Hims & Hers Health (HIMS) Stock: High Growth Potential Or Overvalued Asset?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Hims & Hers Health (HIMS) Stock: High Growth Potential or Overvalued Asset?

Hims & Hers Health (HIMS) has captured significant attention since its public debut, offering telehealth services for a range of health and wellness needs. But is this innovative company a smart investment, or is the stock price inflated beyond its true value? Let's delve into the complexities of HIMS stock, weighing its potential for growth against the risks of overvaluation.

The Allure of Telehealth and Direct-to-Consumer (DTC) Model:

Hims & Hers' success hinges on its disruptive approach to healthcare. By offering convenient, at-home access to treatments for conditions like hair loss, sexual health concerns, and acne, the company taps into a massive market underserved by traditional healthcare systems. This direct-to-consumer (DTC) model, bypassing the complexities of insurance and doctor visits, is a key driver of its growth. The ease of access and discreet nature of the services resonate strongly with a tech-savvy generation increasingly comfortable with digital health solutions.

Growth Potential and Key Market Drivers:

Several factors contribute to HIMS' potential for continued growth:

- Expanding Market: The telehealth market is booming, fueled by increasing consumer demand for convenient and accessible healthcare options. This trend is expected to continue for the foreseeable future.

- Product Diversification: Hims & Hers consistently expands its product offerings, catering to a broader range of health and wellness needs. This diversification mitigates risk and attracts a larger customer base.

- Strong Brand Recognition: The company has effectively built brand awareness and trust through targeted marketing campaigns and positive customer experiences.

- Technological Advancements: Continued investment in technology enhances the user experience and streamlines operations, increasing efficiency and profitability.

However, the Road Ahead Presents Challenges:

Despite the considerable growth potential, investors must consider the challenges facing HIMS:

- Increased Competition: The telehealth sector is increasingly competitive, with established players and new entrants vying for market share.

- Regulatory Scrutiny: The regulatory landscape for telehealth is constantly evolving, and navigating these complexities poses a challenge. Changes in regulations could impact the company's operations and profitability.

- Profitability Concerns: While revenue is growing, Hims & Hers is still striving for consistent profitability. This is a crucial factor for long-term investor confidence.

- Valuation Concerns: Some analysts argue that the current stock price reflects an overly optimistic view of the company's future performance, potentially indicating an overvalued asset.

Analyzing the Financials and Future Outlook:

A thorough analysis of HIMS' financial statements, including revenue growth, profitability margins, and debt levels, is crucial for informed investment decisions. Scrutinizing the company's future projections and comparing them to industry benchmarks is equally important. Consulting with a financial advisor can provide personalized guidance based on your individual risk tolerance and investment goals. Keep abreast of quarterly earnings reports and analyst reviews for the most up-to-date information.

Conclusion: A Risky but Potentially Rewarding Investment?

Hims & Hers Health presents a compelling investment case, driven by its innovative business model and significant market opportunity. However, the competitive landscape, regulatory uncertainties, and current valuation concerns demand careful consideration. Investors should conduct thorough due diligence, assess their risk tolerance, and potentially diversify their portfolios before investing in HIMS stock. The potential for high growth is undeniable, but the risks associated with this relatively young company should not be underestimated. This is not financial advice; always consult with a professional before making investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Hims & Hers Health (HIMS) Stock: High Growth Potential Or Overvalued Asset?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

