Hims & Hers (HIMS): Evaluating The Risks And Rewards Of Investment.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Hims & Hers (HIMS): Weighing the Risks and Rewards of Investment

The telehealth revolution has significantly altered healthcare accessibility, and Hims & Hers (HIMS) sits squarely at its forefront. Offering convenient access to prescriptions for hair loss, sexual health, and general wellness products, HIMS has experienced a meteoric rise, but is it a sound investment? This article delves into the potential rewards and inherent risks of investing in Hims & Hers, offering a balanced perspective for prospective investors.

The Allure of Hims & Hers: A Growing Market

Hims & Hers' success stems from tapping into a substantial and underserved market. Many individuals struggle with conditions like hair loss or sexual dysfunction but face barriers to seeking traditional medical care, including stigma, time constraints, and geographical limitations. HIMS provides a discreet and accessible alternative, utilizing a telehealth platform to connect patients with licensed medical professionals. This convenience is a major draw, fostering rapid growth and a loyal customer base.

Key Growth Drivers:

- Expanding Product Portfolio: Beyond its initial offerings, HIMS continues to broaden its product range, encompassing skincare, mental wellness solutions, and more. This diversification mitigates risk and allows the company to tap into new revenue streams.

- Strong Brand Recognition: HIMS has cultivated a strong brand identity, synonymous with convenience and discretion in a traditionally sensitive market. This brand recognition translates into significant marketing advantages.

- Telehealth Market Expansion: The telehealth sector is experiencing explosive growth, fueled by technological advancements and changing consumer preferences. HIMS is well-positioned to benefit from this broader trend.

Navigating the Risks: Challenges Facing HIMS

While the potential for growth is undeniable, several risks warrant careful consideration before investing in HIMS:

- Regulatory Scrutiny: The telehealth industry is subject to evolving regulations, particularly concerning prescription practices and data privacy. Changes in regulatory landscapes could negatively impact HIMS' operations.

- Competition: The telehealth market is becoming increasingly competitive, with established players and new entrants vying for market share. HIMS needs to maintain its competitive edge through innovation and effective marketing.

- Dependence on Marketing: HIMS relies heavily on digital marketing to reach its target audience. Changes in advertising algorithms or increased marketing costs could affect profitability.

- Profitability Concerns: While HIMS has demonstrated substantial revenue growth, achieving consistent profitability remains a challenge. Investors should carefully analyze the company's financial statements and projections.

