Hims & Hers (HIMS): Analyzing The Risks And Rewards Of Investment.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Hims & Hers (HIMS): Navigating the Risks and Rewards of Investment

The telehealth revolution has brought significant changes to healthcare accessibility, and Hims & Hers (HIMS) stands at the forefront of this transformation. This company, offering convenient online access to treatments for hair loss, sexual health, and skincare, has attracted considerable investor attention. But is investing in HIMS a smart move? Let's delve into the potential risks and rewards.

HIMS's Business Model: Convenience and Accessibility

HIMS operates on a subscription-based model, providing a streamlined approach to healthcare. This convenience is a major draw, attracting a large customer base seeking discreet and easily accessible solutions for various health concerns. Their broad range of offerings, including treatments for hair loss (like finasteride and minoxidil), erectile dysfunction (sildenafil), and acne, creates a diversified revenue stream. This diversification mitigates some risk, but also presents challenges in managing diverse operational needs.

The Rewards: Market Growth and Brand Recognition

The telehealth market is booming, experiencing explosive growth fueled by increased consumer demand for convenient healthcare options. HIMS is well-positioned to capitalize on this trend. Their strong brand recognition and significant marketing efforts have contributed to a substantial user base, providing a solid foundation for future expansion. Further potential rewards include:

- Expansion into new markets: HIMS continuously explores new treatment areas and geographic markets, further diversifying its revenue streams and growth potential.

- Technological advancements: The company's investment in technology and data analytics can enhance personalized healthcare recommendations and improve operational efficiency.

- Strategic partnerships: Collaborations with other healthcare providers and pharmaceutical companies can unlock access to wider patient populations and new treatment options.

The Risks: Competition and Regulatory Hurdles

While the rewards are enticing, several risks need careful consideration before investing in HIMS:

- Intense competition: The telehealth market is becoming increasingly competitive, with established players and new entrants vying for market share. This competition can put pressure on pricing and profitability.

- Regulatory landscape: The healthcare industry is heavily regulated. Changes in regulations or legal challenges could significantly impact HIMS's operations and financial performance. Staying compliant with evolving healthcare laws and guidelines is crucial for the company's long-term success.

- Dependence on marketing: A significant portion of HIMS's revenue is attributed to marketing and advertising expenses. Reduced marketing effectiveness or increased competition could negatively impact user acquisition and growth.

- Subscription model churn: The subscription-based model is susceptible to customer churn. Maintaining high customer retention rates is vital for sustainable growth.

Financial Performance and Valuation:

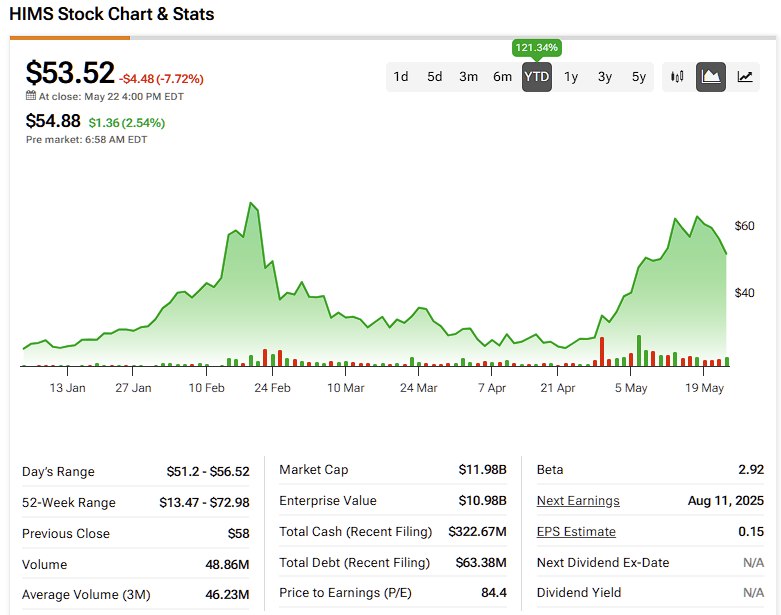

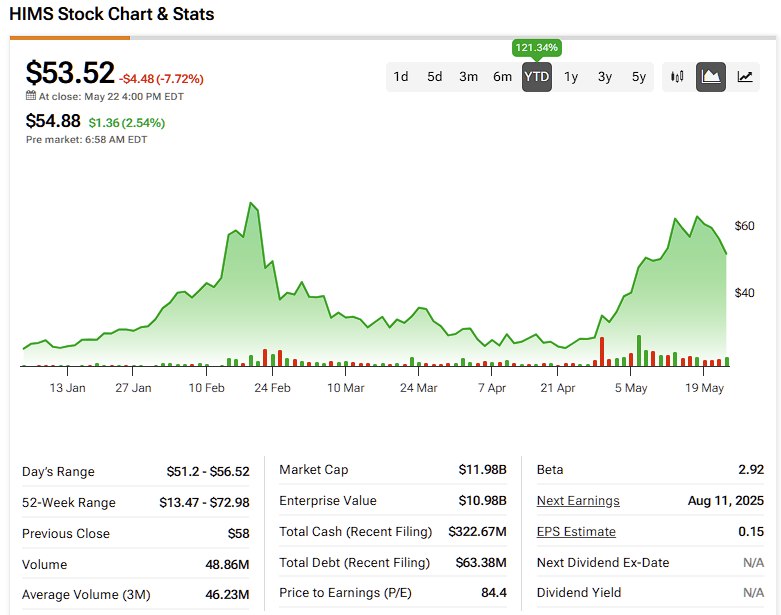

A thorough analysis of HIMS's financial statements, including revenue growth, profitability, and debt levels, is crucial before making any investment decision. Compare these figures with industry benchmarks and consider the company's valuation relative to its future growth prospects. Consult with a financial advisor to assess if the current market price aligns with your investment goals and risk tolerance.

Conclusion: A High-Growth, High-Risk Investment

Investing in HIMS presents both significant opportunities and substantial risks. The company benefits from a growing market and strong brand recognition. However, intense competition, regulatory hurdles, and reliance on marketing present challenges. Thorough due diligence, including a comprehensive review of financial statements and an understanding of the competitive landscape, is crucial before making an investment decision. Remember to consult with a qualified financial advisor to tailor your investment strategy to your individual risk tolerance and financial goals. This analysis shouldn't be considered financial advice; always conduct your own research before investing in any company.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Hims & Hers (HIMS): Analyzing The Risks And Rewards Of Investment.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Walz Challenges Democrats Time For A More Aggressive Strategy Against Trumps Agenda

Jun 03, 2025

Walz Challenges Democrats Time For A More Aggressive Strategy Against Trumps Agenda

Jun 03, 2025 -

Anger Mounts As Dte Energy Rate Increases Burden Michigan Residents

Jun 03, 2025

Anger Mounts As Dte Energy Rate Increases Burden Michigan Residents

Jun 03, 2025 -

Ageing Gracefully Harry Brook On Joe Roots Enhanced Cricket Performance

Jun 03, 2025

Ageing Gracefully Harry Brook On Joe Roots Enhanced Cricket Performance

Jun 03, 2025 -

Understanding The Risks And Rewards Of Investing In Hims And Hers Hims Stock

Jun 03, 2025

Understanding The Risks And Rewards Of Investing In Hims And Hers Hims Stock

Jun 03, 2025 -

Dte Energy Faces Backlash Over Rate Hikes Community Demands Action On Rising Bills

Jun 03, 2025

Dte Energy Faces Backlash Over Rate Hikes Community Demands Action On Rising Bills

Jun 03, 2025