Hims & Hers (HIMS): A Deep Dive Into The Company's Financial Health

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

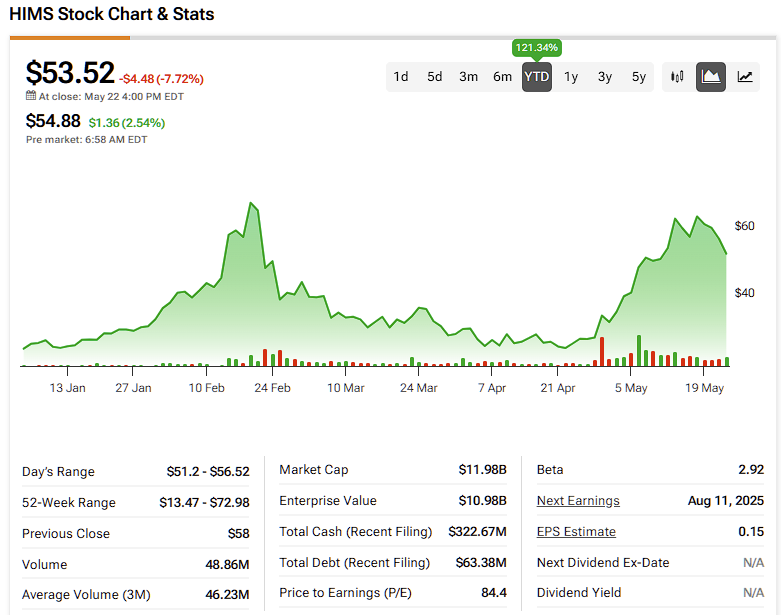

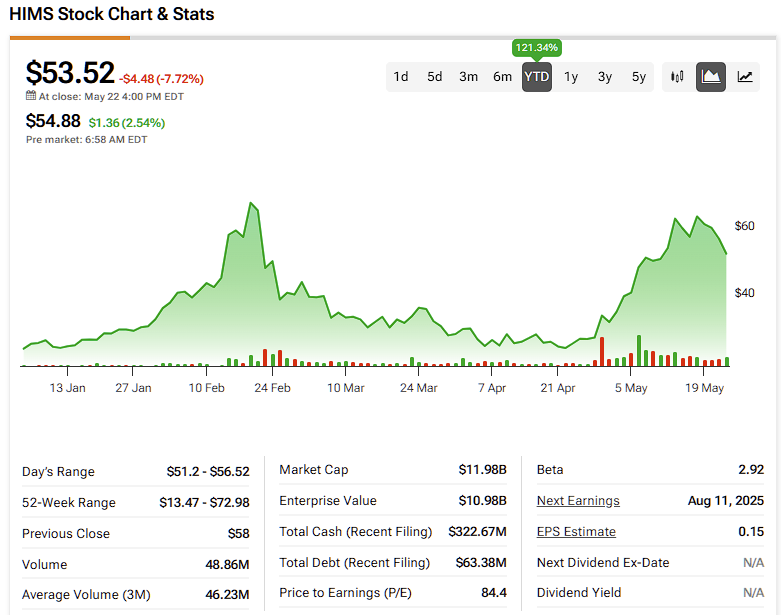

Hims & Hers (HIMS): A Deep Dive into the Company's Financial Health

Hims & Hers Health, Inc. (NYSE: HIMS), the telehealth company revolutionizing access to healthcare for men and women, has seen a rollercoaster ride since its IPO. While its convenient online platform offering dermatology, sexual health, and mental health services has attracted a significant user base, understanding its financial health requires a closer look beyond the glossy marketing. This in-depth analysis explores HIMS's financial performance, key challenges, and future prospects.

Hims & Hers Revenue Growth and Key Metrics:

Hims & Hers has experienced impressive revenue growth since its inception. However, profitability remains a significant hurdle. Analyzing key financial metrics like revenue growth, gross margin, operating expenses, and net income is crucial to evaluating the company's long-term viability. Recent quarterly reports highlight a steady increase in revenue, driven primarily by subscription-based services and increased customer acquisition. However, significant marketing and operational costs continue to impact profitability.