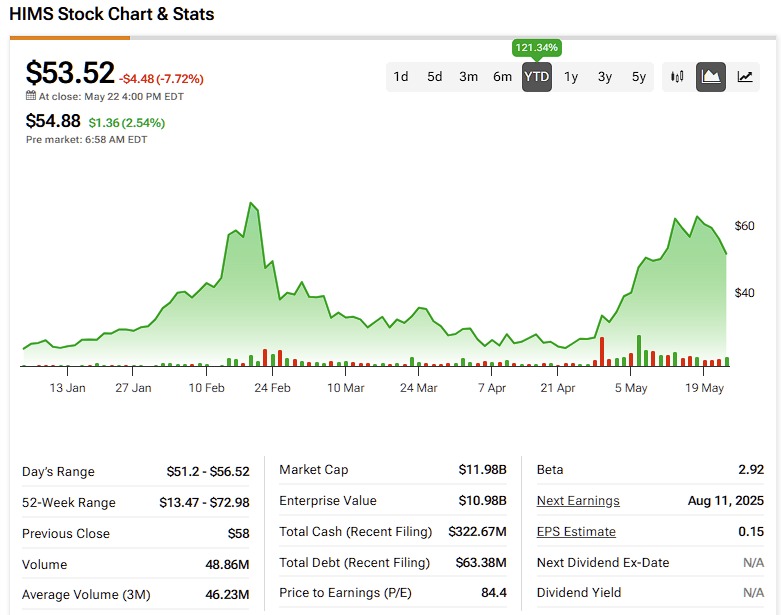

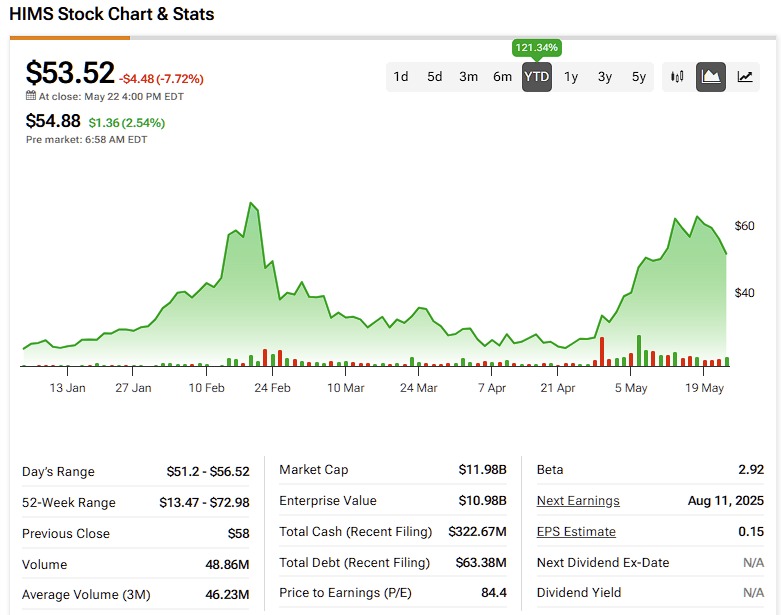

Financial Performance and Future Outlook

[Insert relevant financial data here, including revenue growth, profitability metrics, and debt levels. Cite reputable financial sources.] Analyzing HIMS's quarterly and annual reports is crucial for gauging its financial health. Consider factors like revenue growth, profit margins, and debt levels to assess its long-term viability.

Making an Informed Investment Decision

Investing in HIMS, like any investment, involves careful consideration of both the potential rewards and the associated risks. Thorough due diligence is essential, involving:

- Analyzing financial statements: Understand the company's revenue streams, profitability, and debt levels.

- Assessing market competition: Evaluate HIMS's competitive position within the telehealth industry.

- Considering regulatory risks: Stay informed about potential changes in regulations impacting the telehealth sector.

- Diversifying your portfolio: Avoid putting all your eggs in one basket. Spread your investments across different asset classes to mitigate risk.

Disclaimer: This article provides general information and should not be construed as financial advice. Consult with a qualified financial advisor before making any investment decisions.

Call to Action: Stay informed on the latest developments in the telehealth industry and conduct thorough research before investing in any company. Consider subscribing to reputable financial news sources for ongoing updates on Hims & Hers and the broader market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Hims & Hers (HIMS): Evaluating The Risks And Rewards Of Investment.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nio Q1 Earnings Report Analysis Of Delivery Numbers And Tariff Concerns

Jun 04, 2025

Nio Q1 Earnings Report Analysis Of Delivery Numbers And Tariff Concerns

Jun 04, 2025 -

India Thailand Friendly A Look At The Changed Squads Under Marquezs Guidance

Jun 04, 2025

India Thailand Friendly A Look At The Changed Squads Under Marquezs Guidance

Jun 04, 2025 -

India Vs Thailand Marquez Highlights Roster Revamp Ahead Of Friendly

Jun 04, 2025

India Vs Thailand Marquez Highlights Roster Revamp Ahead Of Friendly

Jun 04, 2025 -

Three Wicket Thriller England Defeats West Indies In Cardiff Test Match

Jun 04, 2025

Three Wicket Thriller England Defeats West Indies In Cardiff Test Match

Jun 04, 2025 -

Lucy Guo Worlds Youngest Self Made Billionaire

Jun 04, 2025

Lucy Guo Worlds Youngest Self Made Billionaire

Jun 04, 2025