England Captain Brook Joe Roots Performance Improving With Age

Jun 03, 2025

England Captain Brook Joe Roots Performance Improving With Age

Jun 03, 2025 -

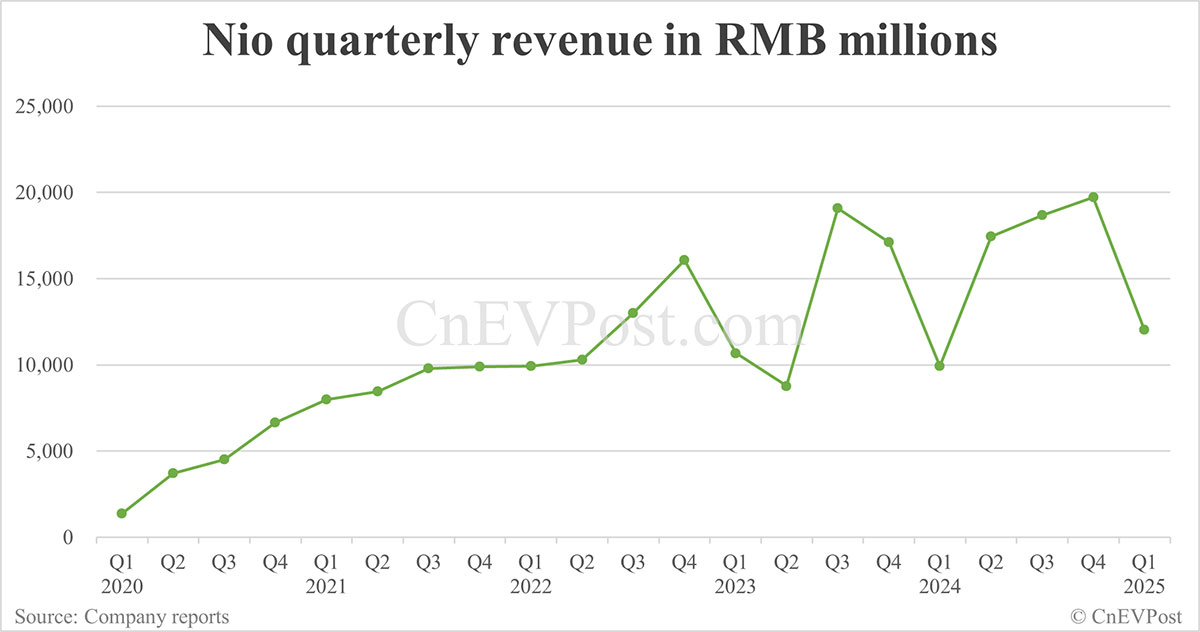

Electric Vehicle Maker Nio Reports Strong Q1 2024 Revenue Growth

Jun 03, 2025

Electric Vehicle Maker Nio Reports Strong Q1 2024 Revenue Growth

Jun 03, 2025 -

The 2 C Threshold Assessing Corporate Readiness For Climate Change

Jun 03, 2025

The 2 C Threshold Assessing Corporate Readiness For Climate Change

Jun 03, 2025 -

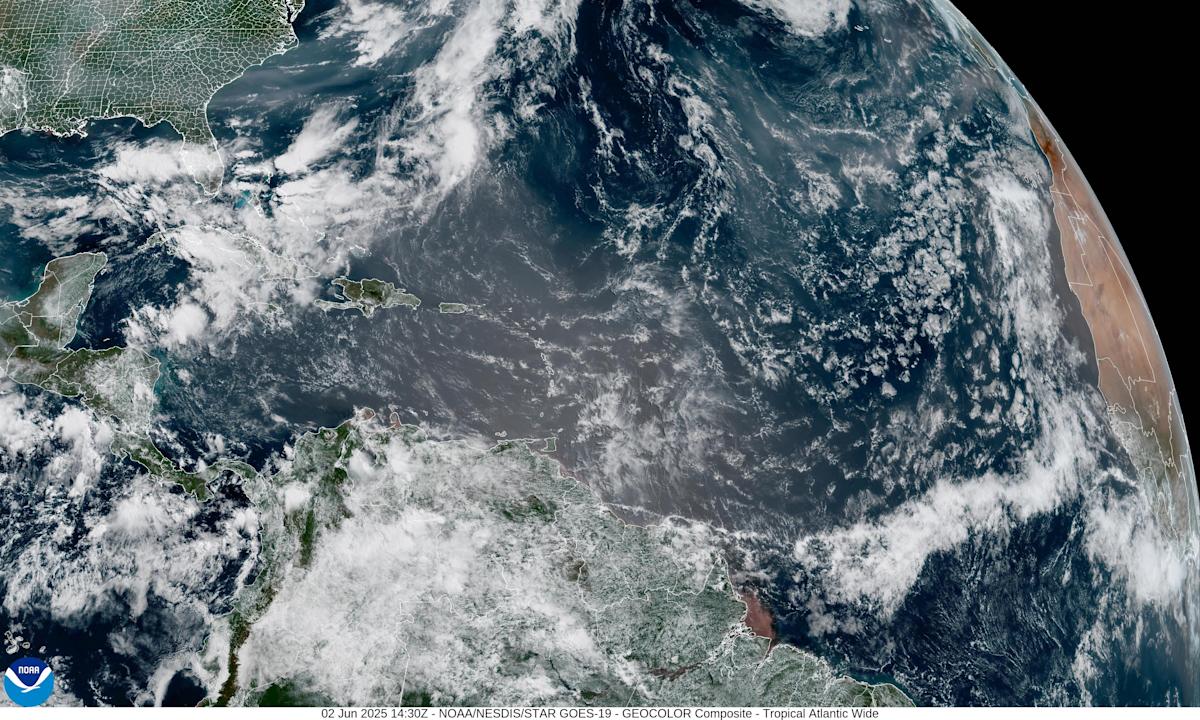

Wall Of Dust Exploring The Impacts Of Saharan Dust And Canadian Wildfire Smoke On Florida

Jun 03, 2025

Wall Of Dust Exploring The Impacts Of Saharan Dust And Canadian Wildfire Smoke On Florida

Jun 03, 2025 -

Crimea Bridge Targeted Analyzing The Implications Of The Blast

Jun 03, 2025

Crimea Bridge Targeted Analyzing The Implications Of The Blast

Jun 03, 2025