Hims & Hers Health (HIMS) Stock: Understanding The Volatility And Future Potential

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Hims & Hers Health (HIMS) Stock: Navigating the Volatility and Unlocking Future Potential

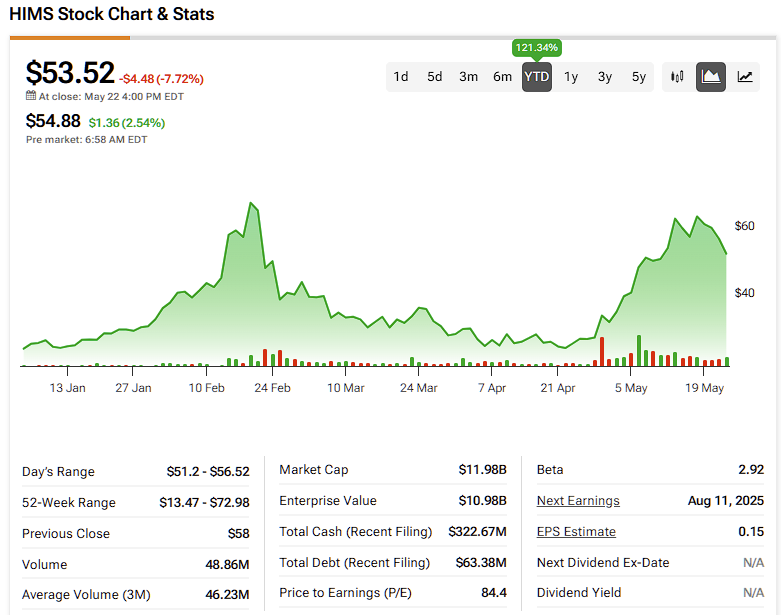

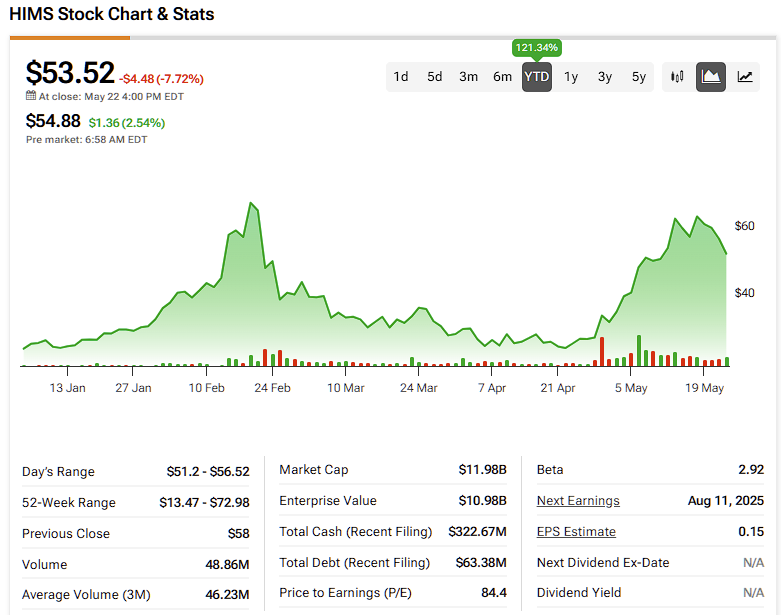

Hims & Hers Health (HIMS) has experienced a rollercoaster ride since its public debut, captivating investors with its innovative telehealth model but also leaving them grappling with significant stock price volatility. Understanding the factors driving this fluctuation is crucial for investors considering adding HIMS to their portfolios. This article delves into the current market dynamics, explores the company's strengths and weaknesses, and offers insights into its potential for future growth.

The Rollercoaster Ride: Understanding HIMS Stock Volatility

HIMS stock, like many other telehealth companies, has faced considerable challenges in recent years. Several factors contribute to this volatility:

- Market Sentiment: The broader telehealth sector has witnessed a shift in investor sentiment post-pandemic. The initial boom fueled by increased demand during lockdowns has cooled, leading to corrections across the sector. This general market trend heavily impacts HIMS' stock price.

