Higher Mortgage Rates Reflect Strengthening Economy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Higher Mortgage Rates Reflect Strengthening Economy: What it Means for Homebuyers

The dream of homeownership is often intertwined with mortgage rates. Recently, we've seen a noticeable climb in these rates, sparking concerns among prospective homebuyers. However, this increase isn't necessarily a negative sign; it often reflects a strengthening economy. Let's delve into the connection between rising mortgage rates and a robust economy, exploring what this means for both buyers and the broader market.

The Correlation Between Mortgage Rates and Economic Health

Higher mortgage rates are often a byproduct of a healthy economy. When the economy is performing well, the Federal Reserve (the Fed) typically raises interest rates to curb inflation and prevent overheating. This policy directly influences mortgage rates, as lenders adjust their rates based on the Fed's actions. A strong economy often leads to increased consumer spending and business investment, ultimately driving up demand for loans and subsequently pushing interest rates higher.

Understanding the Current Market Dynamics

Several factors are currently contributing to the rise in mortgage rates. These include:

- Inflationary Pressures: Persistent inflation forces the Fed to tighten monetary policy, resulting in higher interest rates across the board, including mortgages. [Link to a reputable source on current inflation rates].

- Increased Demand: A strong job market and population growth can increase the demand for housing, creating upward pressure on mortgage rates.

- Investor Confidence: Positive economic indicators can boost investor confidence, leading to increased investment in the housing market and pushing rates higher.

What Does This Mean for Homebuyers?

Higher mortgage rates undoubtedly make homeownership more expensive. Affordability becomes a significant concern, as higher rates translate to larger monthly payments. This can potentially shrink the pool of qualified buyers and slow down the pace of home sales. However, it's crucial to remember that a strong economy also brings:

- Increased Job Security: A thriving economy usually translates to better job security and higher incomes, potentially offsetting the impact of higher mortgage rates for some buyers.

- Greater Wage Growth: Strong wage growth can help potential homebuyers manage higher mortgage payments.

- Long-Term Stability: While the initial cost is higher, a robust economy generally offers long-term economic stability, providing a more secure environment for a significant investment like a home.

Navigating the Higher Rate Environment

For prospective homebuyers, navigating this environment requires careful planning and strategic decision-making. This includes:

- Improving Credit Score: A higher credit score can qualify you for better interest rates, mitigating the impact of the increased rates.

- Saving a Larger Down Payment: A larger down payment can reduce the loan amount and, consequently, the monthly payments.

- Seeking Expert Financial Advice: Consulting with a financial advisor can provide personalized guidance on managing finances and navigating the complexities of homeownership in a higher-rate environment.

The Bigger Picture:

While higher mortgage rates present challenges for homebuyers, they are often a sign of a healthy and growing economy. Understanding the underlying economic factors driving these changes is crucial for making informed decisions about homeownership. The key is to carefully weigh the benefits of homeownership in a stable economy against the increased costs associated with higher mortgage rates. Ultimately, the decision to buy a home remains a highly personal one, requiring a comprehensive assessment of individual financial circumstances and long-term goals.

Call to Action: Stay informed about economic trends and interest rates by regularly consulting reputable financial news sources. This will empower you to make informed decisions about your financial future.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Higher Mortgage Rates Reflect Strengthening Economy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Arlington Renegades Dc Defenders Week 8 Xfl Match Analysis

May 19, 2025

Arlington Renegades Dc Defenders Week 8 Xfl Match Analysis

May 19, 2025 -

The Debate Heats Up Dhs Explores Reality Tv For Immigration Reform

May 19, 2025

The Debate Heats Up Dhs Explores Reality Tv For Immigration Reform

May 19, 2025 -

Find Out Tennessee Vs Ohio State Softball Game Tv Channel Time And Knoxville Regional Final Coverage

May 19, 2025

Find Out Tennessee Vs Ohio State Softball Game Tv Channel Time And Knoxville Regional Final Coverage

May 19, 2025 -

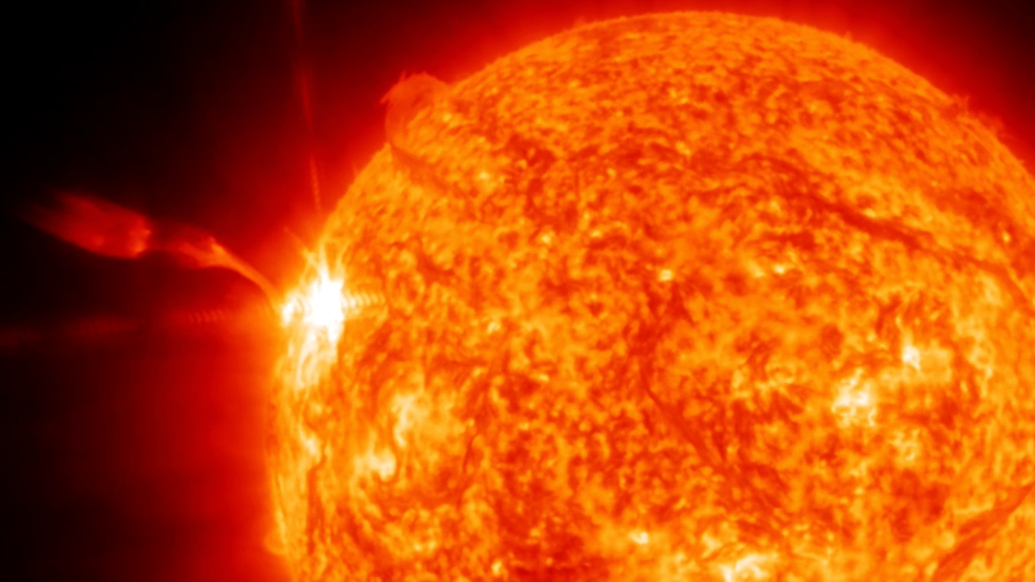

Sun Erupts Major Solar Flare Causes Widespread Radio Outage

May 19, 2025

Sun Erupts Major Solar Flare Causes Widespread Radio Outage

May 19, 2025 -

Betting On Ufl Week 8 Defenders Vs Renegades Expert Picks And Odds

May 19, 2025

Betting On Ufl Week 8 Defenders Vs Renegades Expert Picks And Odds

May 19, 2025