Hims & Hers Health (HIMS): Is The Stock Price Overheated?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

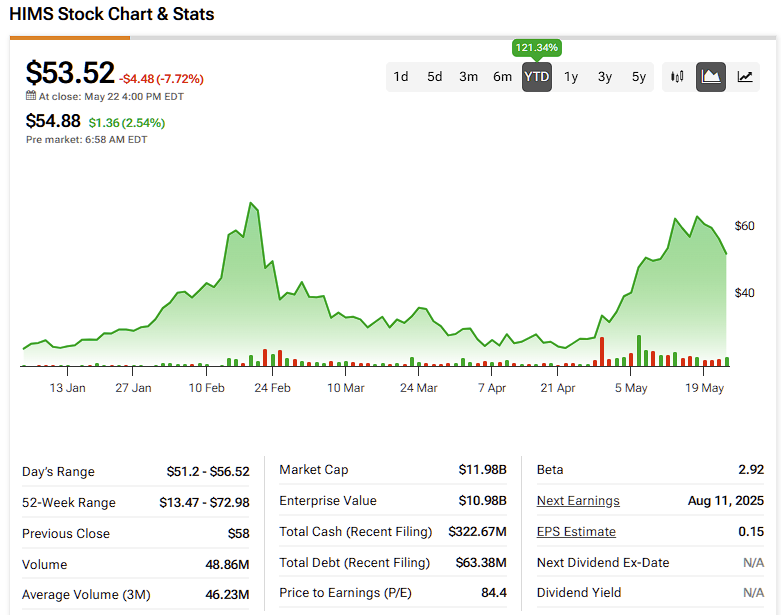

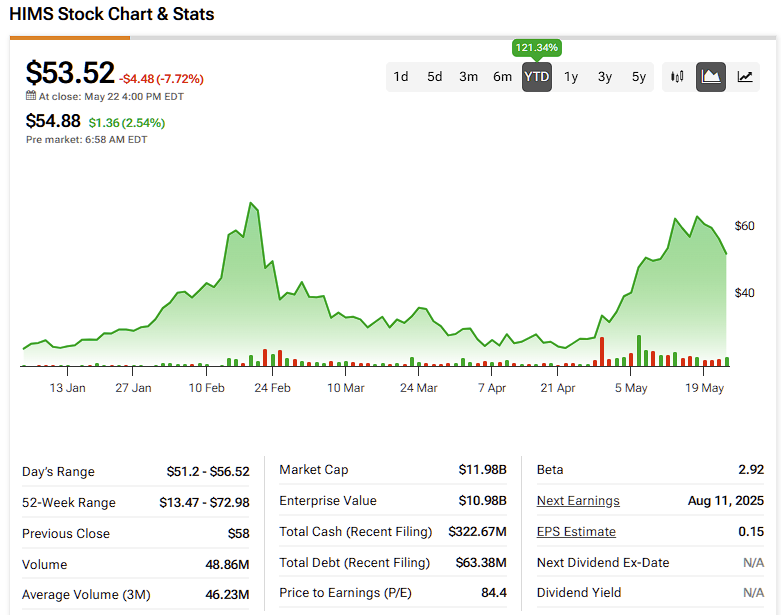

Hims & Hers Health (HIMS): Is the Stock Price Overheated?

Investors are buzzing about Hims & Hers Health (HIMS), the telehealth company disrupting the men's and women's health market. But with its recent stock price surge, many are asking: is HIMS overvalued? This article delves into the company's performance, market position, and future prospects to help you determine whether now's the time to buy, sell, or hold.

Hims & Hers Health has experienced significant growth since its inception, offering convenient access to healthcare services through its online platform. This business model, appealing to a tech-savvy generation seeking streamlined healthcare options, has fueled its rapid expansion. However, this rapid growth has also led to concerns about the sustainability of its current stock price.

The Bull Case for HIMS:

- Massive Market Opportunity: The telehealth market is booming, and HIMS is well-positioned to capitalize on this growth. The company offers a wide range of services, from hair loss treatment and skincare to sexual health and mental wellness, targeting a broad demographic.

- Strong Brand Recognition: HIMS has built a strong brand reputation, particularly among younger consumers, through effective marketing and a user-friendly platform. This brand recognition translates into customer loyalty and acquisition.

- Recurring Revenue Model: A significant portion of HIMS' revenue comes from subscription-based services, providing predictable and recurring income streams. This predictability is attractive to investors seeking stability.

- Strategic Acquisitions: The company has demonstrated a strategic approach to growth through acquisitions, expanding its product offerings and market reach. These moves are designed to consolidate its position within the telehealth landscape.

The Bear Case for HIMS:

- High Valuation: HIMS' current stock price reflects a high valuation, raising concerns about potential overvaluation. Investors need to carefully analyze the company's financials and future projections to determine if the price justifies its growth potential.

- Competition: The telehealth industry is becoming increasingly competitive, with established players and new entrants vying for market share. HIMS faces challenges in maintaining its competitive edge.

- Regulatory Scrutiny: The telehealth industry is subject to regulatory changes and scrutiny, which could impact HIMS' operations and profitability. Keeping abreast of evolving regulations is crucial for investors.

- Profitability Concerns: While HIMS has shown impressive revenue growth, its profitability remains a concern for some investors. Achieving consistent profitability is vital for long-term sustainability.

Analyzing the Stock Price:

The recent volatility in the HIMS stock price reflects the inherent risks and uncertainties associated with investing in a high-growth company within a rapidly evolving industry. Analyzing key financial metrics like revenue growth, profitability margins, and debt levels is crucial before making any investment decisions. Comparing these metrics to industry benchmarks can provide further context.

What's Next for HIMS?

The future success of HIMS will depend on several factors, including its ability to continue expanding its product offerings, manage competition effectively, maintain a strong brand image, and navigate regulatory hurdles. Investors should closely monitor the company's performance and strategic initiatives to assess its long-term potential.

Conclusion:

Determining whether HIMS' stock price is overheated requires a thorough analysis of its strengths and weaknesses, market position, and future prospects. While the company boasts a strong brand and significant market opportunity, concerns about its valuation and competition warrant careful consideration. Before investing, conduct thorough due diligence and consult with a financial advisor to make informed decisions aligned with your risk tolerance. Remember, this analysis is for informational purposes only and does not constitute financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Hims & Hers Health (HIMS): Is The Stock Price Overheated?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Mountainheads Inspiration Uncovering The Real Life Tech Execs

Jun 03, 2025

Mountainheads Inspiration Uncovering The Real Life Tech Execs

Jun 03, 2025 -

Abas Role In Trump Judicial Appointments Diminished By Pam Bondi

Jun 03, 2025

Abas Role In Trump Judicial Appointments Diminished By Pam Bondi

Jun 03, 2025 -

Dte Energys Reliability And Pricing Under Fire At Upcoming Mpsc Town Hall

Jun 03, 2025

Dte Energys Reliability And Pricing Under Fire At Upcoming Mpsc Town Hall

Jun 03, 2025 -

Khanna And Local Unions Demand Action On Devastating Federal Layoffs

Jun 03, 2025

Khanna And Local Unions Demand Action On Devastating Federal Layoffs

Jun 03, 2025 -

Cross State Manhunt Concludes With Murder Suspects Arrest

Jun 03, 2025

Cross State Manhunt Concludes With Murder Suspects Arrest

Jun 03, 2025