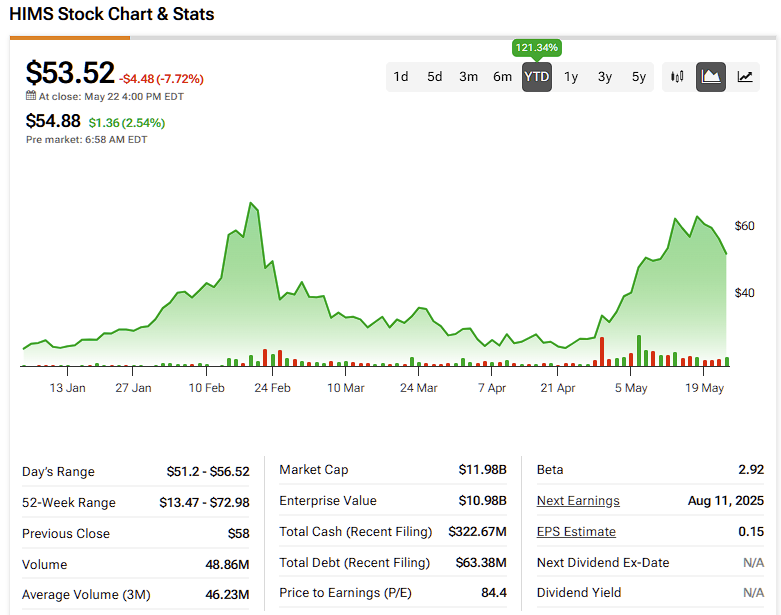

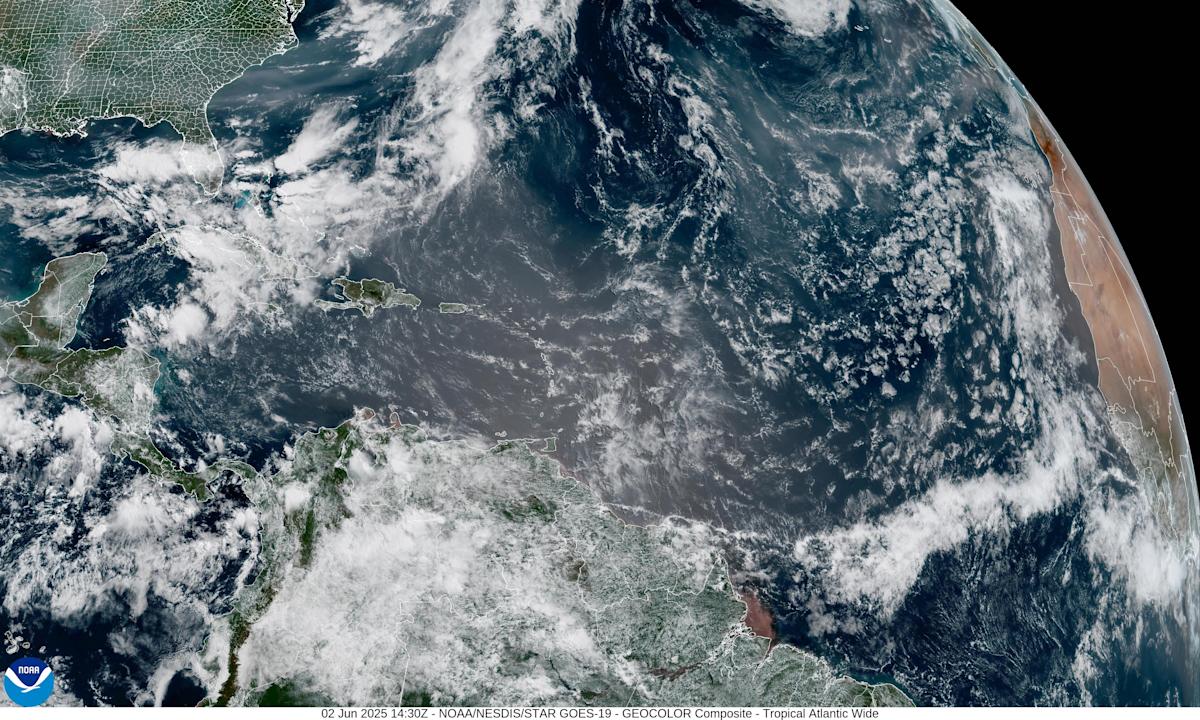

Hims & Hers (HIMS): Analyzing The Volatility And Future Potential.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Hims & Hers (HIMS): Navigating the Volatility and Unveiling Future Potential

Hims & Hers Health (HIMS), the telehealth company disrupting the men's and women's health landscape, has experienced significant market volatility since its public debut. Understanding this volatility and assessing its future potential requires a nuanced look at its business model, market position, and the broader telehealth industry. This article delves into the key factors driving HIMS's price fluctuations and explores its prospects for long-term growth.