- Competition: HIMS operates in a competitive landscape, facing established players and emerging startups. Intense competition puts pressure on pricing and profitability, directly affecting investor confidence.

- Regulatory Landscape: The evolving regulatory environment for telehealth and online prescription services introduces uncertainty. Changes in regulations can significantly influence operating costs and market access, impacting HIMS's growth trajectory.

- Financial Performance: HIMS's financial performance, including revenue growth, profitability, and cash flow, directly influences investor perception. Periods of strong financial results often correlate with positive stock price movement, while setbacks can trigger sell-offs.

HIMS' Strengths: A Foundation for Future Growth?

Despite the volatility, HIMS boasts several key strengths that could drive future growth:

- Convenient and Accessible Healthcare: The company's telehealth platform offers convenient access to healthcare services, particularly appealing to younger demographics and those in underserved areas. This accessibility is a significant competitive advantage.

- Diverse Product Offering: HIMS offers a broad range of products and services, including men's and women's health products, covering areas such as hair loss, sexual health, and skincare. This diversification reduces reliance on any single product line.

- Strong Brand Recognition: HIMS has cultivated a strong brand identity, recognizable for its marketing and direct-to-consumer approach. This brand recognition translates to increased customer acquisition and loyalty.

- Technological Innovation: The company continuously invests in technology to improve its platform and enhance the customer experience. This commitment to innovation can lead to operational efficiencies and improved service delivery.

Challenges Facing Hims & Hers Health

However, HIMS also faces considerable challenges:

- Profitability Concerns: Achieving consistent profitability remains a hurdle. The high cost of customer acquisition and marketing can impact profit margins.

- Maintaining Customer Acquisition: Attracting and retaining customers in a competitive market requires ongoing investment in marketing and service improvements.

- Dependence on Subscription Models: A significant portion of HIMS' revenue is derived from subscription-based models. Changes in customer churn rates can significantly impact financial performance.

The Future Potential: A Long-Term Perspective

The long-term potential of HIMS depends on its ability to address the challenges mentioned above. Successfully navigating the competitive landscape, enhancing profitability, and maintaining sustainable customer growth are crucial for future success. Investors should adopt a long-term perspective, carefully evaluating the company's progress in addressing these key issues.

Conclusion: Informed Investment Decisions

HIMS stock presents both opportunities and risks. The volatility underscores the need for thorough due diligence and a long-term investment strategy. Investors should carefully consider the company's financial performance, competitive landscape, and regulatory environment before making any investment decisions. Staying informed about industry trends and HIMS's strategic initiatives is crucial for navigating the ongoing market fluctuations. Consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Hims & Hers Health (HIMS) Stock: Understanding The Volatility And Future Potential. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

155 New Hot Chicken Restaurants Planned This Year After Major Acquisition

Jun 04, 2025

155 New Hot Chicken Restaurants Planned This Year After Major Acquisition

Jun 04, 2025 -

India Vs Thailand Live Full Match Score Updates And Commentary

Jun 04, 2025

India Vs Thailand Live Full Match Score Updates And Commentary

Jun 04, 2025 -

St Louis To Demolish Almost 200 Homes Ravaged By Recent Tornado

Jun 04, 2025

St Louis To Demolish Almost 200 Homes Ravaged By Recent Tornado

Jun 04, 2025 -

St Louis City Announces Demolition Plan For Tornado Affected Area

Jun 04, 2025

St Louis City Announces Demolition Plan For Tornado Affected Area

Jun 04, 2025 -

Follow Live England Womens Cricket Team Vs West Indies Women 2nd Odi

Jun 04, 2025

Follow Live England Womens Cricket Team Vs West Indies Women 2nd Odi

Jun 04, 2025