Fried Chicken Giant Acquired: Private Equity Investment Reaches $1 Billion

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Fried Chicken Giant Acquired in $1 Billion Private Equity Deal: What it Means for Consumers

Headline: Fried Chicken Giant Acquired in Blockbuster $1 Billion Private Equity Deal

Introduction: In a stunning move that sent ripples through the fast-food industry, popular fried chicken chain, Golden Crust Chicken (GCC), announced its acquisition by the private equity firm, Zenith Capital Partners, for a staggering $1 billion. This monumental deal marks one of the largest private equity investments in the quick-service restaurant (QSR) sector this year and raises several key questions about the future of GCC and the broader fried chicken market.

H2: Zenith Capital Partners and their Investment Strategy

Zenith Capital Partners, known for its aggressive investment strategy in high-growth consumer brands, has clearly identified the potential within GCC. The firm's portfolio already includes several successful food and beverage companies, demonstrating their expertise in the sector. This acquisition signifies a strong belief in GCC's brand recognition and future growth prospects. The details of the transaction, including the specific terms and conditions, remain undisclosed, but industry analysts predict significant changes in GCC's operational strategy and expansion plans.

H2: What This Means for Golden Crust Chicken Customers

The immediate impact on consumers remains to be seen. While Zenith Capital Partners hasn't released an official statement outlining its plans for GCC, several potential scenarios are unfolding. These include:

- Menu Innovation: We might see new menu items introduced, potentially catering to evolving consumer preferences for healthier options or incorporating innovative flavor profiles. The acquisition could also lead to expansion into new menu categories beyond fried chicken.

- Restaurant Renovations: Expect to see upgrades in restaurant aesthetics and technology. This could include modernized interiors, improved ordering systems (including potential mobile ordering enhancements), and a greater focus on customer experience.

- Price Changes: While there's no guarantee, increased operational efficiency resulting from the acquisition could lead to competitive pricing, but it's equally possible that prices might adjust to reflect the increased investment.

- Expansion: Zenith Capital Partners' history suggests a strong focus on expansion. We can anticipate the possibility of new GCC locations opening across the country, bringing their signature fried chicken to new markets.

H3: The Competitive Landscape of the Fried Chicken Market

The fried chicken market is fiercely competitive, with established players and emerging brands vying for market share. This acquisition significantly shifts the power dynamics within the industry. GCC's strengthened financial position, thanks to the private equity investment, will allow them to compete more effectively against larger chains and independent restaurants.

H2: Industry Experts Weigh In

Leading industry analysts at FoodTech Insights commented on the acquisition, suggesting that this deal highlights the continued appeal of established, popular fast-food brands to private equity firms seeking robust returns. They also point to the resilience of the fried chicken market, even during periods of economic uncertainty. [Link to FoodTech Insights article - external link]

H2: The Future of Golden Crust Chicken

The $1 billion acquisition of Golden Crust Chicken by Zenith Capital Partners is a game-changer. While the long-term effects are still unfolding, the deal points to a bright future for the brand. The increased investment capital will likely result in significant changes, impacting everything from the menu and restaurant experience to expansion and competitive positioning. Consumers will undoubtedly be watching closely to see how this private equity investment reshapes the beloved fried chicken chain.

Call to Action (subtle): Stay tuned to this site for further updates on the evolving story of Golden Crust Chicken and its future under Zenith Capital Partners. We will continue to provide in-depth coverage and analysis as more information becomes available.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Fried Chicken Giant Acquired: Private Equity Investment Reaches $1 Billion. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

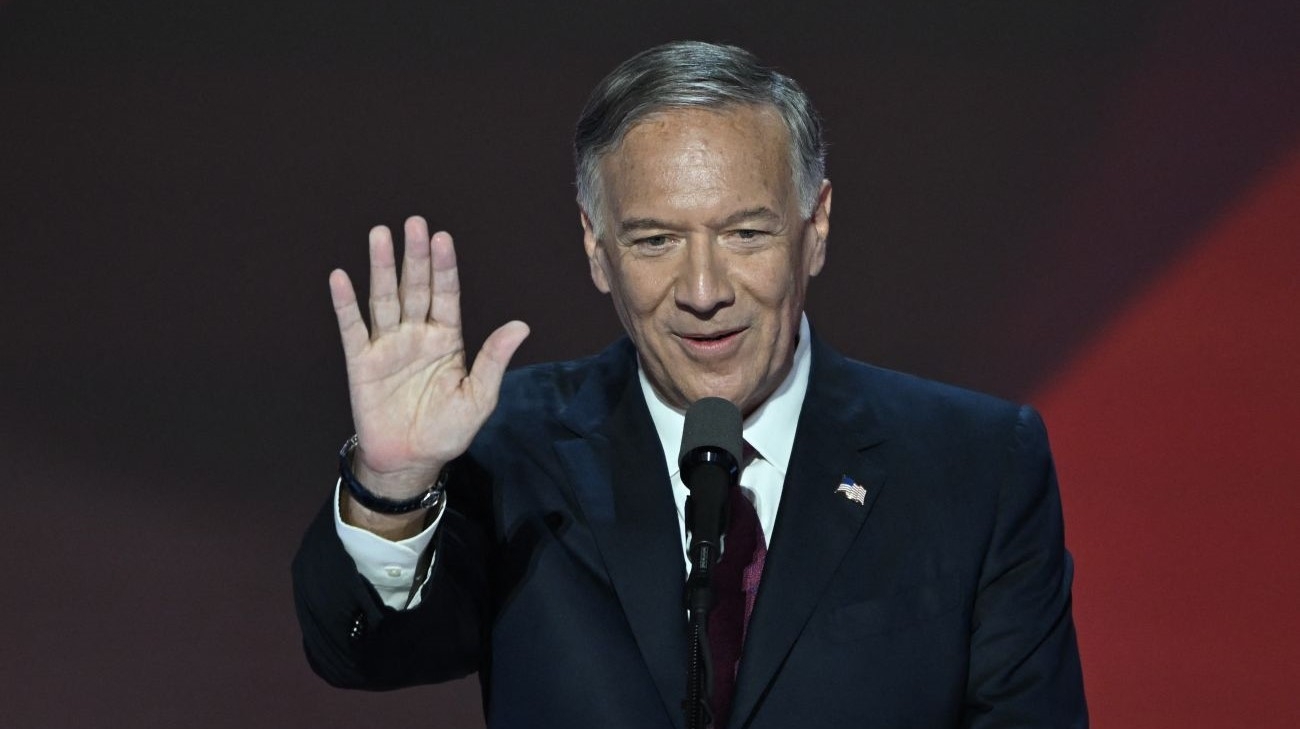

Pompeos Claim Us Inaction Fueled 2014 War

Jun 05, 2025

Pompeos Claim Us Inaction Fueled 2014 War

Jun 05, 2025 -

New Movie And Console Launch This Weeks Entertainment Highlights

Jun 05, 2025

New Movie And Console Launch This Weeks Entertainment Highlights

Jun 05, 2025 -

Sacrifices In Solopreneurship The Realities Of Partnership First Strategies

Jun 05, 2025

Sacrifices In Solopreneurship The Realities Of Partnership First Strategies

Jun 05, 2025 -

The Future Of Work In The Age Of Ai Challenges And Opportunities

Jun 05, 2025

The Future Of Work In The Age Of Ai Challenges And Opportunities

Jun 05, 2025 -

India Thailand Friendly Marquez Acknowledges Roster Changes On Both Sides

Jun 05, 2025

India Thailand Friendly Marquez Acknowledges Roster Changes On Both Sides

Jun 05, 2025