Hims & Hers Health Inc. (HIMS): A 3.02% Stock Surge On May 30

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Hims & Hers Health Inc. (HIMS): A 3.02% Stock Surge on May 30 – What Fueled the Rise?

Hims & Hers Health Inc. (HIMS) experienced a notable 3.02% stock surge on May 30th, catching the attention of investors and market analysts alike. This unexpected jump raises questions about the underlying factors driving this positive movement in the telehealth company's stock price. While pinpointing the exact cause of any single-day stock fluctuation is often difficult, several contributing elements could explain this increase. Let's delve into the potential reasons behind Hims & Hers' positive market performance on May 30th.

Potential Factors Contributing to the HIMS Stock Surge:

Several factors could have independently or collectively contributed to the 3.02% increase in HIMS stock price on May 30th. These include:

-

Positive Market Sentiment: The broader market's overall performance can significantly impact individual stocks. A generally positive day on the stock market could have boosted investor confidence, leading to increased buying pressure on HIMS shares. This is particularly true for growth stocks like HIMS, which are often more volatile than established companies.

-

Increased Investor Interest in the Telehealth Sector: The telehealth industry continues to evolve and grow, fueled by increasing demand for convenient and accessible healthcare services. Positive news or developments within the broader telehealth sector might have generated renewed interest in companies like Hims & Hers, leading to increased investment.

-

Speculation and Trading Activity: Short-term stock price movements can often be attributed to short-term trading activity and speculation. Rumors, analyst upgrades (even unofficial ones), or simply increased trading volume can create volatility, pushing the price up or down in a short period.

-

Company-Specific News (Unreported): While no major news was publicly released by Hims & Hers on May 30th, it's possible that positive internal developments, such as strong preliminary sales figures or positive internal projections, could have leaked to certain market players, influencing trading decisions. This information wouldn't necessarily be publicly available immediately.

-

Algorithmic Trading: The influence of algorithmic trading should not be underestimated. These automated trading systems react to various market signals and can contribute to sudden price movements, regardless of fundamental company news.

Hims & Hers Health Inc. (HIMS): A Company Overview

Hims & Hers Health Inc. is a leading telehealth platform offering a wide range of health and wellness products and services, including men's and women's health, hair loss treatments, and sexual health products. Their direct-to-consumer model and convenient online platform have attracted a substantial customer base. However, the company's stock performance has been subject to volatility, reflecting the challenges and opportunities within the competitive telehealth landscape.

What to Watch For:

Investors looking to understand HIMS' long-term prospects should monitor several key metrics:

- Revenue Growth: Consistent growth in revenue is a crucial indicator of the company's ability to attract and retain customers.

- Customer Acquisition Costs (CAC): A sustainable and efficient customer acquisition strategy is vital for long-term profitability.

- Market Competition: The telehealth market is highly competitive, and understanding the company's competitive landscape is important.

While the 3.02% surge on May 30th was notable, it's crucial for investors to consider the broader picture and not rely solely on short-term fluctuations when making investment decisions. Conduct thorough research and consult with a financial advisor before making any investment choices.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Hims & Hers Health Inc. (HIMS): A 3.02% Stock Surge On May 30. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Chicago Fire Fc Announces South Loop Stadium Location Details And Timeline

Jun 03, 2025

Chicago Fire Fc Announces South Loop Stadium Location Details And Timeline

Jun 03, 2025 -

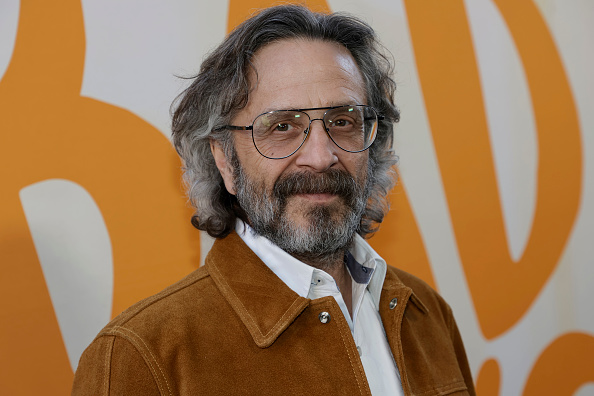

16 Years Of Wtf Marc Maron Announces Podcasts Final Episodes

Jun 03, 2025

16 Years Of Wtf Marc Maron Announces Podcasts Final Episodes

Jun 03, 2025 -

Exclusive Inside Scoop On Miley And Billy Cyrus Evolving Relationship

Jun 03, 2025

Exclusive Inside Scoop On Miley And Billy Cyrus Evolving Relationship

Jun 03, 2025 -

Hims And Hers Health Inc Hims A 3 02 Stock Increase Reported On May 30th

Jun 03, 2025

Hims And Hers Health Inc Hims A 3 02 Stock Increase Reported On May 30th

Jun 03, 2025 -

Real Life Tech Titans The Models For Jesse Armstrongs Mountainhead Characters

Jun 03, 2025

Real Life Tech Titans The Models For Jesse Armstrongs Mountainhead Characters

Jun 03, 2025