Federal Reserve's Rate Cut Prediction: Effect On U.S. Treasury Yields

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Federal Reserve's Rate Cut Prediction: Ripple Effects on U.S. Treasury Yields

The Federal Reserve's (Fed) recent hints at potential interest rate cuts have sent ripples through the financial markets, significantly impacting U.S. Treasury yields. This article delves into the intricate relationship between Fed policy, rate cut predictions, and their consequences for Treasury yields, offering insights for investors and market watchers alike.

The Fed's Shifting Stance and Market Expectations

For much of 2023, the Fed maintained an aggressive stance on inflation, prioritizing rate hikes to cool down the overheating economy. However, recent economic data showing slowing inflation and concerns about potential recession have led to speculation of an impending rate cut. This shift in expectation is crucial because it directly influences investor behavior and Treasury yields.

The anticipation of lower interest rates typically translates to lower Treasury yields. This is because investors are less willing to hold bonds that offer a lower return compared to the expected future rates. Conversely, when interest rates are expected to rise, investors demand higher yields to compensate for the risk of holding bonds that will soon be less valuable.

Understanding the Inverse Relationship

It's vital to understand the inverse relationship between bond prices and yields. When the price of a Treasury bond rises (due to increased demand), its yield falls. Conversely, when the price falls, the yield rises. The expectation of Fed rate cuts increases the demand for Treasury bonds, driving up their prices and subsequently lowering their yields.

Impact on Different Treasury Maturities

The impact of Fed rate cut predictions is not uniform across all Treasury maturities. Shorter-term Treasury yields are generally more sensitive to changes in Fed policy, as they mature sooner and are more directly influenced by the current short-term interest rate environment. Longer-term Treasury yields, while still affected, tend to be influenced by a broader range of factors, including inflation expectations and economic growth forecasts.

Beyond the Fed: Other Influencing Factors

While the Fed's actions are a major driver of Treasury yield movements, other factors also play a role. These include:

- Inflation: High inflation expectations can push Treasury yields higher, as investors demand higher returns to compensate for the erosion of purchasing power.

- Economic Growth: Strong economic growth can increase demand for credit, potentially pushing Treasury yields upward.

- Global Economic Conditions: International events and economic performance in other countries can indirectly influence U.S. Treasury yields.

- Geopolitical Risks: Uncertainties stemming from geopolitical events can impact investor sentiment and Treasury yields.

What This Means for Investors

The current situation presents both opportunities and challenges for investors. Lower yields on Treasury bonds might mean lower returns, but they also signify a potentially safer investment climate as interest rates decrease. However, investors should carefully consider their investment horizon and risk tolerance before making any decisions. Diversification across various asset classes remains a prudent strategy.

Looking Ahead: Uncertainty Remains

Predicting the future direction of Treasury yields is far from an exact science. While the anticipation of Fed rate cuts currently points towards lower yields, unforeseen economic events or a change in the Fed's outlook could easily alter this trajectory. Staying informed about economic developments and Fed pronouncements is crucial for navigating this dynamic market environment. Consulting with a qualified financial advisor is always recommended before making any significant investment decisions.

Keywords: Federal Reserve, interest rate cuts, U.S. Treasury yields, bond prices, inflation, economic growth, investment strategy, financial markets, monetary policy, recession, risk management.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Federal Reserve's Rate Cut Prediction: Effect On U.S. Treasury Yields. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Transparency Concerns Jon Jones On Ufcs Handling Of Aspinall Injury

