Hims & Hers Health (HIMS) Stock: A Comprehensive Investor's Guide.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Hims & Hers Health (HIMS) Stock: A Comprehensive Investor's Guide

Hims & Hers Health (HIMS) has rapidly become a household name, disrupting the telehealth and direct-to-consumer healthcare market. But is HIMS stock a smart investment? This comprehensive guide delves into the company's performance, market position, and future prospects, providing investors with the information they need to make informed decisions.

Understanding Hims & Hers Health (HIMS)

Hims & Hers Health offers a convenient and accessible platform for men and women seeking treatment for various health concerns. Their services, delivered primarily through a telehealth model, cover a wide range of needs including hair loss, sexual health, skincare, and mental wellness. This business model has resonated strongly with consumers seeking discreet and efficient healthcare solutions. The company’s success is built on several key pillars:

- Direct-to-consumer model: Eliminating the need for in-person doctor visits and streamlining the process.

- Wide range of services: Catering to a broad demographic with diverse health needs.

- Tech-driven platform: Utilizing technology to improve efficiency and accessibility.

- Strong brand recognition: Building a recognizable and trustworthy brand within the telehealth space.

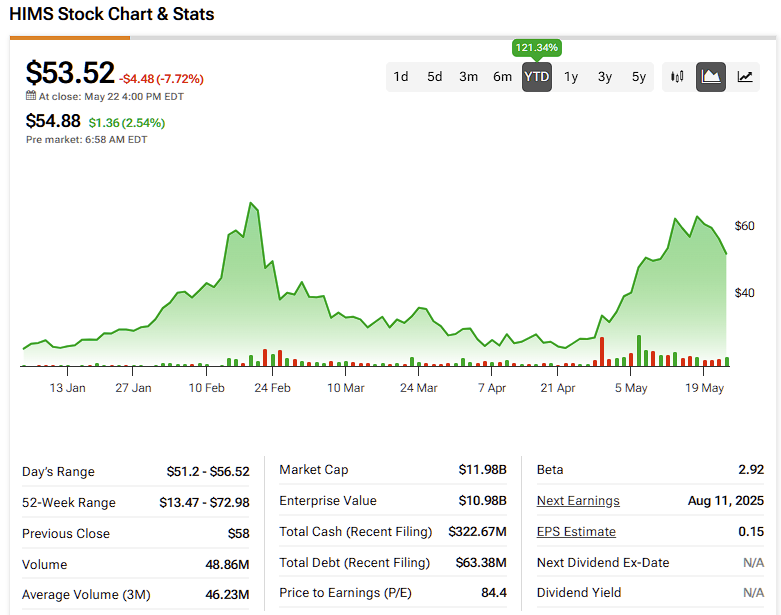

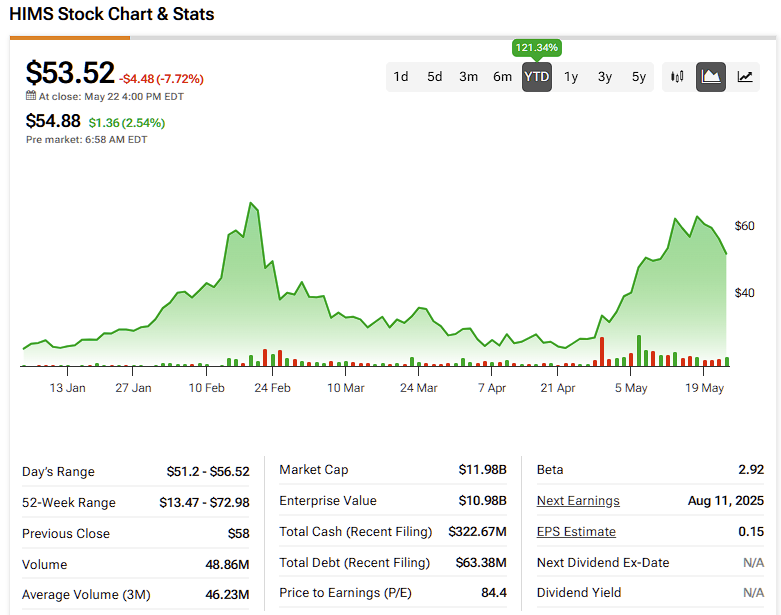

HIMS Stock Performance & Analysis

Since its initial public offering (IPO), HIMS stock has experienced periods of both significant growth and volatility. Analyzing its performance requires considering several factors:

- Revenue growth: While HIMS has shown impressive revenue growth, investors should examine the sustainability of this growth and its correlation to marketing expenses.

- Profitability: The company’s path to profitability is a crucial aspect to monitor. Analyzing operating margins and net income is essential for assessing long-term viability.

- Market competition: The telehealth sector is increasingly competitive. Understanding HIMS' competitive advantages and its ability to maintain market share is vital.

- Regulatory landscape: Changes in healthcare regulations can significantly impact HIMS' operations and profitability. Staying informed about relevant legislative developments is crucial.

Investing in HIMS: Potential Risks and Rewards

Investing in any stock carries inherent risks. With HIMS, potential risks include:

- Increased competition: The rise of other telehealth companies poses a significant competitive threat.

- Regulatory uncertainty: Changes in healthcare regulations could negatively impact the business model.

- Dependence on marketing: HIMS' significant marketing spend raises concerns about the long-term sustainability of its growth.

- Market volatility: The stock market is inherently volatile, and HIMS stock is no exception.

However, potential rewards include:

- High growth potential: The telehealth market is experiencing significant growth, offering significant upside potential for HIMS.

- Disruptive business model: HIMS' innovative approach to healthcare delivery positions it for continued success.

- Strong brand recognition: Its established brand provides a competitive advantage.

HIMS Stock: A Long-Term Perspective?

Whether HIMS stock is a good long-term investment depends on individual investor risk tolerance and long-term market projections. Investors should conduct thorough due diligence, considering the factors outlined above, before making any investment decisions. Consulting with a financial advisor is always recommended.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Further Reading:

- (replace with actual link)

- (replace with actual link)

This comprehensive guide provides a starting point for researching Hims & Hers Health (HIMS) stock. Remember to always conduct your own thorough research and seek professional financial advice before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Hims & Hers Health (HIMS) Stock: A Comprehensive Investor's Guide.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Sahara Dust Storm Engulfs Caribbean Heads Toward Us

Jun 03, 2025

Sahara Dust Storm Engulfs Caribbean Heads Toward Us

Jun 03, 2025 -

Are Us Tariffs On China Ineffective Jp Morgan Ceos Warning

Jun 03, 2025

Are Us Tariffs On China Ineffective Jp Morgan Ceos Warning

Jun 03, 2025 -

New Discovery Scientists Investigate Unusual Stellar Pulsations

Jun 03, 2025

New Discovery Scientists Investigate Unusual Stellar Pulsations

Jun 03, 2025 -

Global Instability Jamie Dimon Pinpoints Trumps Main Focus

Jun 03, 2025

Global Instability Jamie Dimon Pinpoints Trumps Main Focus

Jun 03, 2025 -

Trump Judicial Nominees Abas Influence Curtailed Under Bondi

Jun 03, 2025

Trump Judicial Nominees Abas Influence Curtailed Under Bondi

Jun 03, 2025