The Rollercoaster Ride: Understanding HIMS's Volatility

HIMS's stock price has been anything but stable. Several factors contribute to this volatility:

-

Market Sentiment Towards Telehealth: The broader telehealth sector has witnessed fluctuating investor sentiment. Early pandemic-driven growth has been followed by a period of consolidation and reassessment as in-person healthcare returns. This overall market trend directly impacts HIMS.

-

Competition: The telehealth market is increasingly competitive. Established players and new entrants constantly vie for market share, putting pressure on pricing and profitability. This competitive pressure is a significant factor impacting HIMS's stock performance.

-

Regulatory Uncertainty: The regulatory landscape for telehealth remains dynamic. Changes in regulations regarding telehealth reimbursement and data privacy can significantly impact a company like HIMS. This uncertainty contributes to investor apprehension.

-

Financial Performance: Investors closely scrutinize HIMS's financial reports, looking for signs of sustainable growth and profitability. Any deviation from expectations can trigger sharp price movements. Analyzing key performance indicators like customer acquisition cost (CAC) and customer lifetime value (CLTV) is crucial for understanding the company's financial health.

HIMS's Strengths and Growth Opportunities

Despite the volatility, HIMS possesses several key strengths that suggest significant future potential:

-

Convenient and Accessible Healthcare: HIMS offers a convenient and accessible alternative to traditional healthcare, appealing to a broad demographic seeking efficient and discreet healthcare solutions.

-

Diverse Product Portfolio: The company's diverse range of products and services, catering to both men and women, diversifies its revenue streams and reduces reliance on any single product category. This diversification mitigates risk.

-

Strong Brand Recognition: HIMS has successfully built a strong brand presence and recognition, particularly among younger demographics. This brand recognition is a key asset for future growth.

-

Expansion Opportunities: HIMS has significant potential for expansion into new markets and product categories. Exploring international markets and expanding its service offerings could unlock substantial growth opportunities.

Analyzing the Future: Challenges and Potential

While the future looks promising, HIMS faces several challenges:

-

Maintaining Profitability: Achieving and maintaining profitability remains a key challenge. Balancing customer acquisition costs with revenue generation is crucial for long-term success.

-

Managing Competition: Effectively competing against established players and new entrants requires continuous innovation and strategic adaptation.

-

Ensuring Regulatory Compliance: Navigating the evolving regulatory landscape and ensuring compliance is paramount for sustained growth.

Conclusion: A Long-Term Perspective

The volatility surrounding HIMS's stock price reflects the inherent risks and uncertainties of the telehealth sector. However, the company's strong brand recognition, diversified product portfolio, and potential for expansion suggest significant long-term growth prospects. Investors need to adopt a long-term perspective, carefully considering the risks and rewards before making any investment decisions. Further research into HIMS’s financial statements and market analysis is crucial for informed decision-making. Staying updated on industry news and regulatory changes will also be essential for navigating the dynamic telehealth landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Hims & Hers (HIMS): Analyzing The Volatility And Future Potential.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Protecting Federal Employee Rights The Challenges Facing Unions And Collective Bargaining

Jun 03, 2025

Protecting Federal Employee Rights The Challenges Facing Unions And Collective Bargaining