- Revenue Growth: While showing positive growth, investors need to scrutinize the sustainability of this growth. Is it solely dependent on aggressive marketing campaigns, or is there evidence of strong organic growth and customer retention?

- Gross Margin: Analyzing the gross margin provides insight into the profitability of the company's products and services. A shrinking gross margin could signal increasing costs of goods sold or pricing pressures.

- Operating Expenses: High marketing and administrative expenses are common in the telehealth industry, but HIMS needs to demonstrate effective cost management strategies to improve profitability.

- Net Income (or Loss): The bottom line is crucial. Consistent net losses raise concerns about the company's long-term financial sustainability. Investors should analyze the trend of net income and its contributing factors.

Challenges Facing Hims & Hers:

The telehealth industry is fiercely competitive. HIMS faces challenges from both established healthcare providers and emerging telehealth startups. Some key challenges include:

- Competition: The market is saturated with competitors offering similar services. HIMS needs a strong competitive advantage to maintain its market share.

- Regulatory Landscape: The ever-evolving regulatory landscape for telehealth presents challenges in terms of compliance and operational efficiency. Changes in regulations could significantly impact the company's operations.

- Customer Acquisition Costs: Attracting new customers can be expensive, especially in a competitive market. HIMS needs to find a balance between effective marketing and sustainable customer acquisition costs.

- Maintaining Customer Retention: High customer churn rates can significantly impact profitability. HIMS needs to focus on improving customer satisfaction and retention strategies.

Future Outlook and Investment Considerations:

Despite the challenges, HIMS's convenient access to healthcare services and its strong brand recognition represent significant potential. However, potential investors should carefully consider the following:

- Profitability: The company's path to profitability is a key factor to consider. Investors need to see evidence of effective cost management and a sustainable business model.

- Market Saturation: The competitive landscape necessitates a strong differentiation strategy. HIMS needs to innovate and expand its offerings to maintain a competitive edge.

- Long-term Growth Strategy: A clearly defined long-term growth strategy is crucial for attracting and retaining investors. This should include plans for market expansion, new product development, and improved operational efficiency.

Conclusion:

Hims & Hers represents a significant player in the growing telehealth market. While revenue growth is encouraging, a thorough analysis of its financial health, including profitability, competitive landscape, and regulatory hurdles, is critical for potential investors. Careful consideration of the challenges and future outlook is vital before making any investment decisions. Further research into HIMS's quarterly and annual reports is recommended for a comprehensive understanding of its financial performance and future prospects. Stay informed about the latest financial news and industry trends to make well-informed decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Hims & Hers (HIMS): A Deep Dive Into The Company's Financial Health. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Sheinelle Jones Focuses On Family After Husbands Death A Sources Insight

Jun 04, 2025

Sheinelle Jones Focuses On Family After Husbands Death A Sources Insight

Jun 04, 2025 -

Donald Trump And Scott Walker Examining A Critical Moment In The 2024 Race

Jun 04, 2025

Donald Trump And Scott Walker Examining A Critical Moment In The 2024 Race

Jun 04, 2025 -

Controversy Erupts Beanie Bishops Actions Towards Pitt Logo

Jun 04, 2025

Controversy Erupts Beanie Bishops Actions Towards Pitt Logo

Jun 04, 2025 -

Collective Bargaining Rights A Look At The Future For Federal Unions

Jun 04, 2025

Collective Bargaining Rights A Look At The Future For Federal Unions

Jun 04, 2025 -

Pitt Logo Defaced Former Wvu Defensive Back And Current Steeler Under Fire

Jun 04, 2025

Pitt Logo Defaced Former Wvu Defensive Back And Current Steeler Under Fire

Jun 04, 2025