reliance on any single offering and potentially mitigating risk. This diversification is a positive for long-term stability.

- Strong Brand Recognition: The company has cultivated a strong brand presence, particularly among younger demographics. This brand recognition translates into customer loyalty and potentially faster revenue growth.

Navigating the Challenges: Potential Risks of HIMS Investment

- Competition: The telehealth market is becoming increasingly competitive, with established players and new entrants vying for market share. Hims & Hers faces pressure from larger, more established healthcare companies.

- Regulatory Scrutiny: The healthcare industry is heavily regulated, and any changes in regulations could significantly impact Hims & Hers' operations and profitability. Staying compliant and adapting to regulatory shifts is crucial.

- Profitability Concerns: While Hims & Hers has shown significant revenue growth, achieving consistent profitability remains a challenge. Investors need to closely monitor the company's financial performance.

- Dependence on Technology: The company's reliance on technology exposes it to potential risks associated with cybersecurity breaches, app malfunctions, and technological disruptions. Robust cybersecurity measures are essential.

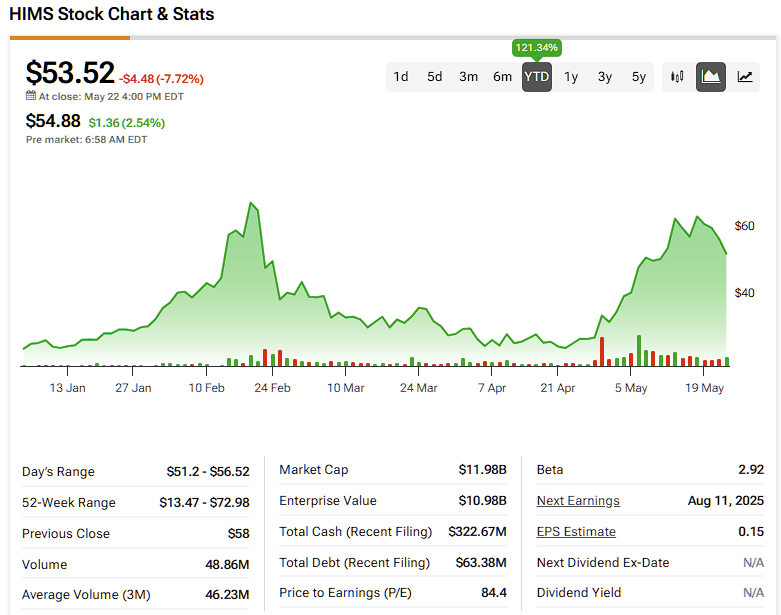

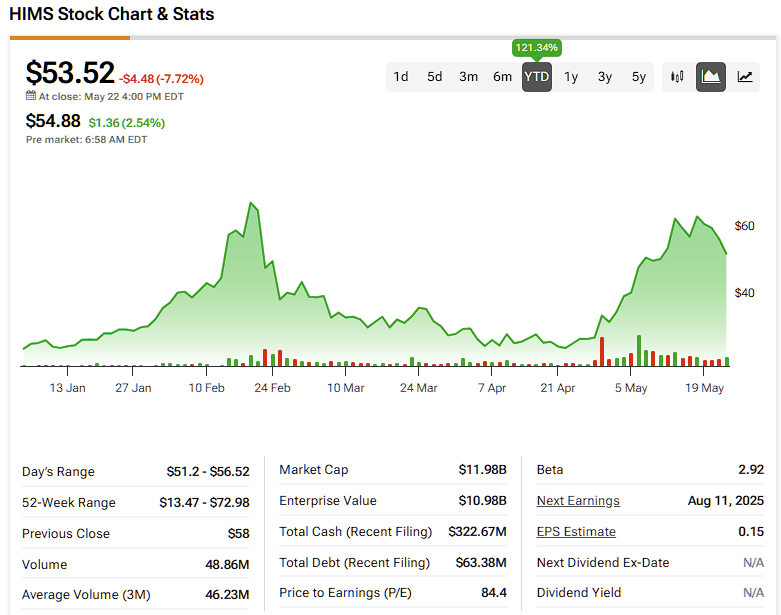

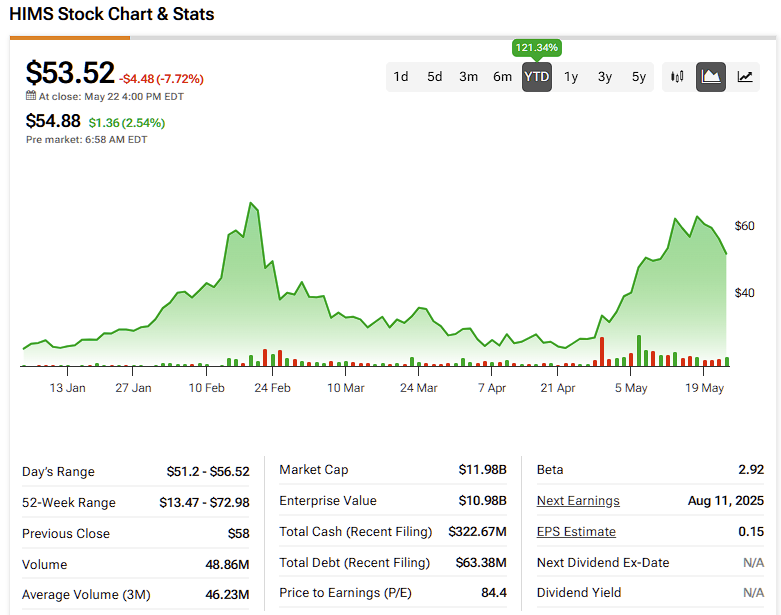

Analyzing the Financials: A Deep Dive into HIMS Performance

Analyzing HIMS's quarterly and annual reports is crucial before making any investment decisions. Look for key indicators such as revenue growth, net income (or loss), operating margin, and customer acquisition costs. Comparing these figures to industry benchmarks and competitors can help determine the company's relative financial health and growth potential. [Link to a reputable financial news site providing HIMS financial data].