Jun 03, 2025 -

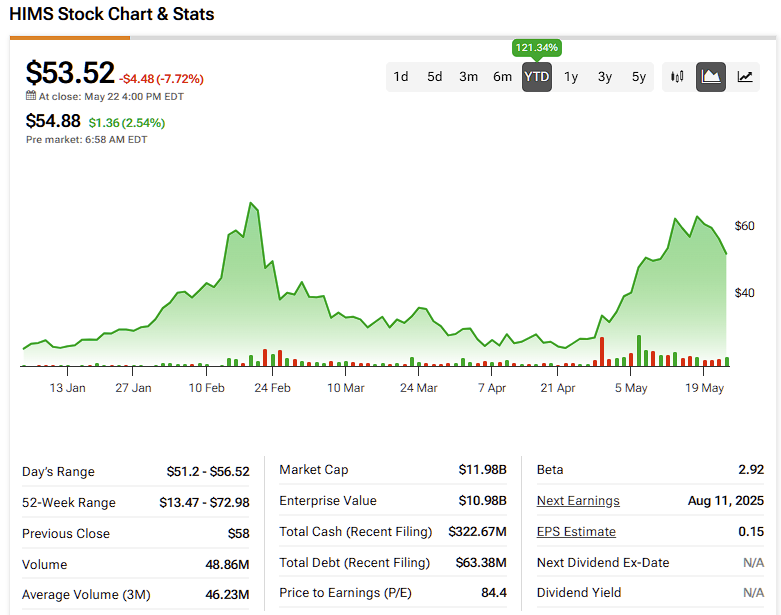

Canadian Wildfires And Saharan Dust A Double Threat To Floridas Air Quality

Jun 03, 2025

Canadian Wildfires And Saharan Dust A Double Threat To Floridas Air Quality

Jun 03, 2025 -

16 Years Of Wtf Marc Marons Podcast Coming To An End

Jun 03, 2025

16 Years Of Wtf Marc Marons Podcast Coming To An End

Jun 03, 2025 -

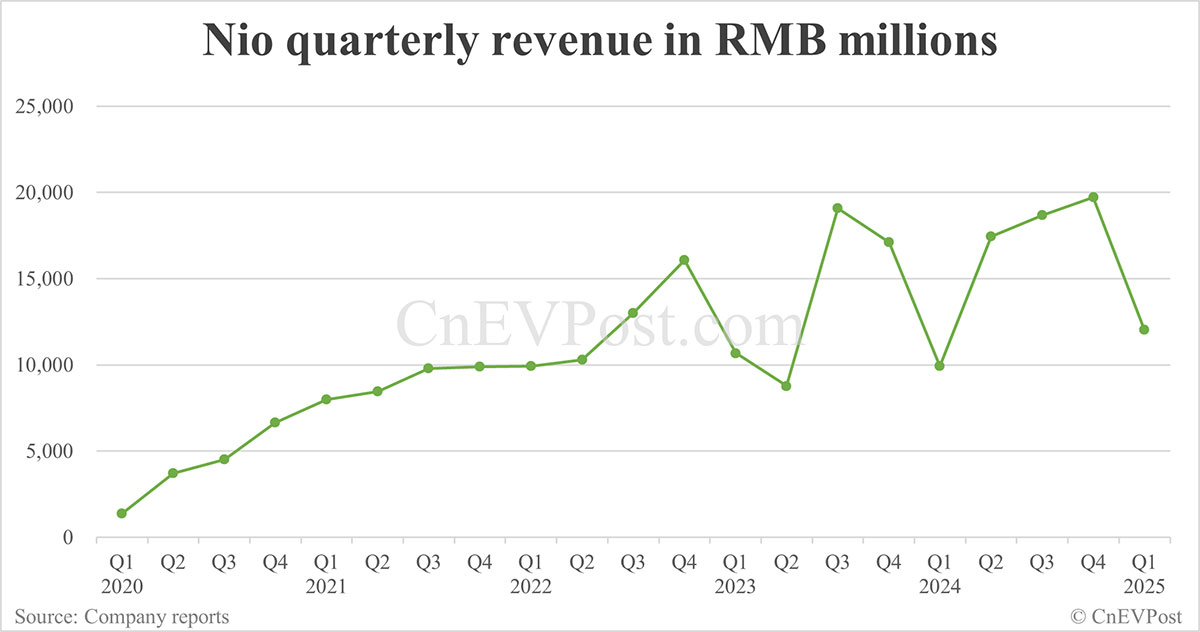

Electric Vehicle Maker Nio Reports Strong Q1 2024 Revenue Growth

Jun 03, 2025

Electric Vehicle Maker Nio Reports Strong Q1 2024 Revenue Growth

Jun 03, 2025 -

North Texas Manhunt Ends Murder Suspect Arrested After Nearly A Month

Jun 03, 2025

North Texas Manhunt Ends Murder Suspect Arrested After Nearly A Month

Jun 03, 2025