May 20, 2025

Transparency Concerns Jon Jones On Ufcs Handling Of Aspinall Injury

May 20, 2025 -

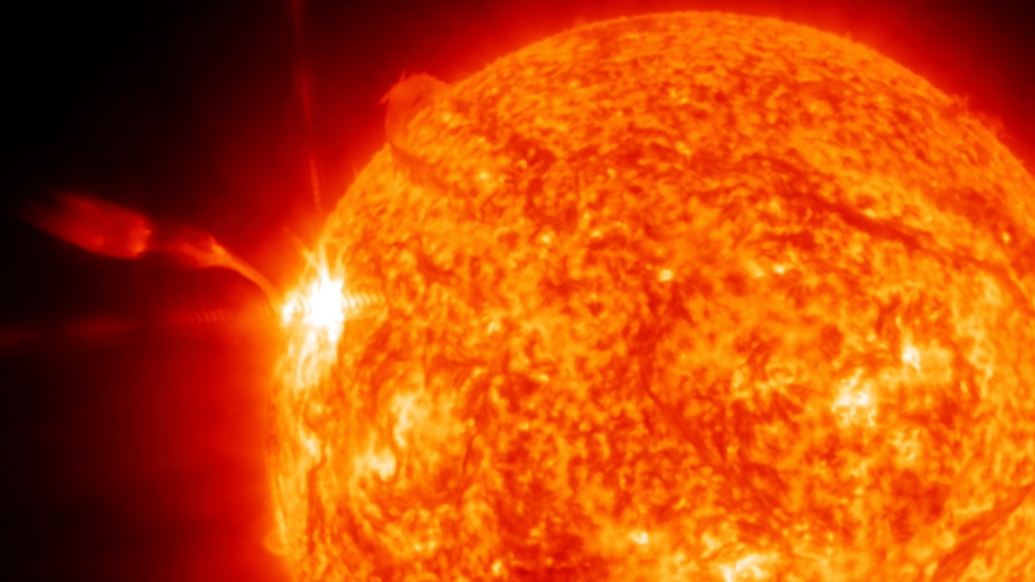

Major Solar Flare Of 2025 Radio Blackouts Hit Europe Asia And The Middle East

May 20, 2025

Major Solar Flare Of 2025 Radio Blackouts Hit Europe Asia And The Middle East

May 20, 2025 -

Always Kept It Real Jamie Lee Curtiss Honest Words On Lindsay Lohan

May 20, 2025

Always Kept It Real Jamie Lee Curtiss Honest Words On Lindsay Lohan

May 20, 2025 -

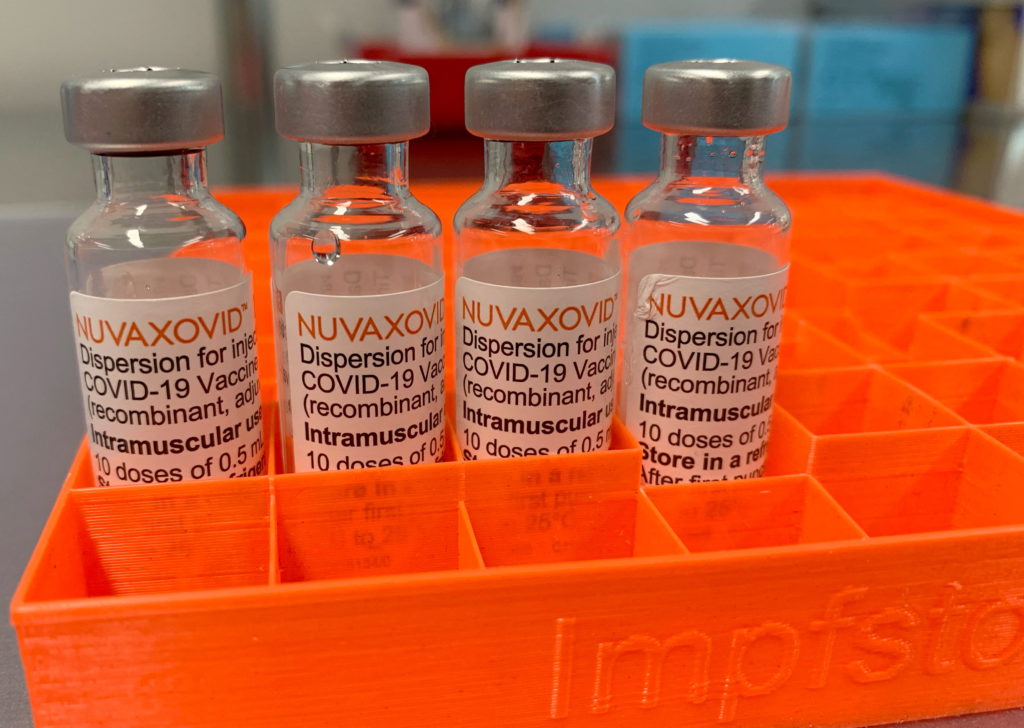

Conditional Fda Approval Novavax Covid 19 Vaccine Faces Usage Restrictions

May 20, 2025

Conditional Fda Approval Novavax Covid 19 Vaccine Faces Usage Restrictions

May 20, 2025 -

Bali Urges Global Cooperation To Prioritize Tourist Safety And Responsible Travel

May 20, 2025

Bali Urges Global Cooperation To Prioritize Tourist Safety And Responsible Travel

May 20, 2025