Should You Invest in HIMS? The Verdict

Hims & Hers presents a compelling investment opportunity for those comfortable with moderate-to-high risk. The company’s strong brand recognition and the expanding telehealth market offer significant potential for long-term growth. However, the intense competition, regulatory uncertainties, and profitability challenges necessitate careful consideration. Before investing, conduct thorough due diligence, including consulting with a financial advisor to assess your personal risk tolerance and investment goals. Investing in the stock market always carries inherent risks, and past performance is not indicative of future results.

Call to Action: Stay informed about the latest developments in the telehealth industry and Hims & Hers' financial performance by following reputable financial news sources. Remember to always conduct thorough research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Hims & Hers (HIMS): Evaluating The Risks And Rewards Of This Healthcare Stock.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Hope For Recovery Actors Son Injured In Henry County Tornado

Jun 03, 2025

Hope For Recovery Actors Son Injured In Henry County Tornado

Jun 03, 2025 -

Roseanne Barr Finds Peace And Healing On Her Texas Ranch

Jun 03, 2025

Roseanne Barr Finds Peace And Healing On Her Texas Ranch

Jun 03, 2025 -

Al Rokers Weight Loss Maintenance Lessons Learned Over 20 Years

Jun 03, 2025

Al Rokers Weight Loss Maintenance Lessons Learned Over 20 Years

Jun 03, 2025 -

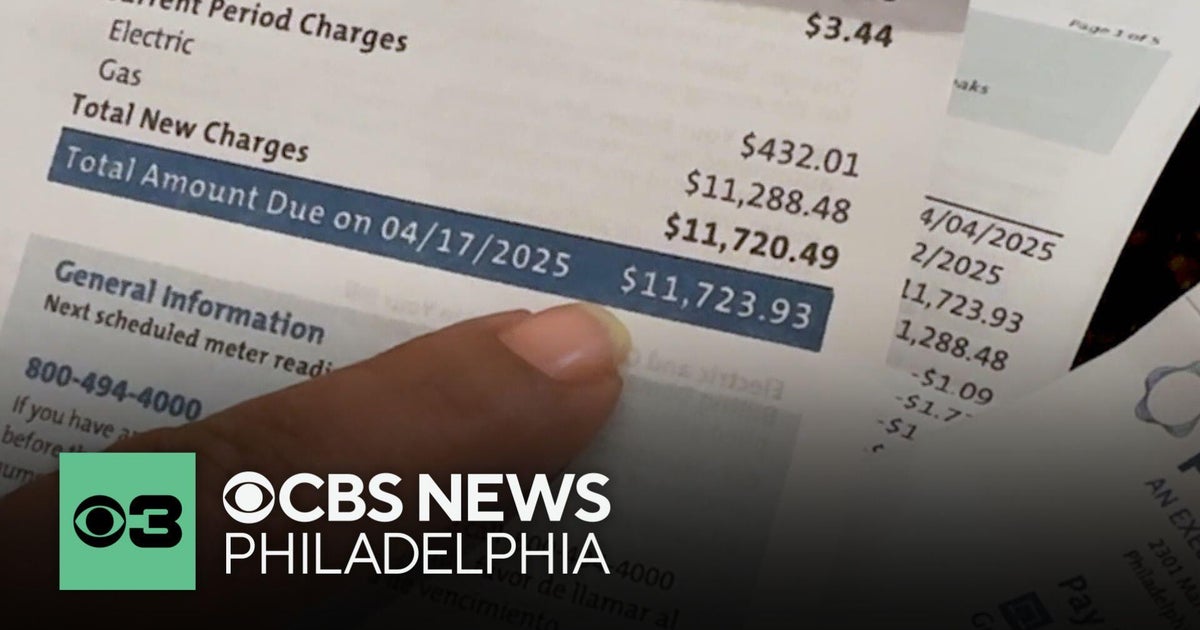

Philadelphia Customer Faces 12 000 Peco Energy Bill After Billing Glitch

Jun 03, 2025

Philadelphia Customer Faces 12 000 Peco Energy Bill After Billing Glitch

Jun 03, 2025 -

The Volatility Of Hims And Hers Hims Understanding The Stocks Price Fluctuations

Jun 03, 2025

The Volatility Of Hims And Hers Hims Understanding The Stocks Price Fluctuations

Jun 03, 2025