Global Shifts: Jamie Dimon Highlights Trump's Main Concern

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Global Shifts: Jamie Dimon Highlights Trump's Main Concern – A Looming Economic Storm?

JPMorgan Chase CEO Jamie Dimon's recent comments have sent ripples through the financial world, echoing a key concern previously voiced by former President Donald Trump: the potential for a looming economic downturn. Dimon's warning, delivered during a recent earnings call, highlights a confluence of factors that could trigger a significant economic slowdown, mirroring anxieties expressed by Trump during his presidency. This isn't simply Wall Street chatter; it’s a potential harbinger of significant global economic shifts.

Dimon, known for his candid assessments of the economic landscape, didn't pull any punches. He cited several key factors contributing to this increased risk, including persistent inflation, rising interest rates, and the ongoing geopolitical instability stemming from the war in Ukraine. These are not new concerns, but their convergence creates a potent cocktail of uncertainty.

Inflation's Persistent Grip: A Major Headwind

One of Dimon's primary concerns is the stubbornly persistent inflation plaguing the global economy. While inflation rates may be showing signs of easing in some regions, the underlying pressure remains significant. This prolonged inflation forces central banks to maintain aggressive interest rate hikes, leading to the next major concern.

Rising Interest Rates: Squeezing Businesses and Consumers

The Federal Reserve, along with other central banks worldwide, is employing aggressive monetary policy to combat inflation. This means higher interest rates, which increase borrowing costs for businesses and consumers alike. Higher interest rates can stifle economic growth by making it more expensive to invest and expand. This ripple effect can lead to job losses and decreased consumer spending, further exacerbating the economic slowdown.

- Impact on Businesses: Increased borrowing costs can hinder business expansion plans, leading to reduced investment and potential layoffs.

- Impact on Consumers: Higher interest rates translate to higher mortgage payments, loan repayments, and credit card interest, reducing disposable income and hindering consumer spending.

Geopolitical Instability: A Wildcard in the Deck

The ongoing war in Ukraine adds another layer of complexity to the already precarious economic situation. The conflict has disrupted global supply chains, leading to energy price volatility and contributing to inflationary pressures. Furthermore, the geopolitical uncertainty creates a climate of risk aversion, impacting investor confidence and potentially leading to capital flight.

This echoes concerns raised by Trump during his tenure, who often emphasized the importance of energy independence and a strong domestic economy in the face of global instability. While the specifics of their concerns differ slightly, the underlying anxiety about global economic fragility remains a common thread.

What Lies Ahead? Navigating Uncertain Waters

Predicting the future of the global economy is always a challenging endeavor. However, Dimon's warnings, coupled with persistent inflation and geopolitical instability, underscore the need for careful navigation. Businesses need to prepare for potential downturns by strengthening their balance sheets and diversifying their operations. Consumers should likewise adopt a cautious approach to spending and debt management.

The coming months will be crucial in determining the severity of any potential economic slowdown. Monitoring key economic indicators like inflation rates, unemployment figures, and consumer confidence will be paramount in assessing the evolving economic landscape. Stay informed and adapt your strategies accordingly. This is not a time for complacency.

Disclaimer: This article provides general commentary and does not constitute financial advice. Consult with a qualified financial advisor for personalized guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Global Shifts: Jamie Dimon Highlights Trump's Main Concern. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Major Upgrades Announced For Celebrity Cruises Ships

Jun 02, 2025

Major Upgrades Announced For Celebrity Cruises Ships

Jun 02, 2025 -

Miley Cyrus Addresses Billy Ray Cyrus New Romance With Elizabeth Hurley

Jun 02, 2025

Miley Cyrus Addresses Billy Ray Cyrus New Romance With Elizabeth Hurley

Jun 02, 2025 -

We Re All Going To Die Joni Ernsts Controversial Comments And Sarcastic Response

Jun 02, 2025

We Re All Going To Die Joni Ernsts Controversial Comments And Sarcastic Response

Jun 02, 2025 -

French Open 2025 Day 8 Results Scores And Match Reports Swiatek Alcaraz

Jun 02, 2025

French Open 2025 Day 8 Results Scores And Match Reports Swiatek Alcaraz

Jun 02, 2025 -

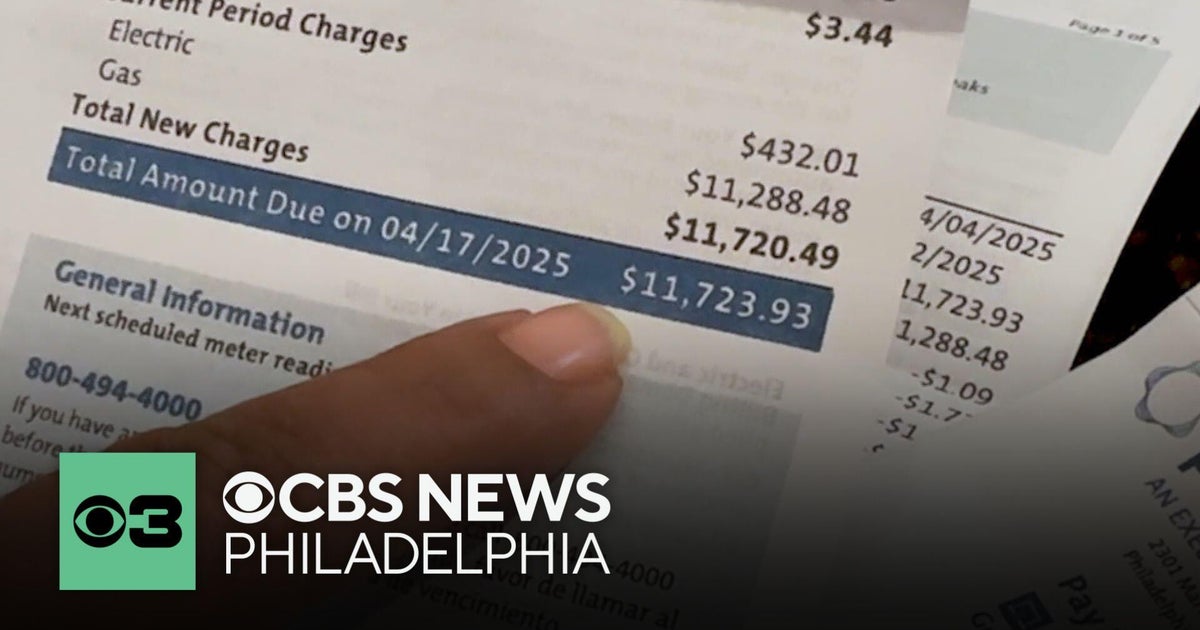

Peco Billing Glitch Leads To 12 000 Surprise For Pennsylvania Resident

Jun 02, 2025

Peco Billing Glitch Leads To 12 000 Surprise For Pennsylvania Resident

Jun 02, 2025